Quantitative easing was just what cryptocurrencies needed this year Fed It did not increase liquidity. Moreover, although monetary tightening measures have been shelved as of December, QE has not started yet. And while nearly every central bank in the world has loosened, the Fed has stayed tight. So 2025 cryptocurrencies It could have gone great for the U.S., but the Fed prevented it. The White House is in a celebratory mood today because Trump was proven right.

White House Statement

trump customs duties He was saying that it would not cause inflation and that interest rates should fall. He said the same thing throughout the year, often hurling insults at Powell such as “stupid, senile.” He even tried to remove him from office and continued Fed’s Although it dismissed one of its hawkish members, Cook, the court reinstated him.

At this point today, Trump has been proven right. White House Press Secretary Leavitt said;

“Just as President Trump told Americans last night: inflation continues to fall, wages continue to rise, and America is trending towards a historic economic boom. Today’s report shows that inflation is well below market expectations — a sharp contrast to the record 9% inflation crisis caused by Joe Biden. Core inflation has reached a new multi-year low as prices for food, medicine, gasoline, airfares, car rentals, and hotels continue to fall. Americans expect the trend of falling prices and rising wages to continue into the New Year.” They can wait!”

Interest Rates Will Fall Crypto Will Rise

Yes today inflation That was the hope their report instilled. But still, Powell and the hawks at the Fed will not consider themselves successful until inflation drops to 2% or below, because they always say the same thing. unemployment rate They argue that it is wrong to reduce interest rates quickly, taking the fact that it has reached a 4-year peak little seriously and saying “inflation has been above the level it should be for more than 4 years.”

But 2026 is an election year and Trump must launch electoral economics to win the election. The Fed must keep pace, and risk assets, including cryptocurrencies, must grow as monetary expansion begins rapidly. Latest data shows the inflation rate is down nearly 70% from its peak under Biden. In fact, if the pace of the last two months continues, inflation could fall as low as 1.2%.

The rapid decline in gasoline prices and the decrease in costs in many items have a positive impact on inflation. Moreover, Trump, who expelled illegal immigrants, was right when he said that housing inflation would decrease. The White House celebrated the success today by sharing the opinions of many experts.

- CNBC’s Steve Liesman: “That’s a very good number.”

- CNN’s Matt Egan: “Obviously, this is another step in the right direction.”

- Ken Rogoff, Professor of Economics and Public Policy at Harvard University: “It’s a better number than anyone expected… It’s positive news. There’s no other way to interpret it.”

- Economist Steve Moore: “Amazing… This is good news for Wall Street and good news for Main Street… This number put a big smile on my face right before Christmas.”

- Mark Tepper, CEO of Strategic Wealth Partners: “Amazing. By the way, I thought tariffs would increase inflation, but we’re seeing inflation coming down. Under President Trump’s watch, the affordability gap is closing day by day. We’ve seen real wage growth be positive, inflation slowing — that’s a great thing for America.”

- Tiana Lowe Doescher of The Washington Examiner: “This basic [enflasyon] It’s incredible to look at the number… It’s the lowest number we’ve seen since Biden started setting the economy on fire… This is called a comeback. Congratulations to Donald Trump!”

- Bloomberg’s Chris Anstey: “The lowest estimate in a Bloomberg survey of 62 economists was 2.8% for the annual basis increase. (This estimate came from Citigroup.) And the number came out two-tenths below that. Remarkable.”

- Andrew Ackerman of The Washington Post: “Inflation unexpectedly cooled in November, easing pressure on household budgets and giving the White House a welcome respite.

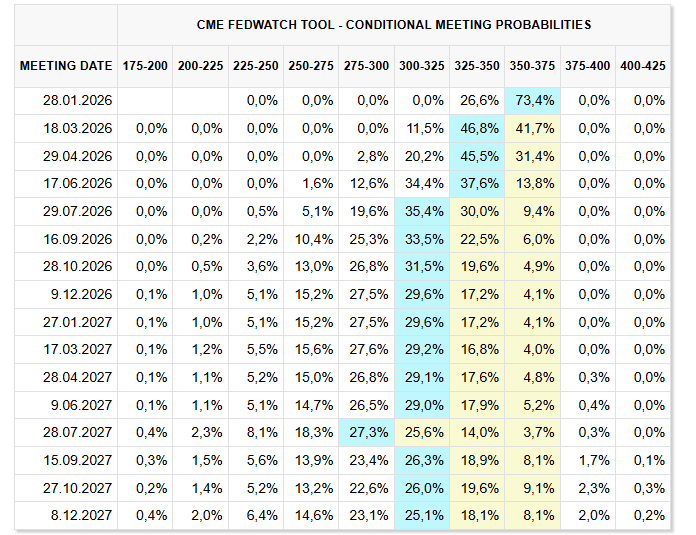

However, none of these could increase the interest rate cut expectation for 2026 from 2 to 3. Miran and other doves need to stomp on the latest data and the December inflation report needs to confirm today’s report ahead of the interest rate decision next month.