We are now coming to the end of 2025 and it has been a difficult year for cryptocurrencies. On-chain analyst Darkfost clarifies the issue of overselling by short-term investors, which has been on the agenda a lot especially in recent weeks. Bloomberg shared a new assessment and analysts shed light on the current situation of cryptocurrencies.

Data Was Sabotaged

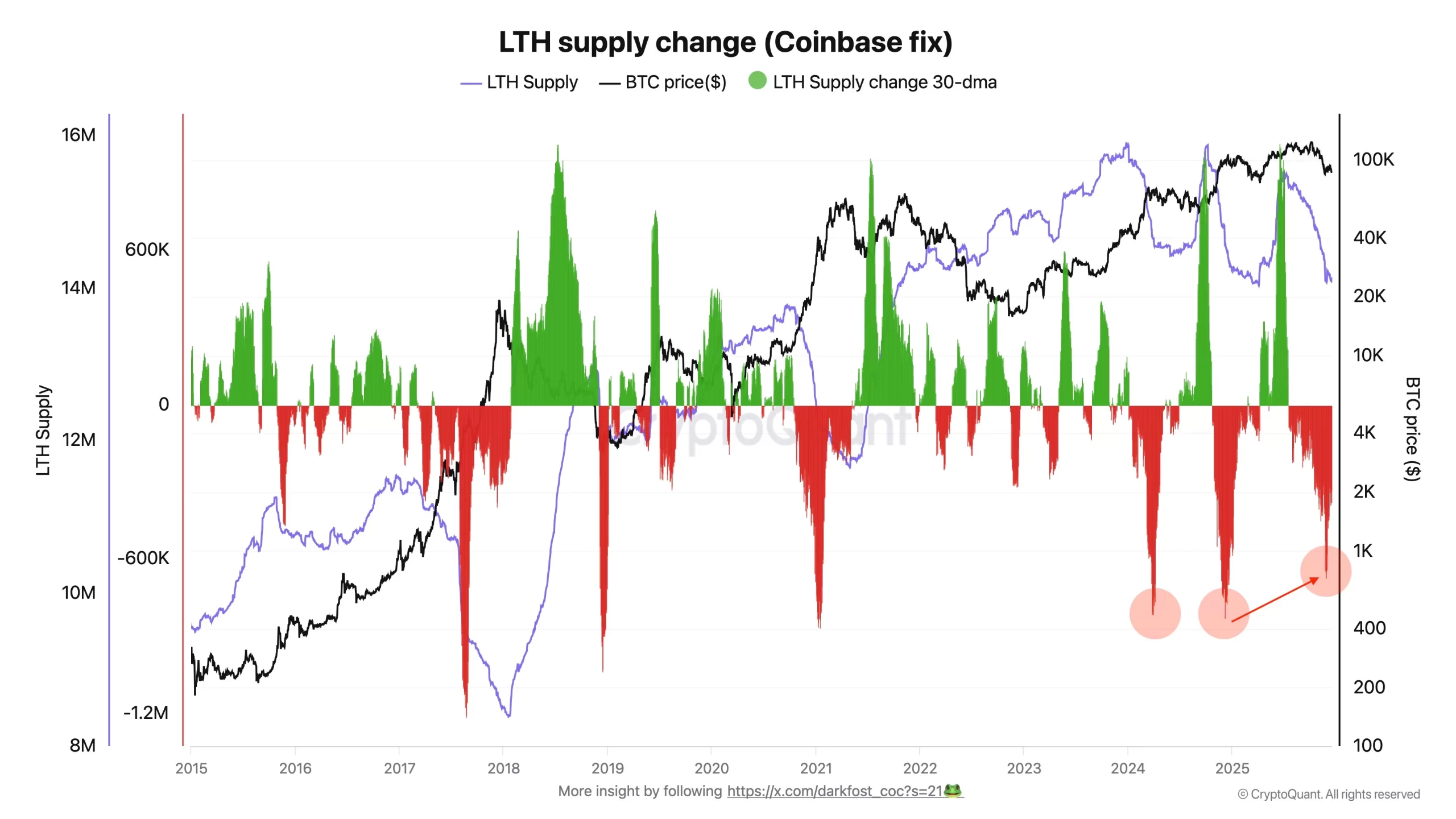

Anil warned investors about FUD and blindness in on-chain data when 800 thousand BTC was moved. CryptoQuant Darkfost, one of the analysts, touches on this very issue and says that some metrics are misinterpreted for short-term investors (LTH) and that investors are deceived because this feeds the perception that “they are selling like crazy”.

“It is said that short-term investors are selling like crazy, this view is wrong. I have said this several times and I will say it again.

Since the movement of approximately 800,000 BTC by Coinbase, a large amount of on-chain data has been affected.

Coinbase destroyed LTH UTXOs and created new ones on November 22 and 23, when BTC was trading around $85,000. As a result, all datasets across all platforms incorporated this movement, impacting UTXO-based metrics, time and value cohorts, STH cost base, realized value, volumes, and more.

This is even done by Bloomberg, who claims that LTHs have never sold this much. “After manually adjusting the data to isolate and remove Coinbase-related transactions, the change in LTH supply actually looks like this.”

“It is true that LTHs have resumed distribution, but this has occurred in a completely normal manner, consistent with the behavior they have exhibited throughout this entire cycle.”

So there’s bubbles in the panic and probably when the January FUD dissipates as well cryptocurrencies You can breathe easy. The short-term outlook is still not good.

What’s Happening in Cryptocurrencies?

The latest report published by Bloomberg, whose data appears to be more robust, focuses on crypto hedge funds. Analysts say that the funds have experienced their worst year since 2022. Fundamental and altcoin-heavy strategies fell about 23%, and market-neutral funds alone gained about 14.4%.

“ETFs and institutional capital inflows through structured products have narrowed traditional arbitrage opportunities, causing many funds to reduce their altcoin positions, and structural opportunities continue. to DeFi “It caused him to turn.”

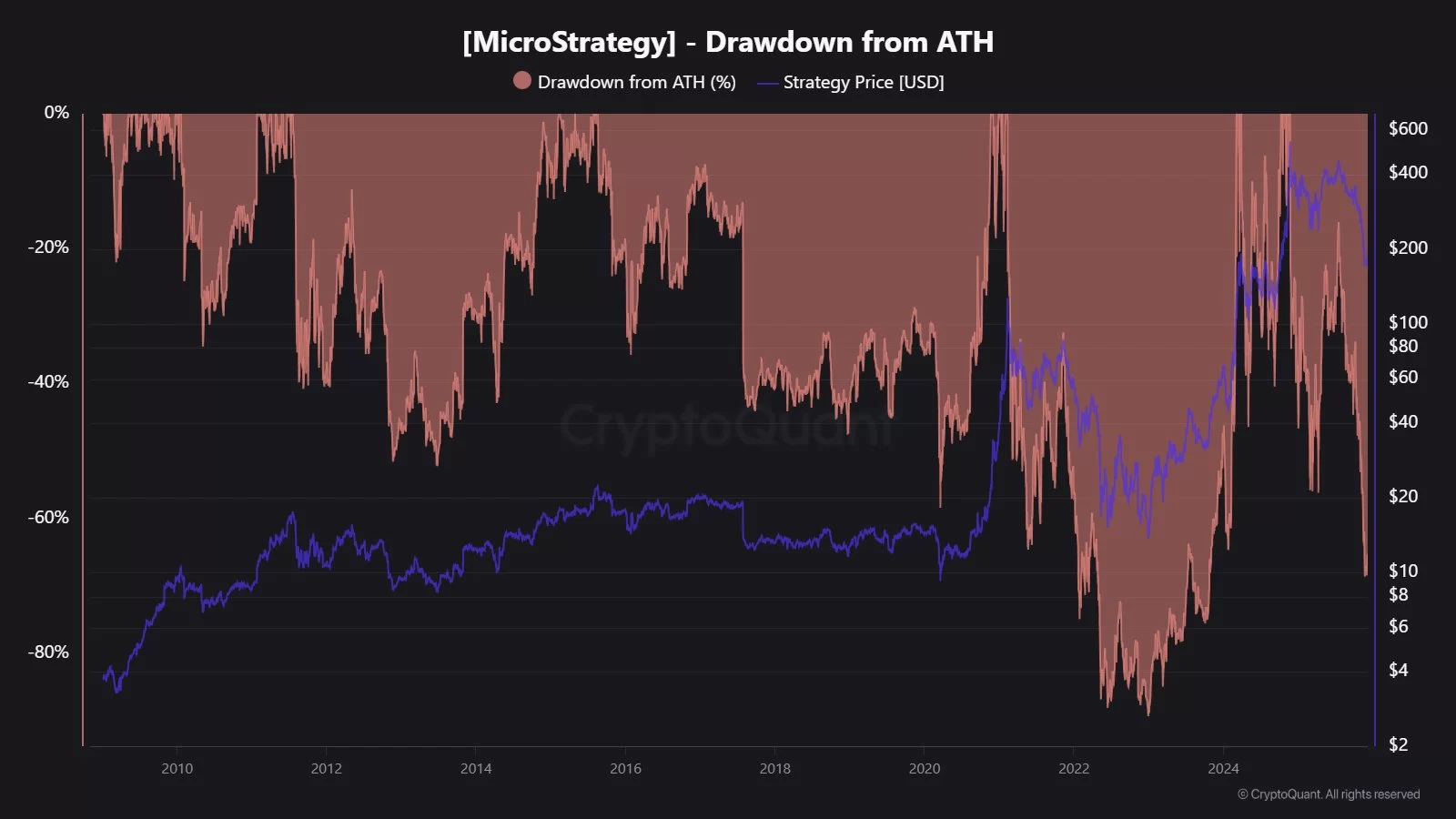

The on-chain analyst, nicknamed Maartunn, says that Strategy is creating MSTR selling pressure to buy more BTC, even though its stocks are in terrible shape. After reaching the ATH level this year, MSTR shares fell rapidly, reaching a 442-day low. Moreover, on January 15, MSCI will announce that if MSTR and other crypto reserve companies If it is classified as a fund, we will see billions of dollars more outflow.

The good news is that USDT dominance has been rejected at the 6.5% resistance level. This peak had previously said that altcoins were bottoming, and as the dominance retreated, altcoins were on the rise.

So people traded their USDT for altcoins. USDT dominance decreased and the market value of altcoins increased along with their prices. Now we have seen the same resistance rejection again, which is hopeful.

Volatility due to news flow is strong and CryptoAppsy The news section of the application can make your job easier.