cryptocurrency market As we approached the end of the year, it was shaken by sharp sales in the first days of the week. Bitcoin $[mcrypto coin=”BTC” currency=”USD”] largest altcoin Ethereum as it tested below $85,000 at one point  $[mcrypto coin=”ETH” currency=”USD”] It fell below $3,000, and liquidations averaged around $600 million on Monday and around $400 million per day in the following days. Leading market maker wintermute dated 23 December 2025 report He emphasized that the volatility in the market is gradually calming down and Bitcoin is gradually recovering towards the $ 90,000 region. In the same evaluation, market leadership narrowed further and capital was concentrated more heavily in BTC and ETH, altcoin market On the side, it was emphasized that supply pressure and coin lock opening calendars made the weakness clear.

$[mcrypto coin=”ETH” currency=”USD”] It fell below $3,000, and liquidations averaged around $600 million on Monday and around $400 million per day in the following days. Leading market maker wintermute dated 23 December 2025 report He emphasized that the volatility in the market is gradually calming down and Bitcoin is gradually recovering towards the $ 90,000 region. In the same evaluation, market leadership narrowed further and capital was concentrated more heavily in BTC and ETH, altcoin market On the side, it was emphasized that supply pressure and coin lock opening calendars made the weakness clear.

While BTC and ETH came to the fore, Altcoins fell behind

According to the report Christmas and liquidity tends to decrease in the year-end period. Although position closing by discretionary trading desks keeps price movements within the band, it can produce sudden “air gaps”. The main area where risk is absorbed in the market is again the most liquid assets. Bitcoin And Ethereum. This picture points to a structure in which the price is shaped more by positioning dynamics rather than a credible direction, in the absence of a clear macro or policy-based catalyst.

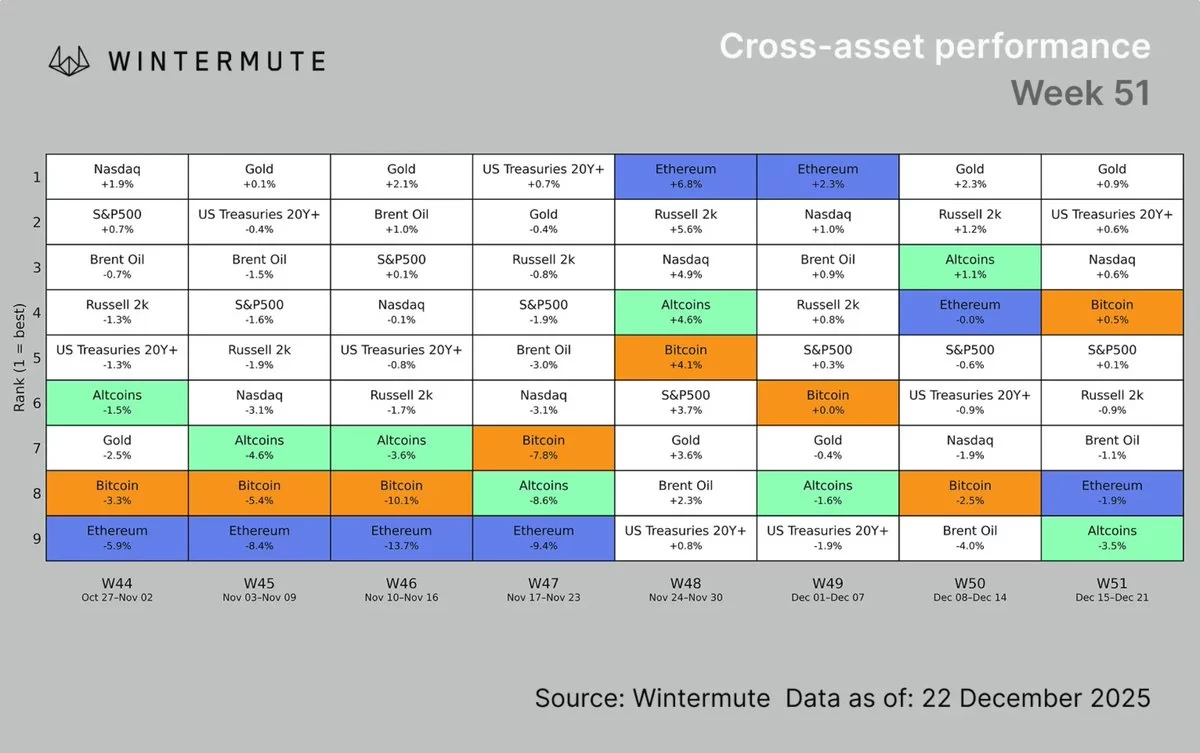

The visual data Wintermute attached to its report also supports the narrowing of leadership. In the 51st week in the company’s “Cross-asset performance” table (15-21 December) altcoinEthereum remained in the weakest bracket of the list at -3.5 percent, while Ethereum fell -1.9 percent. In the same week, Bitcoin was in the positive zone with +0.5 percent, gold was in the first place with +0.9 percent, US bonds over 20 years were at the top with +0.6 percent and Nasdaq was at the top with +0.6 percent.

According to the report, the main reason for the weakness in altcoin performance is the intense supply pressure described as “supply overhang” and the intense coin lock opening calendar. The view that Bitcoin must lead before risk appetite can permanently fall to the bottom of the curve is gaining strength as individual investors begin to turn from altcoins to mainstream cryptocurrencies.

What is the Latest Situation in the Market?

Wintermute masters internal flow data cryptocurrencyHe stated that it points to renewed purchasing pressure in the 2020s. BTCAs we approach the end of the year, in addition to the longer-standing buying trend in ETHThere are also greater buying pressure signals in . It was noted that institutional flows have been a stable source of purchases since the summer months, while individual investors left altcoins and turned to main cryptocurrencies.

On the other hand, price discovery is at the margin. derivative marketThis fact makes it possible to experience sharp intraday sags at the same time as the net purchase on the spot side. The report states that funding and base remained relatively tight during the sale. options marketThe implied volatility remains high and expectations are divided between a retreat to the mid-$80,000 region and a recovery to previous peaks. Wintermute’s expectation is that lighter activity, band movement and selectivity will continue until the end of the year.