On-chain analysis is the biggest advantage of cryptocurrencies and the advantage of blockchain and gives important signals about the future. Detailed readings of investor behavior, trends and cycles are among the benefits of on-chain analysis for cryptocurrency investors. CryptoQuant analysts think something big is waiting for us.

Cryptocurrencies and the Demand Wave

Demand is what determines price, and there are so many things that affect demand in cryptocurrencies. News flow, change on the macro front, dozens of things. However, the result does not change, while demand waves push the price up, apathy triggers bear markets. Of course, the news flow that triggers apathy forms the general framework of the story.

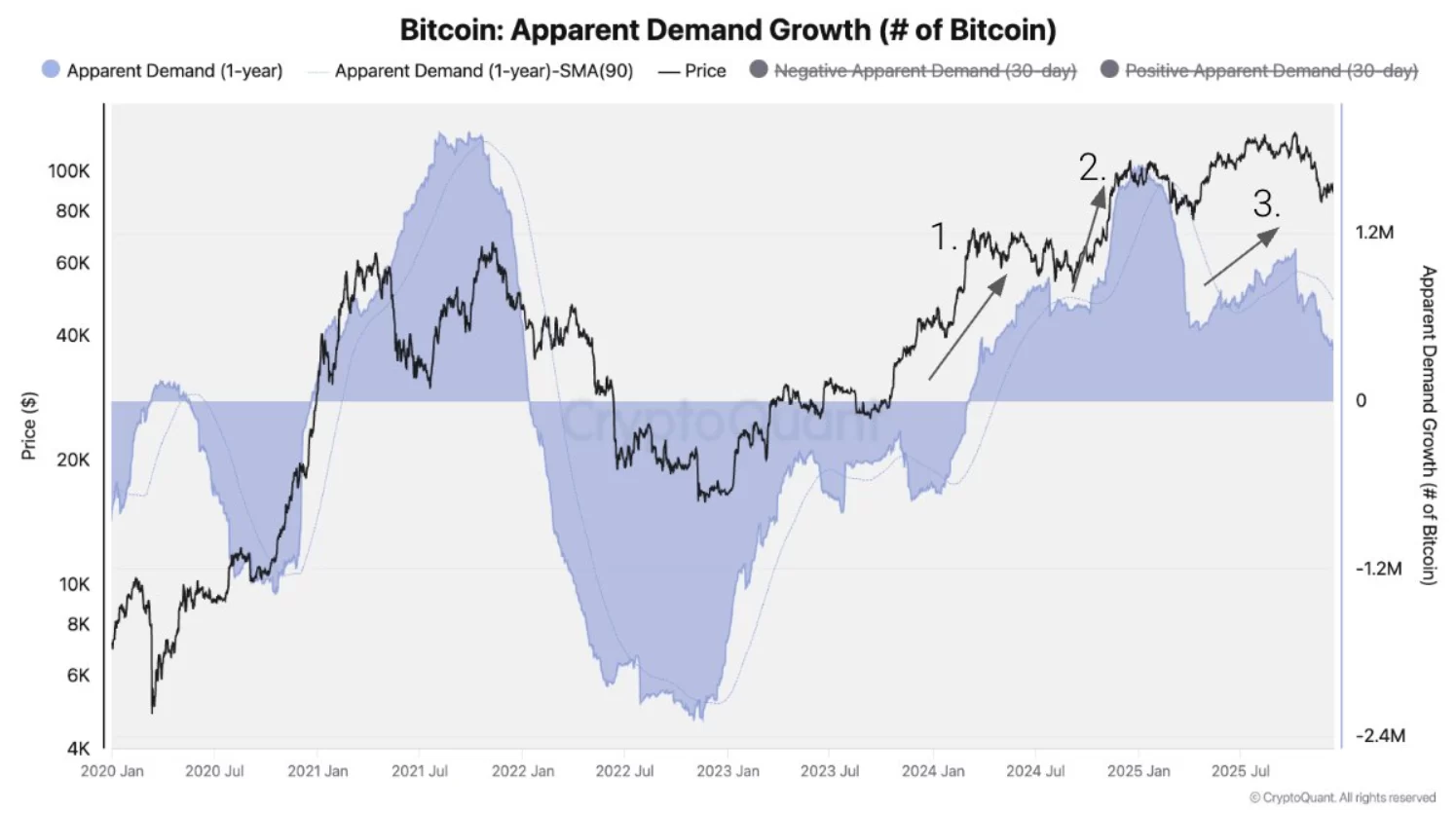

CryptoQuant analysts say that in the current cycle, BTC demand came in 3 waves but stopped.

- First wave at the beginning of 2024 spot BTC ETFs It came with the listing.

- The second wave of investor demand will follow Trump’s 2024 US elections. crypto- It happened after his victory with his friendly image. Altcoins experienced the best days of this cycle at the end of 2024.

- The third was the BTC treasury company bubble. Big players coming to the stage for ETH in June ether While moving to the ATH level, MNAV problems prevented this bubble from growing further.

Essentially, all three promise more growth for cryptocurrencies in the long term, but as demand waves weaken, more boring growth may be seen in the longer term. Or, periodically, we see their rapid revival.

Cryptocurrencies Will Fall

The failure of the three demand waves to continue promises us a decline for cryptocurrencies in the short term. Analysts even think that bear markets have started due to the reversal of these demand waves. this too Fidelity He explains from a different perspective why he expects horizontal and downward performance in cryptocurrencies in 2026.

“Demand from institutional and large investors is now shrinking rather than expanding: US spot Bitcoin

$88,128.24 ETFsbecame a net seller in Q4 2025 and their holdings decreased by 24 thousand BTC, in sharp contrast to the strong accumulation observed in Q4 2024. Similarly, addresses holding 100-1,000 BTC representing ETFs and treasury companies are growing below trend, reflecting the decline in demand seen in late 2021 ahead of the 2022 bear market.

Derivative markets confirm that risk appetite has weakened: In futures, funding rates (365-day moving average) fell to their lowest level since December 2023. Historically, declining funding rates have reflected a reduced incentive to maintain long positions. This is a pattern that is more consistently observed during bear market periods than during bull market periods.

The price structure has deteriorated in line with weakening demand: Bitcoin has fallen below its 365-day moving average, an important long-term technical support level that has historically separated bull and bear market periods.

Bitcoin’s four-year cycle is driven by demand cycles, not halvings: The current decline is driven by Bitcoin’s cyclical behavior primarily being driven by expansions and contractions in demand growth.” – CryptoQuant Analysts

How many dollars is the target? Analysts’ expectation is the realized price zone of 56 thousand dollars. Their prediction for the intermediate support level is 70 thousand dollars.