Bitcoin  $87,270.31 It is above $88 thousand again, but altcoins continue to linger at the bottom. Inflation data, which is well below expectations, is on the decline due to limited money supply, as Hanke predicted. Although BTC rose rapidly after the report cryptocurrency The prophet said that investors should not get too excited.

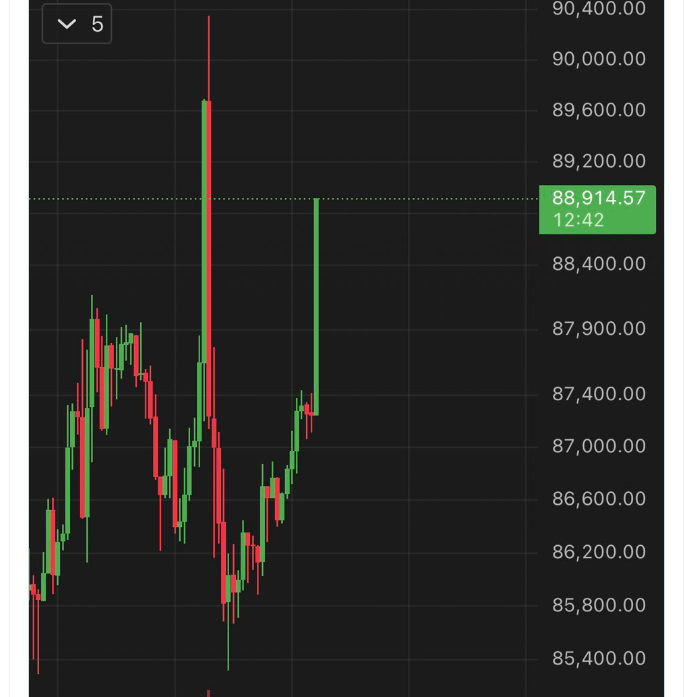

$87,270.31 It is above $88 thousand again, but altcoins continue to linger at the bottom. Inflation data, which is well below expectations, is on the decline due to limited money supply, as Hanke predicted. Although BTC rose rapidly after the report cryptocurrency The prophet said that investors should not get too excited.

Cryptocurrencies Will Fall

The analyst with the pseudonym Roman Trading is known for knowing the declines for 2 quarters, and despite the BTC price above 120 thousand dollars, he predicted a decrease to 80 thousand dollars in those days. He was right and says that even if we see a big reaction rise to $ 104 thousand since then, BTC will fall below $ 76 thousand.

Nowadays, the analyst who argues that “every rise is a short selling opportunity” says that the reaction rise triggered by inflation data is short-term. short liquidation He said he was nothing but his prey.

“They’re liquidating everyone here and they’re not even trying to hide it anymore.

“I feel very sorry for new investors trying to learn from this.”

Bitcoin, which has been going back and forth like a ping-pong ball to the levels where both short and long liquidations have been concentrated for a long time, triggered large liquidations. Roman Trading argues that this will continue and the main route for BTC is lower levels.

Although investors, especially those who open transactions with high leverage, try to benefit from this fluctuation, the price moves faster than expected and they are swallowed up as well. Therefore, it is difficult to be sure of the direction without breaking one of the $83,000 or $94,000 levels.

BTC It attempted close to 90 thousand dollars many times this week and eventually experienced rapid declines. Although the liquidation of hundreds of millions of dollars in a few hours no longer surprises investors, CME open interest has decreased significantly.

Where Are Cryptocurrencies Going?

Realistically, the inflation data was a surprise and we should not be surprised that an unpriced event triggered a healthier rise. On the other hand, if the Japanese interest rate decision, which will come at 07:30 on Friday, is in the direction of an increase as expected, the negativity may increase for a while. Until then, investors may remain cautious due to concerns about this negativity, but after Japan gets over the interest rate decision, of cryptocurrencies It will have time to rise.

Japan interest rate increase If it doesn’t, it could see a big rise tomorrow. If there is an increase in interest rates, a decrease is expected first and then balancing as the decision is already priced in. Since investors will largely be on holiday next week, markets are expected to perform better in the last days of the year. However, as January approaches, the wave of risk aversion will begin again as the reasons we have talked about in detail many times settle over us like a dark cloud.

Therefore, those looking for a short selling opportunity should not neglect the potential for next week’s rise to continue to higher levels than they expected.