As volatility rises again in the cryptocurrency market, Binance Coin  $867.11 (BNB) has become the focus of investors in recent days. While the BNB price lost approximately 4 percent of its value in the last 24 hours and fell to the level of 832 dollars, a downward trend is also noticeable in the weekly and monthly outlook. BNB, which is still 39 percent below its peak of $1,369 in October, is trying to stay balanced with strong fundamental developments despite technical pressure.

$867.11 (BNB) has become the focus of investors in recent days. While the BNB price lost approximately 4 percent of its value in the last 24 hours and fell to the level of 832 dollars, a downward trend is also noticeable in the weekly and monthly outlook. BNB, which is still 39 percent below its peak of $1,369 in October, is trying to stay balanced with strong fundamental developments despite technical pressure.

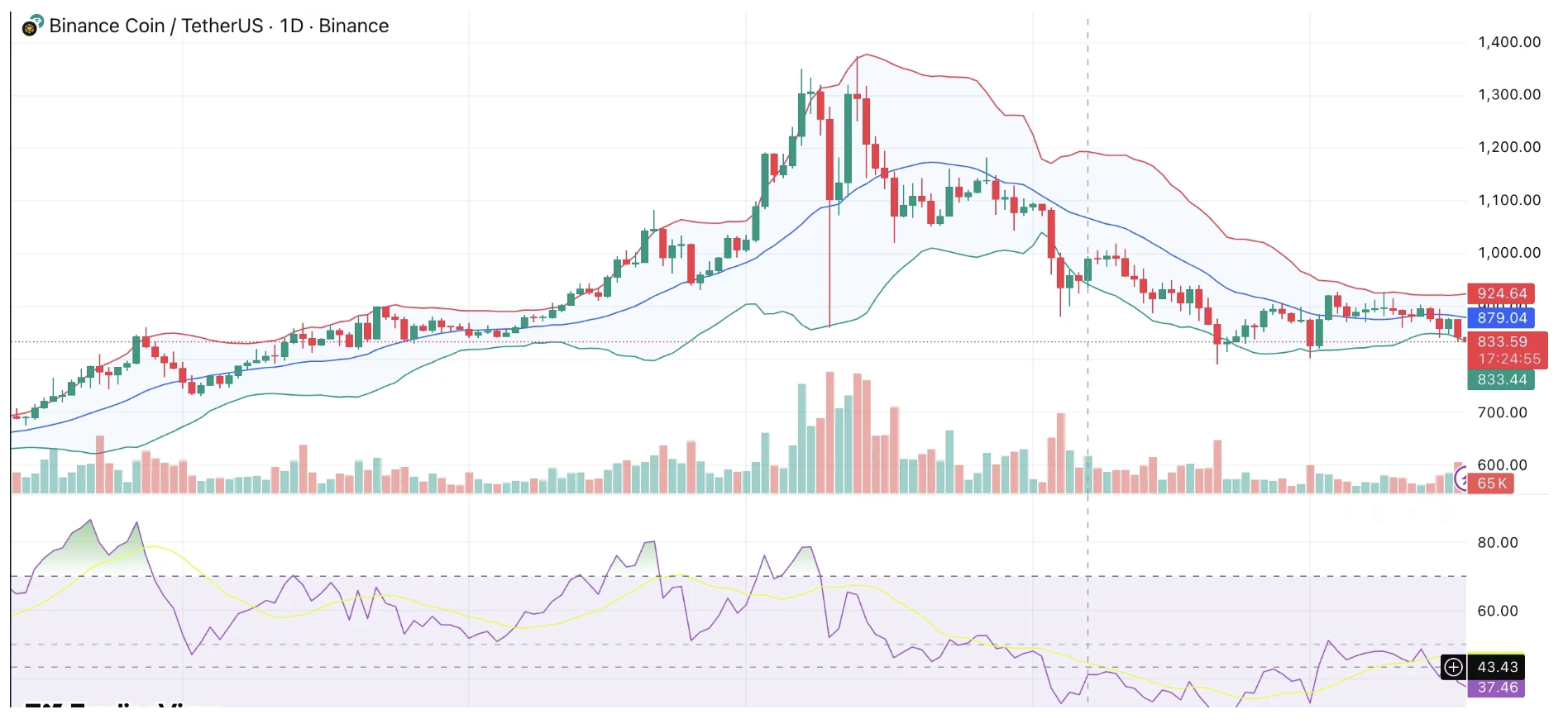

The price, which moved between 830-899 dollars in the last seven days, decreased by 4.3 percent on a weekly basis, while the loss reached 8.4 percent in the last 30 days. The increase in transaction volume during this period shows that there are active position changes rather than a silent wait in the market.

What Do Increasing Volume and Derivatives Market Data Say?

During the pullback in BNB, trading volume increased significantly. While a spot transaction volume of $2.51 billion was recorded in the last 24 hours, this figure indicates an increase of 33.6 percent compared to the previous day. In the derivatives market, according to CoinGlass data, the volume increased by 48 percent to 2.03 billion dollars, while the open position amount decreased by 1.72 percent to 1.33 billion dollars.

This picture suggests that investors close their leveraged positions and turn to risk reduction during volatility. In other words, the selling pressure reflects a controlled repositioning process rather than panic. A similar picture was seen on the Solana (SOL) side in recent weeks, and the decrease in open positions despite the increasing volume indicated a cautious short-term market structure.

Strong Fundamentals, Weak Technical Outlook

Despite the weakness on the price side, BNB’s long-term fundamentals continue to strengthen. Binance received full regulatory approval from Abu Dhabi Global Market, making the company the first crypto platform to receive exchange, clearing and brokerage licenses simultaneously. This development is seen as an important step that increases Binance’s credibility among institutional investors and regulatory authorities.

On the other hand, BNB Chain continues to be adopted in real-world applications. Backing BlackRock’s tokenized treasury fund on BNB Chain creates tangible demand on-chain while expanding institutional use of the network. In addition, BNB’s auto-burn mechanism reduces the circulating supply, supporting its long-term value proposition.

From a technical perspective, BNB price is hovering near the lower border of the Bollinger Band around $830. The fact that the price has difficulty with every attempt to rise towards the middle band around $ 880 indicates that the downward trend continues. While the RSI indicator remains below the 50 level, the MACD is still in the negative zone. The $900 turn into a strong resistance area limits the chances of recovery in the short term.