XRP Coin has done a lot of good this year, but its achievements have been undermined by the negativity in overall market sentiment. However, it is not in a terrible situation as it has remained strong in the declines compared to others and we are hopeful for next year. So what awaits XRP Coin in the short and medium term? This is exactly what we will cover today.

Ripple (XRP)

Having lost the support of $ 1.98, XRP Coin fell below $ 1.93 and now finds buyers at $ 1,919. The interest rate decision on Friday and this week’s US inflation figures will shape the short-term outlook. Although it performed well throughout the year, XRP Coin has now begun to be affected by year-end weakness, losing $ 1.98, as we see from the chart.

That’s exactly why Efloud is last Ripple (XRP)  $1.93 He made the following warnings in his analysis:

$1.93 He made the following warnings in his analysis:

“For this reason, let me remind you in this analysis as I have in every analysis. When considering taking trend reversal transactions at supports, be careful to see bullish breakout structures, that is, signs of reversal, in low time frames (confirmation).

The price unfortunately lost the “Daily Imb” region. If purchases occur after the last swing low zone occurs, the $1.98 region will be the area that I expect to work as resistance in the first phase. As I emphasized in the previous analysis, I think there is no positivity after losing the Daily Imb place without gaining YO.”

On Efloud ETF channel XRP Coin He mentions that although his interest continues, the dynamics of the market itself do not say great things yet. It also emphasizes that in an environment where market pressure continues, purchases can be made at $1.53 and that we are likely to see a bounce from here. If January starts badly due to reasons such as the first quarter MSCI dellists, the Supreme Court Tariff decision and the Fed taking a break from interest rate cuts, the level we should look at for XRP Coin will probably be $ 1.53.

XRP Coin ETF

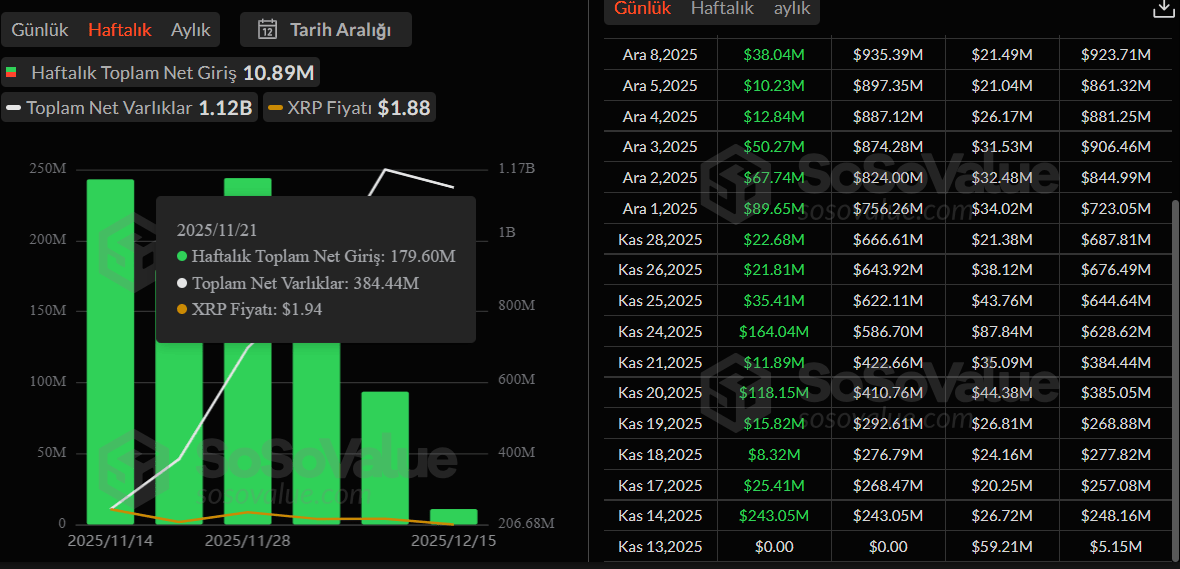

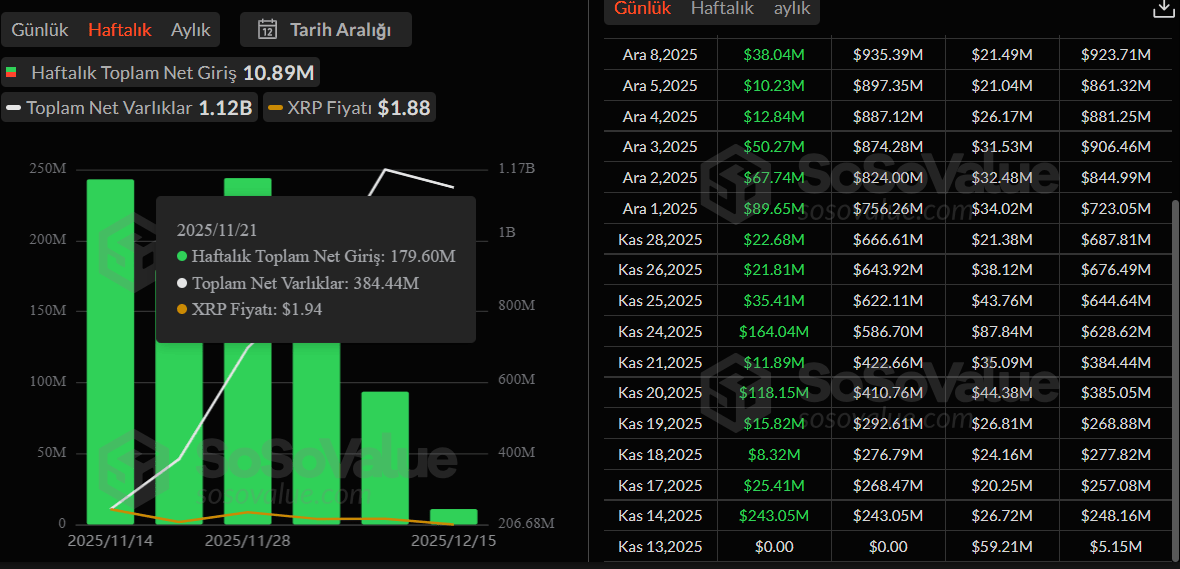

According to SoSoValue data XRP Coin ETFs has surpassed the $1 billion entry threshold since launch. Moreover, total net assets reached $1.12 billion, which is almost 1% of the XRP market value. Canary, 21Shares, Grayscale, Bitwise and Franklin attract corporates to XRP Coin with 5 products in total. Although their asset distribution is balanced and Franklin offers the most attractive transaction fee, Canary comes first in terms of asset size.

It is an undeniable fact that the excitement in the ETF channel has begun to fade. Last week we saw the lowest inflows and this week the demand is a little weaker so the negativity in the general market sentiment may be affecting those here as well.