Although the King cryptocurrency targets 89 thousand dollars as of noon, the safe area is above 90 thousand dollars and has still not been gained. Bitcoin  $87,969.54 The ongoing closures under the support of the bear flag on the chart fed the concerns about the bottom reaching 76 thousand dollars, causing altcoins to make deeper bottoms in December. So, what are the expectations on the ETH and XRP front for the end of 2025?

$87,969.54 The ongoing closures under the support of the bear flag on the chart fed the concerns about the bottom reaching 76 thousand dollars, causing altcoins to make deeper bottoms in December. So, what are the expectations on the ETH and XRP front for the end of 2025?

ETH Chart and Predictions

The largest altcoin by market cap ether Despite the recent BitMine purchases, it cannot maintain $ 3 thousand in a healthy way. of ETHZilla We wrote that having to sell ETH and buy shares due to the MNAV decline was a bad and turning point for crypto reserve companies. Following this development, the crypto reserve company bubble weakened and contributed to the decline in overall market sentiment.

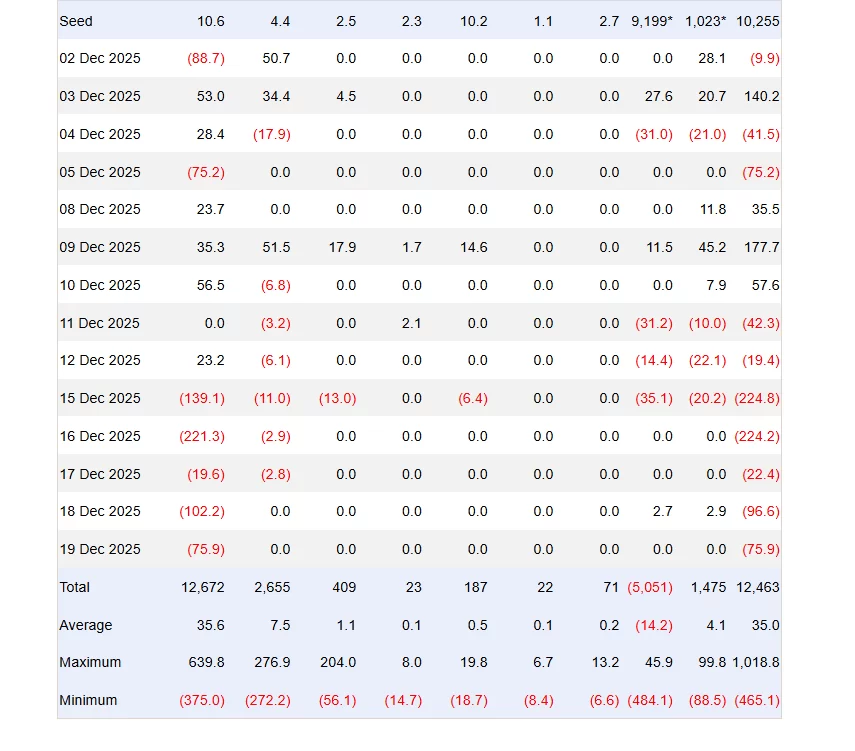

In the last 7 business days ETH ETFs We saw a clear exit. According to Farside data, we can say that net sales dominated throughout December, excluding short-term entries. If the lack of appetite of investors in the ETF channel continues steadily, there are serious problems here.

$2,820 was the breakout point where this year’s ATH rally began. That’s why the bulls are struggling to hold here on the ETH chart and they are unable to gain $3,100 permanently. The squeeze has caused the price to fluctuate here since mid-November. Volatility will continue in the current region as weak volume and uncertainty will probably continue until the end of the year. The direction is determined when we start to see daily closes above/below one of the two levels. The $3,460 resistance above and the $2,400 bottom could be tested below.

XRP Coin Price Predictions

Continuing to make lower lows since October 17 XRP Coin In an environment where negativity continues, it may make a lower bottom at $1.67. However, regaining $2.08 could end the race to the bottom that has been going on for 65 days. The next target is a return to the $2.28 and $2.62 range.

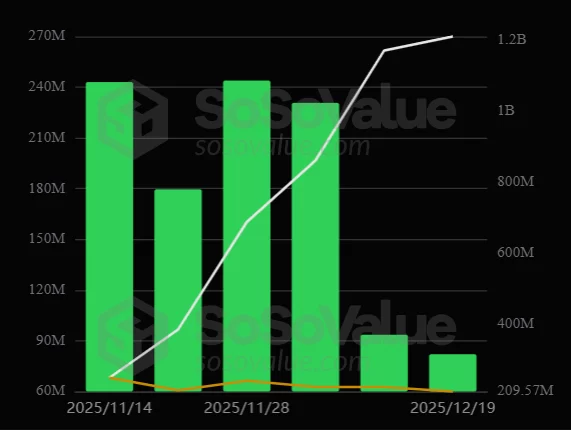

Ripple (XRP)  $1.90 The good news for ETFs has been continued net inflows since the November 14 launch. Despite BTC and ETH ETF outflows, US investors are investing in Ripple’s blockchain-based corporate financial services target through the ETF channel. Ripple company does not have shares, instead XRP Coin ETF It is perceived as a share of the company.

$1.90 The good news for ETFs has been continued net inflows since the November 14 launch. Despite BTC and ETH ETF outflows, US investors are investing in Ripple’s blockchain-based corporate financial services target through the ETF channel. Ripple company does not have shares, instead XRP Coin ETF It is perceived as a share of the company.

Inflows in the XRP Coin ETF channel are not surprising as Ripple company reached a valuation of $40 billion with an investment of $500 million and acquired 3 companies for $1.5 billion this year. ETF has a big advantage here. Total net inflows are over $1 billion and ETF net assets have reached almost 1% of the XRP Coin market cap. With such strong demand in just a few weeks, it’s exciting to think about how much total inflow we’ll see once the XRP ETFs hit their 1-year anniversary. This situation is an alarming signal for those who can see it since November 14th.