We followed US data, which is important for cryptocurrencies, throughout the year. Now the last data set for 2025 has been published. A few minutes ago ADP reported that private sector employment increased by 11,500 in the 4-week period. The Chinese Ministry of Commerce, in its ongoing statements at the time of writing, mentions that they may take measures against the USA, and this again indicates that tensions may increase.

US Data Breaking News

The last major data set for the US was released today, and the GDP figures are well above expectations. Strong numbers for growth Fed’s It shows that there should be no rush for easing and unemployment can recover.

- US GDP Quarterly Leading Data Released: 4.3% (Expected: 3.3% Previous: 3.8%)

- US GDP Price Index Announced: 3.8% (Expected: 2.7% Previous: 2.1%)

- US Durable Goods Announced: -2.2% (Expected: -1.5% Previous: 0.5%)

- US Core Durable Goods Announced: 0.2% (Expected: 0.3% Previous: 0.6%)

The threatening statements coming from China were the most disturbing thing of the last few minutes.

“If the US insists, we will take the necessary measures to protect Chinese companies. China wants the US to lift the ban on new foreign unmanned aerial vehicles.” – Ministry of Commerce of China

Recent data showing that the US economy is far from recession and vibrant is uncertain due to the shutdown. But last week inflation data It was also unsafe, so that doesn’t mean it can’t be taken seriously. We see that prices also increase with growth. The fact that the GDP Price Index was 1.1% points higher than expected indicates that inflation is still sticky. Both details support the view that the Fed may slow down on interest rate cuts next year.

Growth is driven by services and consumption rather than production. The figures indicating the contraction on the industrial side are negative.

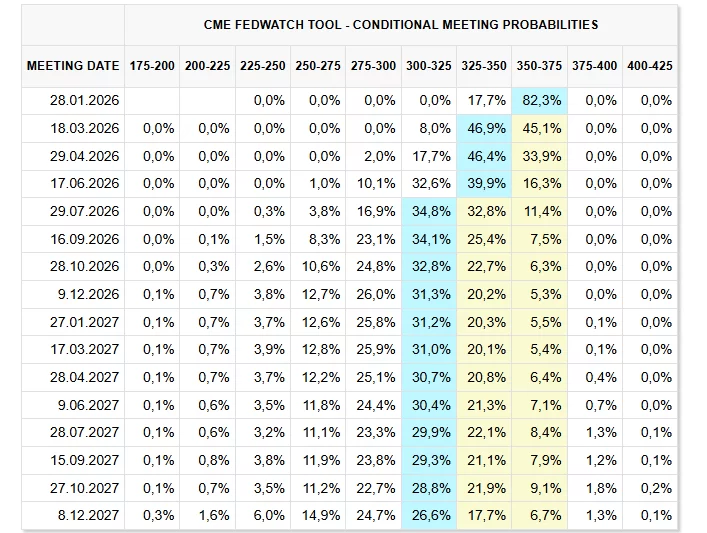

for 2026 interest rate cut expectation 2 or worse, no discount is expected in 2027. This situation is negative for cryptocurrencies.