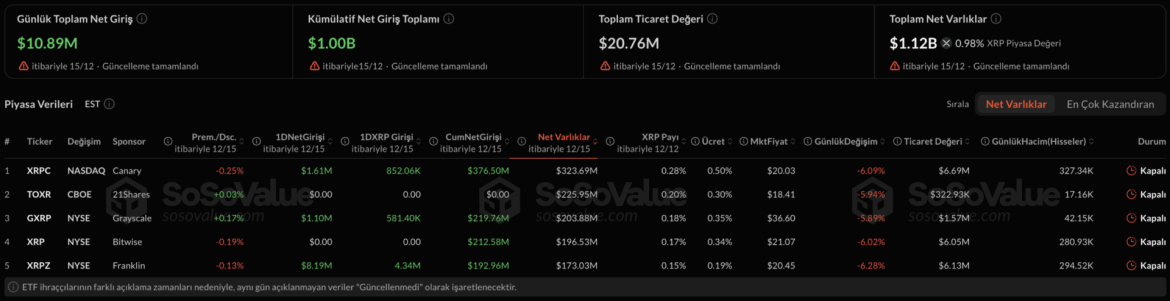

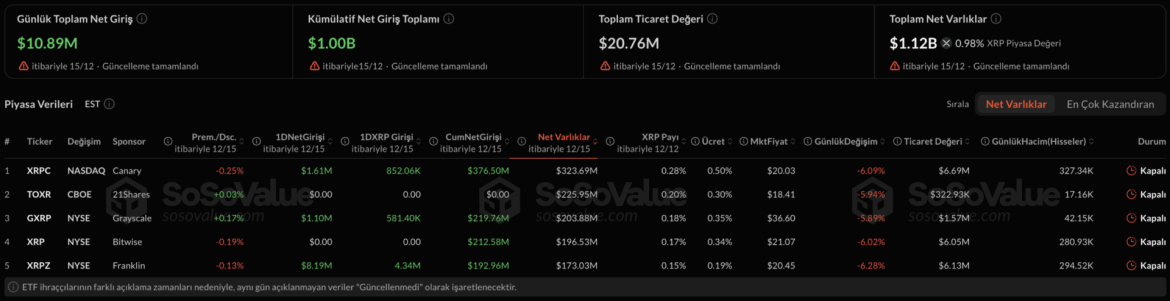

Spot traded in the USA XRP ETF‘s have crossed the $1 billion threshold since launch on November 13, reaching a new milestone in institutional interest in altcoins. SoSoValue According to data, there was a total net inflow of 10.89 million dollars into these ETFs on Monday. Entries contributed by Canary, Grayscale and Franklin Templeton funds XRPBitcoin  $87,270.31 and Ethereum

$87,270.31 and Ethereum

$2,959.50 stood out in the field of regulated investment outside.

$2,959.50 stood out in the field of regulated investment outside.

Institutional Capital Turns to XRP

CIO of Kronos Research Vincent LiuHe described the increase in funding in XRP ETFs as evidence that institutional investors are moving into regulated, cryptocurrencies with different stories. Liu stated that macroeconomic uncertainties are still effective, but investors are diversifying their portfolios with long-term strategies. The clarity XRP has achieved on the regulated front and its potential for use in corporate payments has ensured steady inflows.

The data shows a similar trend in Solana’s spot ETFs. Solana, which started trading in October ETF‘s total reached $711.3 million with $35.2 million inflows on Monday. The resulting table Bitcoin And Ethereum It reveals that assets other than these now have serious investor interest.

Hard Exit from Bitcoin and Ethereum ETFs

On the other hand, on Monday Bitcoin ETFThere was a total net outflow of 357.7 million dollars. Fidelity’s FBTC ETF led with an outflow of $230.1 million, while Bitwise’s BITB ETF had an outflow of $44.3 million. ETFs from Grayscale, Ark & 21Shares and VanEck have faced similar investor retreats. These outflows were recorded as the largest single-day outflow since November 20. Ethereum ETF‘s continued its weak course with an outflow of 224.8 million dollars on the same day.

The price of Bitcoin dropped from $89,000 to $85,500 on Monday and stabilized around $86,080 as of Tuesday morning. Liu explained that investors turned to safe havens again due to the year-end liquidity contraction and the unwinding of leverage positions. The limited effect of the Fed’s interest rate cut is cryptocurrency marketHe underlined that the sales wave deepened.