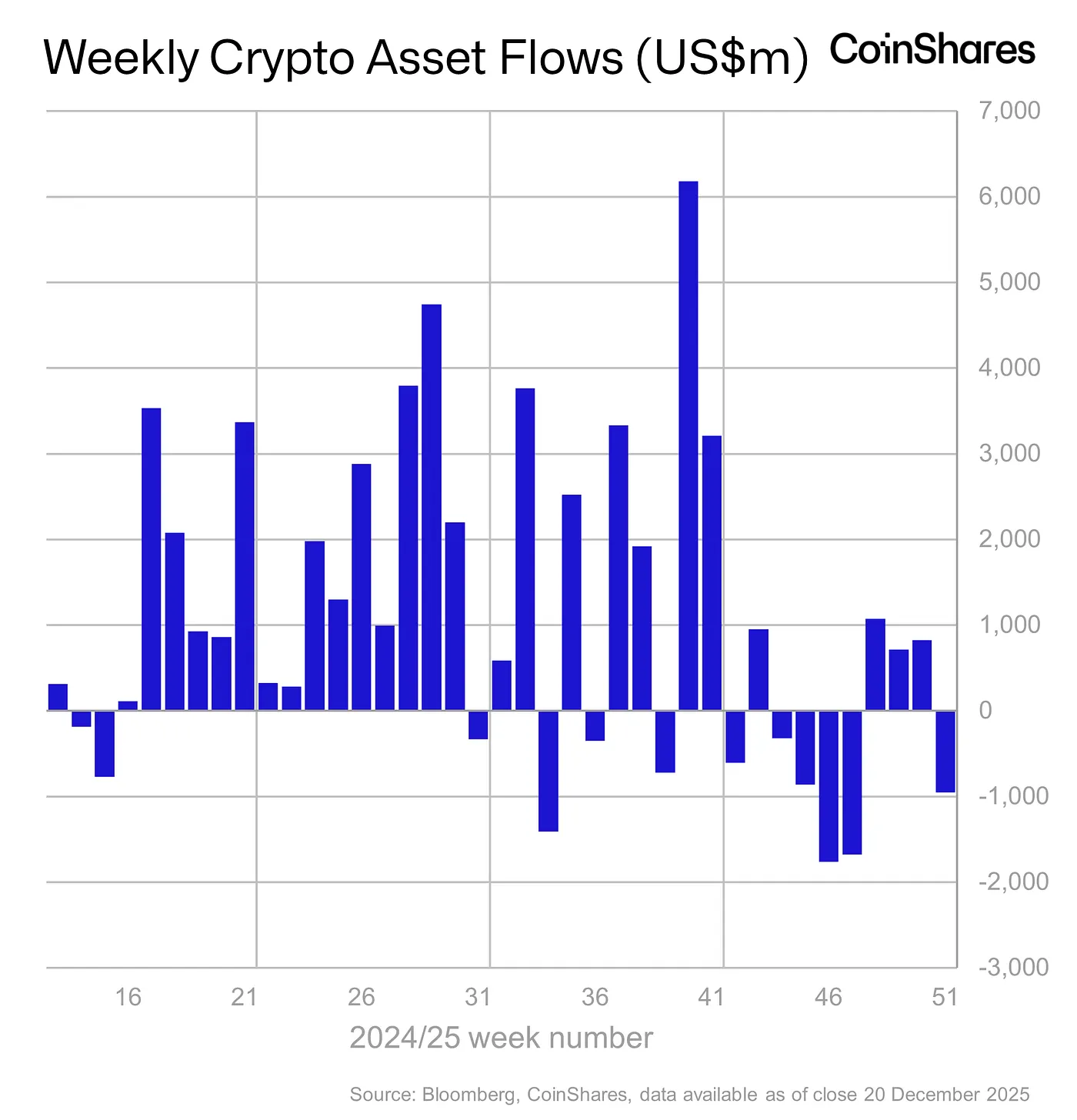

CoinShares Digital Asset Fund Flows Weekly Report (Volume 265) according to the report cryptocurrency -based investment products saw a rebound after a four-week break. As of the period ending on December 20, 2025, weekly net outflow reached 952 million dollars and almost all of the fund flows originated from the USA. The report emphasized that the delay in the passage of the Clarity Act in the USA prolonged the regulatory uncertainty, and in addition, the uneasiness created by the sales of whales weakened the risk appetite.

US Outflows Highlight Regulatory Uncertainty

CoinShares‘s data shows that $990 million of the $952 million outflow recorded last week in cryptocurrency-based investment products USAIt shows that it is concentrated in . Canada And GermanyInflows from , with $46.2 million and $15.6 million respectively, balanced the table to a limited extent, but the center of gravity clearly remained in the USA.

It was stated in the report that the market reaction was attributed to the regulatory uncertainty prolonged by the delay of the Clarity Act in the USA. Again, the report stated that concern about the continued sales of whale-sized investors also diminished the appetite for risky assets.

On the asset management size (AUM) front, it was noted that the total amount remained at 46.7 billion dollars, falling behind the level of 48.7 billion dollars in 2024. CoinShares noted that under the current outlook, it is now highly unlikely that cryptocurrency-based investment products will surpass last year’s total inflows.

Exit in Ethereum and Bitcoin, Selective Entry in XRP with Solana

The biggest fund outflow of the week was 555 million dollars Ethereum  $3,048.58 seen on the side. CoinShares underlined that Ethereum is positioned as the asset that can gain and lose the most from the delay in the Clarity Law, so its higher sensitivity to the news flow is understandable. The report also reminded that Ethereum’s intra-year fund inflows reached $12.7 billion and significantly exceeded the $5.3 billion fund inflow in 2024.

$3,048.58 seen on the side. CoinShares underlined that Ethereum is positioned as the asset that can gain and lose the most from the delay in the Clarity Law, so its higher sensitivity to the news flow is understandable. The report also reminded that Ethereum’s intra-year fund inflows reached $12.7 billion and significantly exceeded the $5.3 billion fund inflow in 2024.

Bitcoin  $89,869.55Weekly net outflow was reported as 460 million dollars. On the other hand, it was shared that the total fund inflow for the year remained at 27.2 billion dollars, falling behind the 41.6 billion dollars in 2024. The framework drawn by the report is that the delay in the regulatory agenda and concern about large investor sales highlight the selling pressure in the two main cryptocurrencies.

$89,869.55Weekly net outflow was reported as 460 million dollars. On the other hand, it was shared that the total fund inflow for the year remained at 27.2 billion dollars, falling behind the 41.6 billion dollars in 2024. The framework drawn by the report is that the delay in the regulatory agenda and concern about large investor sales highlight the selling pressure in the two main cryptocurrencies.

same week solana And XRPIt was observed that there was a positive separation of . According to the report, there was a net inflow of 48.5 million dollars into Solana-based investment products and 62.9 million dollars into XRP-based investment products. CoinShares interpreted this chart as selective investor support.