Trump said tariffs had brought drug companies to their feet and talked about a big deal. That’s good for a further decline in inflation, and if a possible Supreme Court decision in January also causes Trump to cut rates, the decline in inflation could continue. So what do Coinbase analysts expect from 2026?

2026 Cryptocurrency Predictions

Latest report published by Coinbase Institutional to cryptocurrencies It offers a broad reading on the subject. The most important part is their expectations for 2026. Admitting that this year has been difficult due to volatility and unstable liquidity, analysts think that 2025 is important for the transition to a new phase in the global market infrastructure of cryptocurrencies.

The biggest expectation for 2026 is that global cryptocurrency regulations will mature further. USA stablecoins approved GENIUS for, but the comprehensive law regulating cryptocurrency markets has still not been voted on. It is hoped that at least the draft studies will be completed and voting will begin in the first quarter of 2026. Then, by July, the Senate and the House of Representatives will vote on the draft by reducing it to one. If the calendar progresses slowly, the rules may be delayed until 2027 due to midterm elections. Trump doesn’t want this.

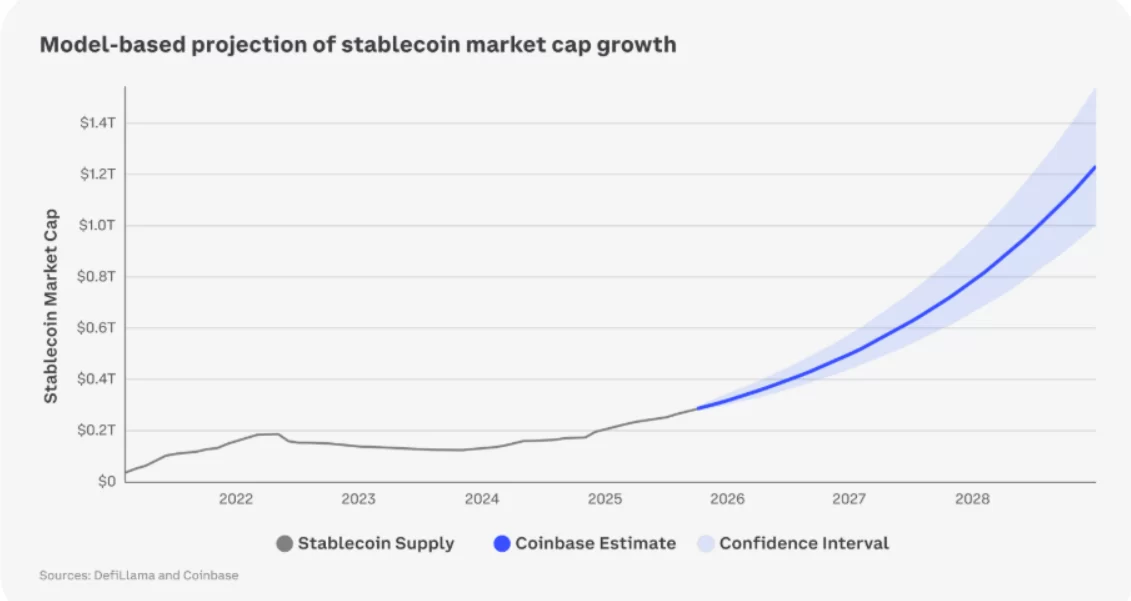

The model used by analysts says stablecoins could reach $1.2 trillion by 2028.

Macroeconomic Analysts, who declared 2026 a “year of cautious optimism” due to expectations, expect economic growth to remain unbalanced and inflation risks to remain strong. This stance is not surprising since the Fed is expected to make only 2 cuts next year, but Trump will surprise everyone. We may see reductions at the speed Trump wants, starting from May, with the name he appoints at the risk of compromising the Fed’s independence.

Bitcoin’s Style Has Changed

Coinbase analysts list Bitcoin among major assets  $87,270.31He says that it has found a place for itself, but now shows a similar volatility trend to technology stocks. Bitcoin’s 90-day volatility was over 60% last year (elections also have an impact) but this year it has dropped to around 35%. The launch of ETFs and the serious impact of corporate investment were effective in this.

$87,270.31He says that it has found a place for itself, but now shows a similar volatility trend to technology stocks. Bitcoin’s 90-day volatility was over 60% last year (elections also have an impact) but this year it has dropped to around 35%. The launch of ETFs and the serious impact of corporate investment were effective in this.

Bitcoin, which we see coming onto the scene for the first time in 2025 as a maturing new asset class BlackRock As its CEO put it, it has turned into “an asset where fear is priced”. Bitcoin, defined as an asset that can find a place in portfolios, comes to the fore with the recommendation that “1-5% should be in the portfolio” by many financial institutions and asset managers. Most do not recommend more than 3%, but it is nice that Bitcoin can find a place in institutional portfolios.

If inflation does not cause bad surprises next year and liquidity increases, despite all the concerns, cryptocurrencies may experience strong increases. Even if Bitcoin does not experience a major collapse in the first quarter of 2026, it may increase the appetite of investors again, as it will throw away the mandatory collapse scenario imposed by the 4-year cycle story. The return of those who have been selling with this expectation for the last 3 months to the game will change many things.