Bitcoin  $87,270.31 It fell to 84 thousand dollars, and the decline was quite sharp for a day when inflation was announced extremely low. There are multiple reasons for the sales, and cryptocurrencies could not recover after the October 10 devastation. For Bloomberg, the reason is clear, and we are seeing devastation in cryptocurrencies due to a fact that people are less focused on.

$87,270.31 It fell to 84 thousand dollars, and the decline was quite sharp for a day when inflation was announced extremely low. There are multiple reasons for the sales, and cryptocurrencies could not recover after the October 10 devastation. For Bloomberg, the reason is clear, and we are seeing devastation in cryptocurrencies due to a fact that people are less focused on.

The Reason for the Cryptocurrency Decline

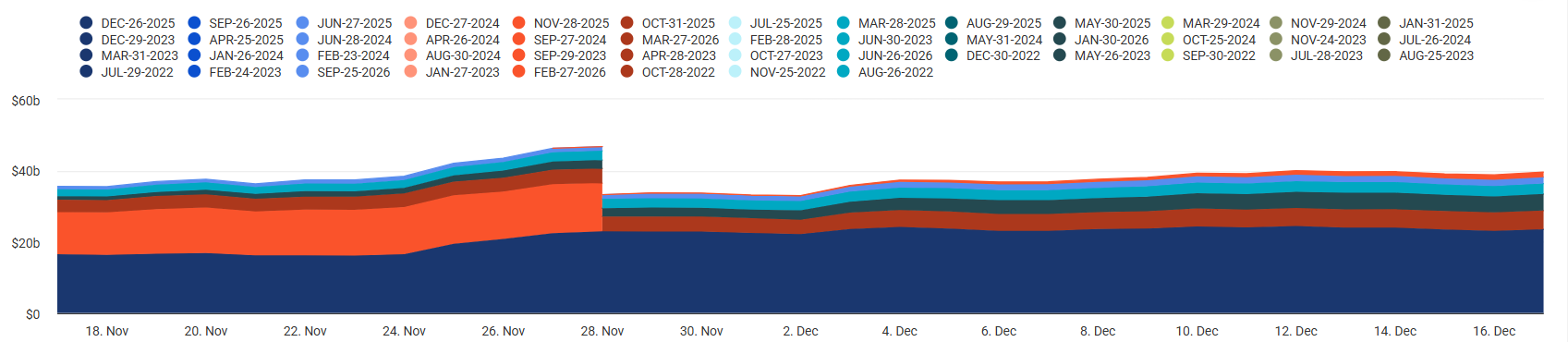

Bloomberg analysts say volatility has increased due to the $23 billion option expiring next Friday. We are in the last weeks of 2025 and investors’ annual positions are about to end. That’s why the number is higher than previous option closings. Even more Deribit We can say that half of the total open positions in the stock exchange will be closed on Friday.

Analysts note that 30-day implied volatility has risen to close to 45%, while options have deviated around 5%. This continues to dominate market pricing of downside risk.

Major option closes in cryptocurrencies It caused volatility throughout the year. But throughout 2025, we have seen position closings over $5 billion only a few times. Under current conditions, the size of the options to be closed is huge, and when corporate year-end profit selling and concerns originating from Japan coincide with this, things become even more complicated.

Risk appetite is weak and volume is limited, and investors who have been constantly preying on the liquidity game since October 10 have lost their courage along with billions of dollars. This situation increases sales to escape risk. Moreover, we already have 2 bad news for January. Well of cryptocurrencies The most likely direction to run is down.

Warnings for Cryptocurrency Investors

Volatility is the appeal of crypto, but this often works to the detriment of investors. Today’s inflation data and this week’s unemployment rate suggest that the Fed should start QE faster. Even Goolsbee, who opposed the December interest rate cut (one of the 2 Fed members who wrote a dissenting opinion), said the following in his statements that just ended;

“Last inflation data It was positive. If clarity is achieved and inflation falls, interest rates may also fall. I am uncomfortable with advance interest rate cuts. I would like to see inflation cool in a more sustainable way. Most indicators of the labor market show a fairly steady cooling trend.

As long as we know inflation will return to 2%, interest rates can drop considerably. The labor market is cooling slightly and steadily. The point at which interest rates will stabilize is well below current levels. Realistic interest rates could be quite low.”

Today’s report was so effective that Goolsbee was able to say these things. But in the short term, there is a very challenging environment that favors decline and volatility is high. So short-term, highly leveraged trades can be painful for investors.

However, if the December inflation report confirms the November data before the interest rate decision to be announced next month and can overcome the developments that cause negativity in the future, we can have a good start towards February. Although there are promising developments for now, it seems like a better option to stay on the sidelines and watch what happens, as we have more reasons to pump up fear.