With his latest statements, the US Treasury Secretary said that January cryptocurrencies He hinted that it might start out badly for you. BTC is having difficulty maintaining the $88,000 support and cannot permanently overcome the $94,000 resistance. As increasingly weak investors sit on huge losses, Darkfost thinks deeper bottoms are inevitable.

Bitcoin Bottom Target

Each analyst has different targets and scenarios ranging up to 50 thousand dollars are floating in the air. Darkfost, on the other hand, focuses on the average costs of investors. of BTC He thinks he can live deeper, closer to $74,000. Moreover, in today’s evaluation, we talked about why January can start badly, so if we combine the two, we will have a bad start in January. BTC It may decrease to 74 thousand dollars. If Japan raises interest rates on Friday and Fed If he continues to take it slow, this could happen sooner.

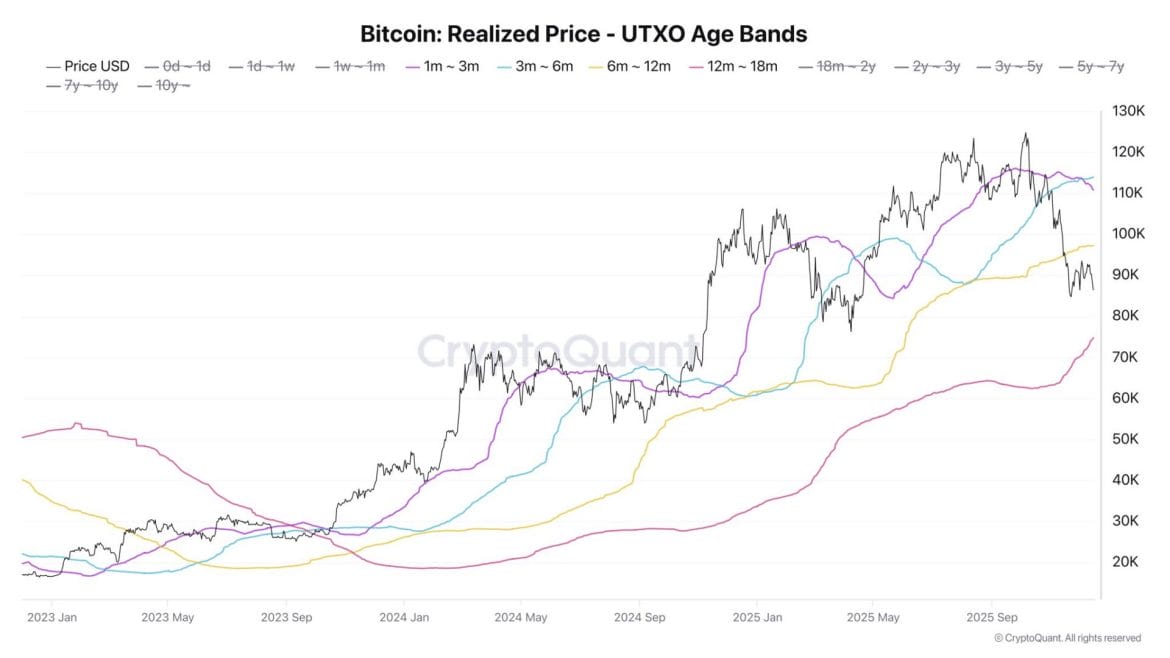

The analyst who shared the chart above wrote that the average unrealized loss was approximately 11.6%. The first LTH cohort (6 months-12 months) has an average cost basis of $97,320 and they are currently at a loss. LTH’s increasing losses are not a very positive sign and the analyst thinks that although this may not have major consequences in the short term, it may pull down the spot price in the medium term. But there is another important detail.

“What’s interesting is the growth of the 12-month–18-month UTXO group. Since November 1, their costs have increased from $63,217 to $74,745.”

This shows that the first LTH group continues to hold their positions in the current conditions and allows their UTXOs to move into the next range. Therefore, the $74,000 level seems like a solid front line here, especially as it is also converging from a technical analysis perspective. “Given current market dynamics, I wouldn’t be surprised if we hit this level again.”

2 Different BTC Analysis

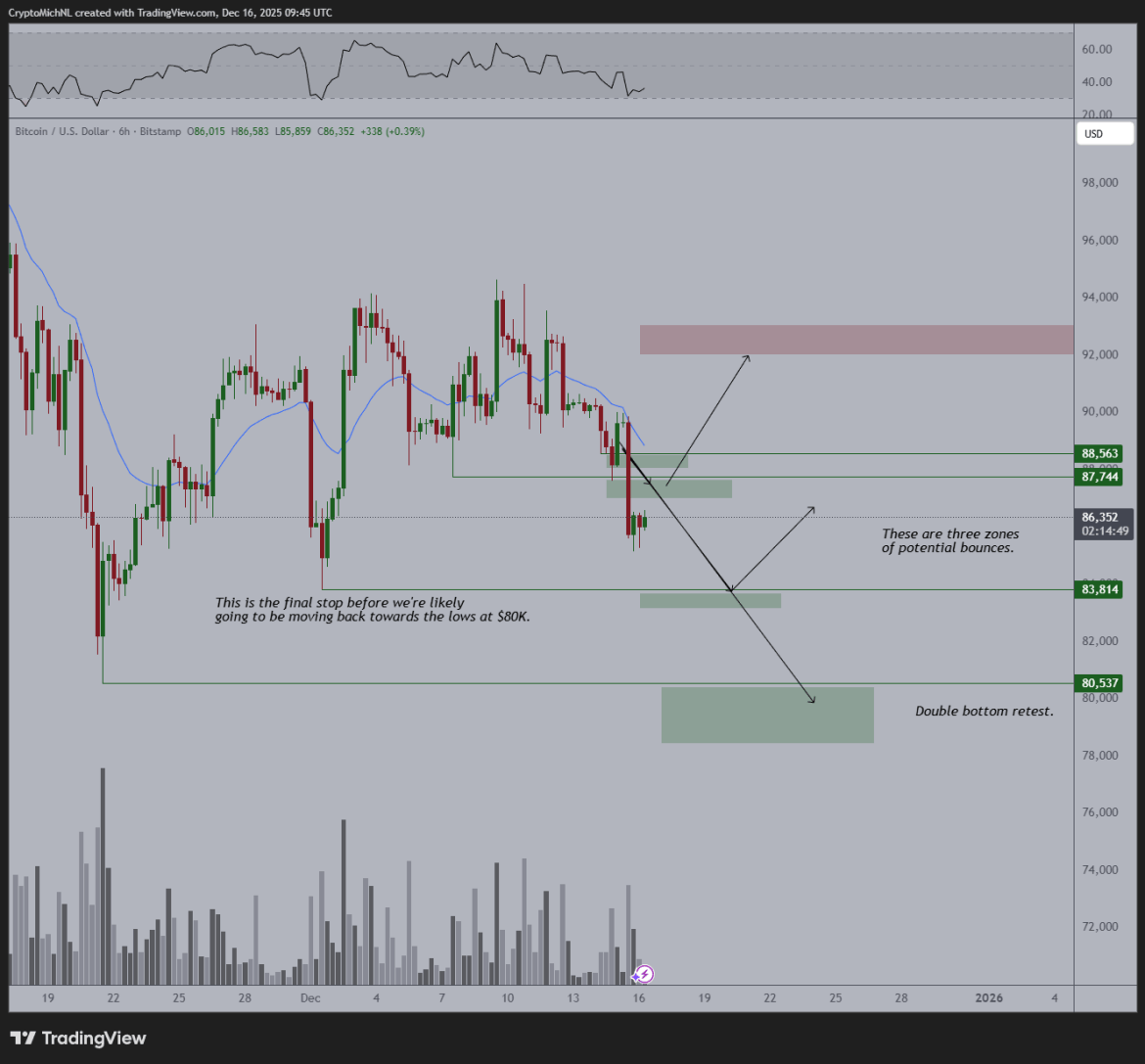

BTC It is stalling at $87,000, and Michael Poppe, who is known for always looking to the future with hope, is worried about the continuation of the downward trend unless $88,000 is taken back. Despite all his optimism, due to the fluctuation on the macro front, the analyst drew attention to the possibility of clearing the liquidity at 83 thousand dollars and creating a double bottom at 80 thousand dollars. If Poppe is starting to worry, either things have gotten dire or cryptocurrencies It is preparing for a big rise; there is usually no middle ground.

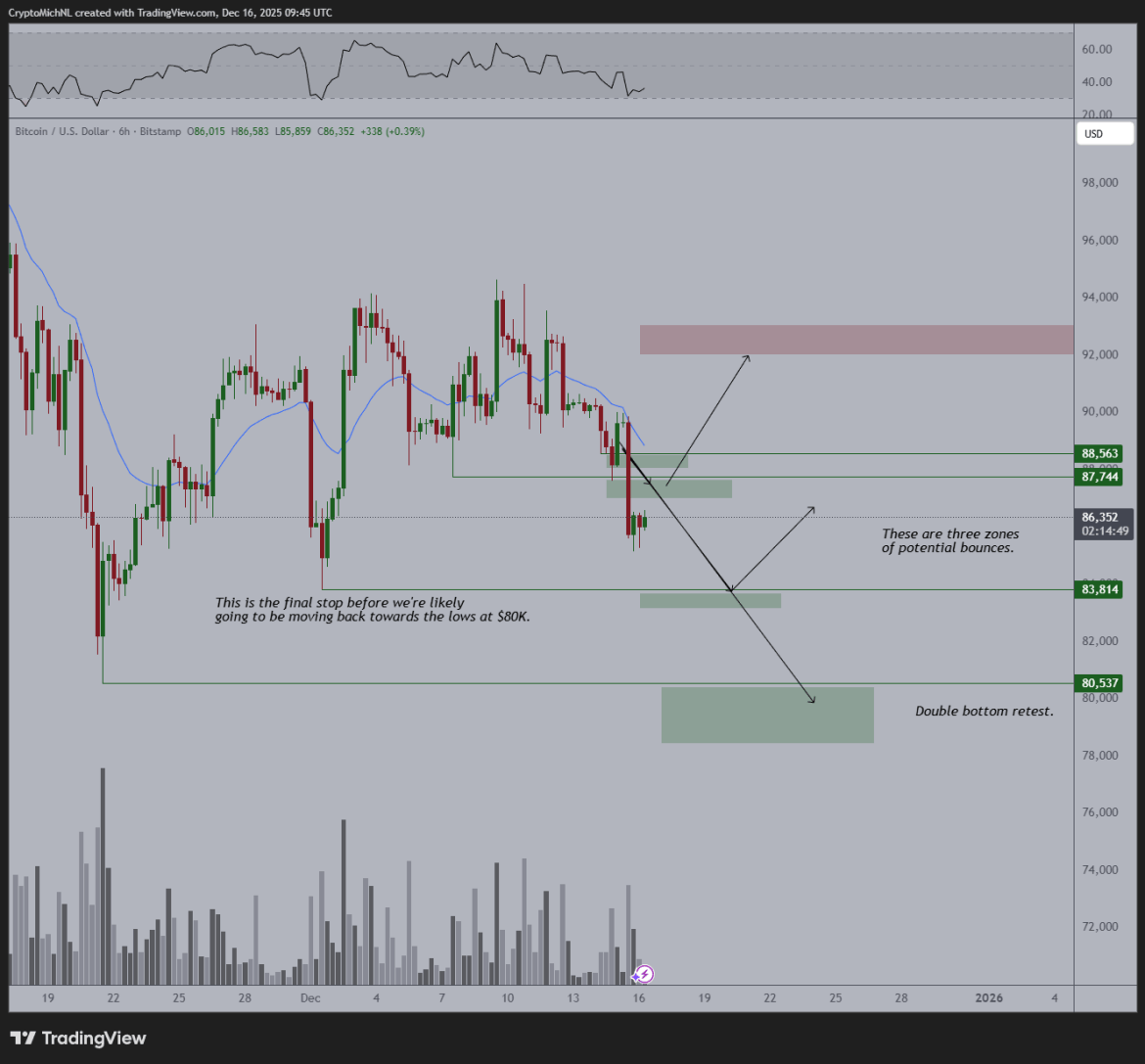

DaanCrypto warns against the liquidity hunting game by sharing the chart below.

“In an unstable market like the one we have been in for the last few weeks, liquidity is more important than ever. The basis of all these “Bart moves” is the lack of liquidity and the search for liquidity.”

If one side gets too extreme -> It gets hunted down and eliminated by market makers and bigger players. For the last few weeks, there has been no clear direction, volume or liquidity to truly initiate a trend move. With all this said, if you are trading, it is very important to know where potential stop hunts may occur and where reversals may occur.”