Two of the most popular altcoins, LINK and XRP Coin It has been greatly affected by the accelerating sales in recent months. Even though there are good developments in the ETF channel, their prices are falling. Bitcoin  $87,720.35 While closing below $ 88 thousand, the king cryptocurrency has not yet determined its direction. The unstable period we are in has painful consequences for altcoins as it also includes sudden declines.

$87,720.35 While closing below $ 88 thousand, the king cryptocurrency has not yet determined its direction. The unstable period we are in has painful consequences for altcoins as it also includes sudden declines.

Chainlink (LINK) 2026 Predictions

Chainlink  $12.29 It is a very popular project and has many corporate partners. It takes care of almost all price feeds in the DeFi space. Trillions of dollars of volume have been realized in decentralized finance protocols over the years with the help of its infrastructure. But few people to LINK Coin shows interest. Other steps taken to increase stake and token benefits did not work either.

$12.29 It is a very popular project and has many corporate partners. It takes care of almost all price feeds in the DeFi space. Trillions of dollars of volume have been realized in decentralized finance protocols over the years with the help of its infrastructure. But few people to LINK Coin shows interest. Other steps taken to increase stake and token benefits did not work either.

The biggest hope for 2026 is LINK Coin ETF to Chainlink The view that it is the safest way to invest continues to be adopted by corporates. We should also see an uptick in risk markets due to the impact of QT. With ETF support and market uptrend, LINK Coin can fully realize its potential.

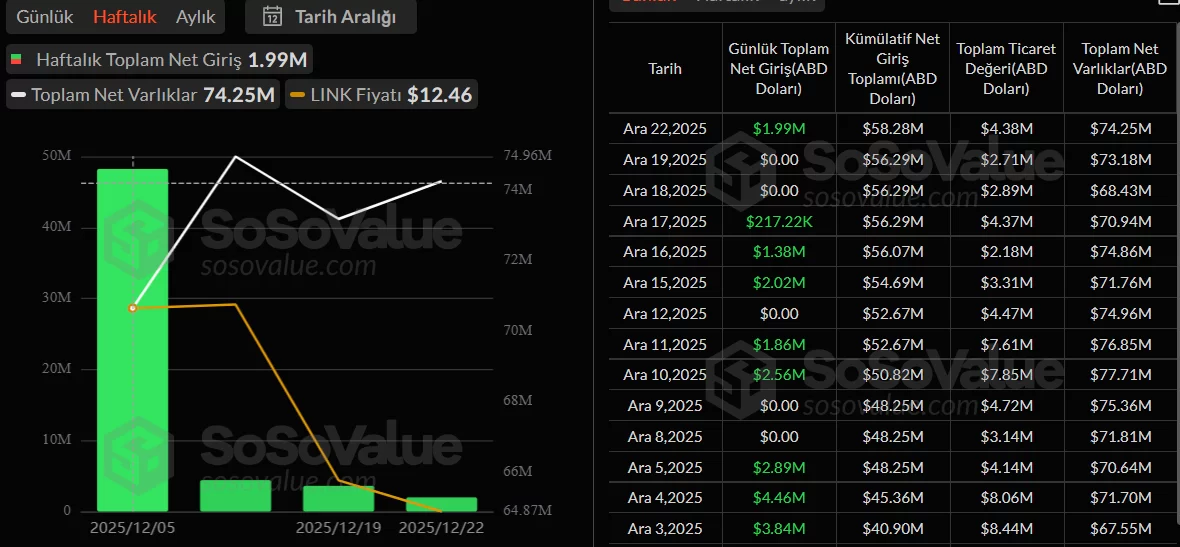

Listed in December, the LINK Coin ETF saw massive inflows in its first week. The following weeks continued to see net inflows weakening from week to week, driven by negativity in overall market sentiment. This allowed his ETF to continue growing while LINK Coin was falling.

As with all altcoins, things did not go well for LINK Coin after the October 10 bottom. The long lower wick is more than half filled and with the loss of $ 11.7, we can see the new bottom between $ 10.9 and $ 9.36 in the first quarter of 2026. In a possible rise, the memorized resistance at $ 14.8 will be taken back and $ 22.3 will be exceeded.

Ripple (XRP)

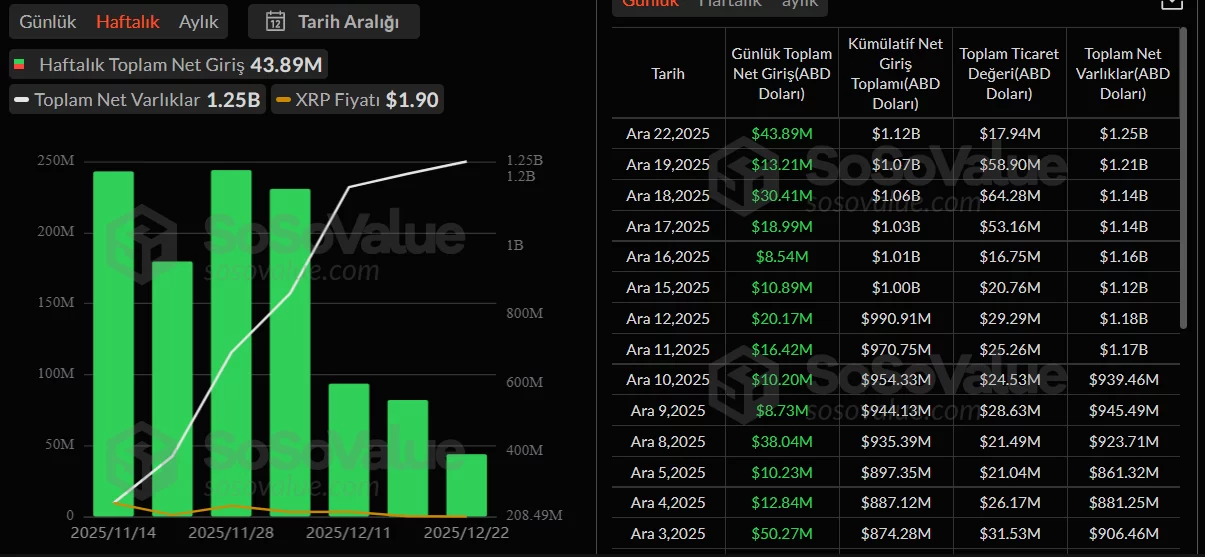

in the ETF channel Ripple  $1.90 It is extremely powerful and has never had a clear launch day since launch. While ETH and BTC saw billion-dollar outflows, the XRP Coin ETF attracted nearly $44 million in inflows just yesterday. This is good news because, like Chainlink, Ripple cannot help its own altcoin become sufficiently valued. Therefore, the ETF can be seen as a share of the Ripple company and enable XRP Coin to grow in the ETF channel. After all, spot ETFs absorb supply. Moreover, since investors here buy with longer-term expectations, the shrinkage of sales supply in the stock markets is quite positive.

$1.90 It is extremely powerful and has never had a clear launch day since launch. While ETH and BTC saw billion-dollar outflows, the XRP Coin ETF attracted nearly $44 million in inflows just yesterday. This is good news because, like Chainlink, Ripple cannot help its own altcoin become sufficiently valued. Therefore, the ETF can be seen as a share of the Ripple company and enable XRP Coin to grow in the ETF channel. After all, spot ETFs absorb supply. Moreover, since investors here buy with longer-term expectations, the shrinkage of sales supply in the stock markets is quite positive.

Total assets in ETFs exceeded $1.25 billion, which is less than 10% of ETH. Even though it’s so new XRP ETFs The fact that XRP Coin has reached !% of the market value shows the potential here.

It is difficult to say the same good things about the chart because the $ 1.98 support has been lost and it is possible to return to the range of $ 1.62 and $ 1.47 in the continuation of the decline. It is possible to say the same things here for after October 10th, the long lower wick is being filled painfully and the decline is stable despite all the good news.