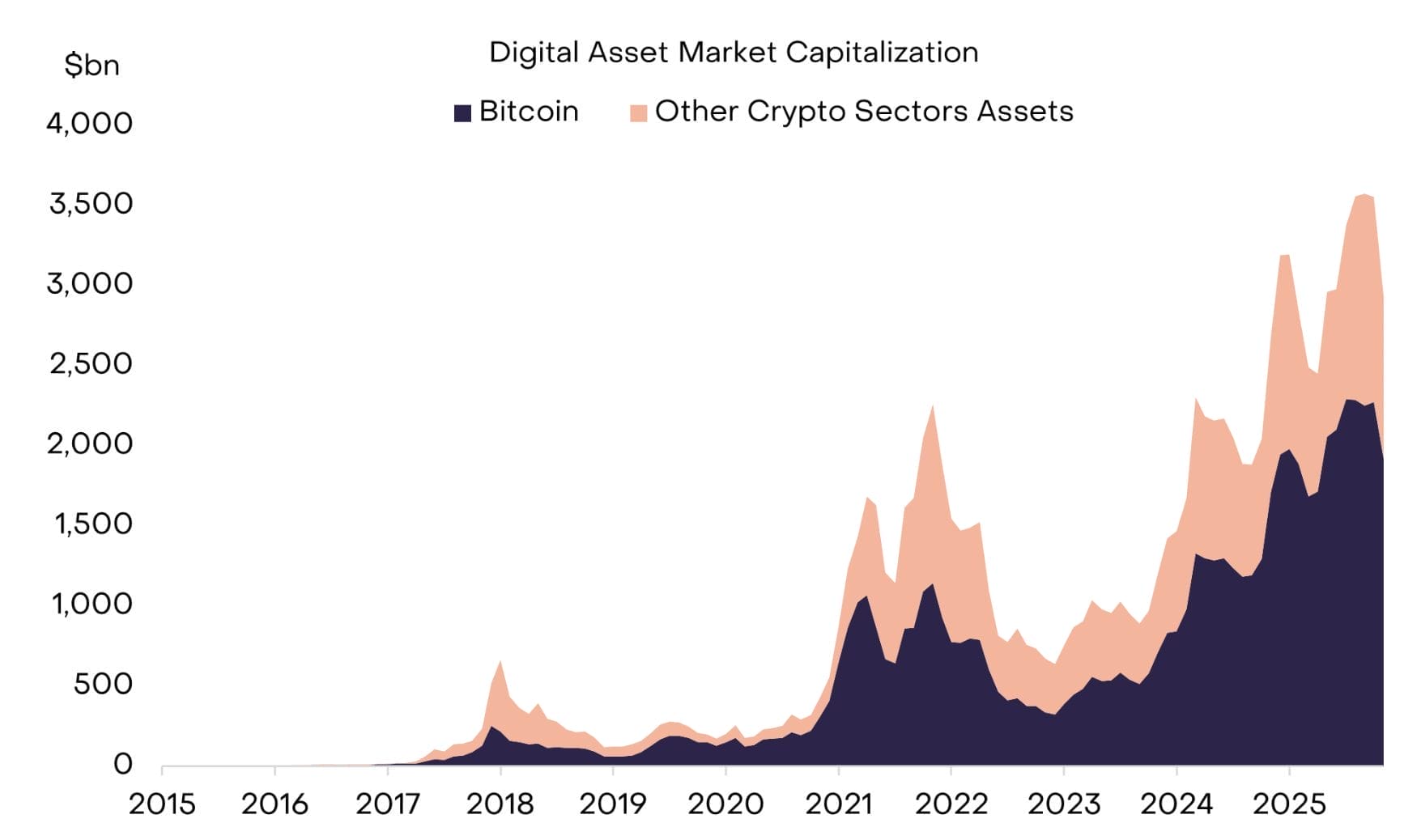

Grayscaletitled “2026 Digital Asset Outlook: Dawn of the Institutional Era” in the report He argued that the cryptocurrency market is moving into a corporate era as it enters 2026. Macroeconomic pressures and a clearer regulatory framework support the ongoing bullish outlook on cryptocurrencies, according to the asset manager. The report emphasized that the classic four-year cycle linked to Bitcoin’s block reward halving has weakened, and instead more stable capital inflows and deeper integration with traditional finance have come to the fore. Grayscale listed the themes that will come to the fore in 2026 and the titles that it thinks will be ineffective in the same framework.

Two Main Drivers That Will Direct 2026

Grayscale’s optimism is based first on macro demand for alternative stores of value. The company stated that high public debt and financial imbalances pose risks to fiat currencies. Bitcoin And EthereumIt positioned them as “scarce digital commodities” with a transparent and scheduled supply structure. This approach reinforces the idea of a stabilizing role in portfolios against inflation and currency depreciation concerns.

The report cited Bitcoin’s fixed issuance schedule as an example and noted that the 20 millionth Bitcoin is expected to be issued in March 2026. Grayscale pointed out that predictable supply dynamics are a key feature that distinguishes it from nominal systems tied to monetary policy.

As a second driver, it was emphasized that regulatory clarity accelerates corporate investment. Spot cryptocurrency-based ETF approvals, stablecoin regulation GENIUS Act and the expectation of a bipartisan market structure law in 2026 were listed as developments that lower institutional barriers in areas such as custody, transaction and intra-Blockchain capital allocation.

Grayscale’s 2026 Investment Themes

Grayscale defines 10 investment themes for 2026 rather than speculative narratives. adoption, infrastructure And sustainable areas of use gathered on its axis. In the “Macro, money and market structure” cluster, concerns about dollar depreciation are reflected in Bitcoin, Ethereum and privacy-focused altcoinIt was noted that it could keep interest in ‘s alive, and regulatory clarity could expand corporate participation throughout the ecosystem.

stablecoin On the other hand, after the GENIUS Act, its usage areas were expected to grow towards payments, cross-border settlement, collateral in derivative transactions and corporate treasury operations. TokenizationIt was stated that with better regulation and infrastructure, it may approach a threshold point where stocks, bonds and other securities can be issued and traded on public Blockchains.

Under the heading “Technology, infrastructure and intra-Blockchain finance”, it was stated that DeFi lending markets could accelerate with increased liquidity and positive regulatory winds. It was shared that institutional investors will focus more on measurable fundamental metrics such as transaction fees, while staking may become a more default feature across investment products and custody platforms with regulatory guidance. It has also been suggested that the demand for identity, computation and payment infrastructure at the Blockchain-AI intersection may be strengthened by centralization and data ownership concerns.