Due to the US government shutdown, many reports are either not being released or are coming in a row. Although the delayed reports provide a broader reading because they come in bulk, Powell thinks the numbers are not as reliable because the data was not collected adequately during the shutdown. Now let’s take a look at what data bombardment promises us.

Cryptocurrencies Should Rise

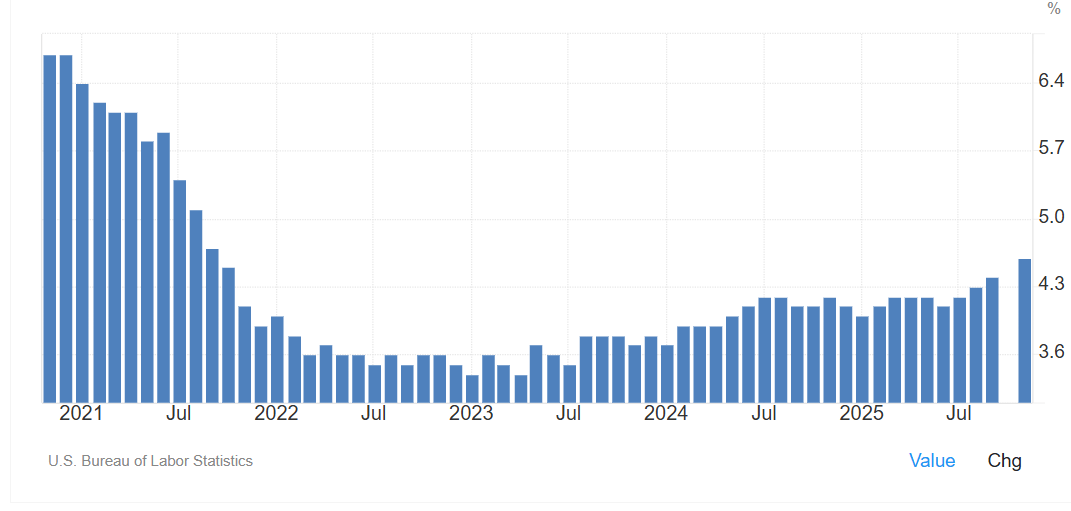

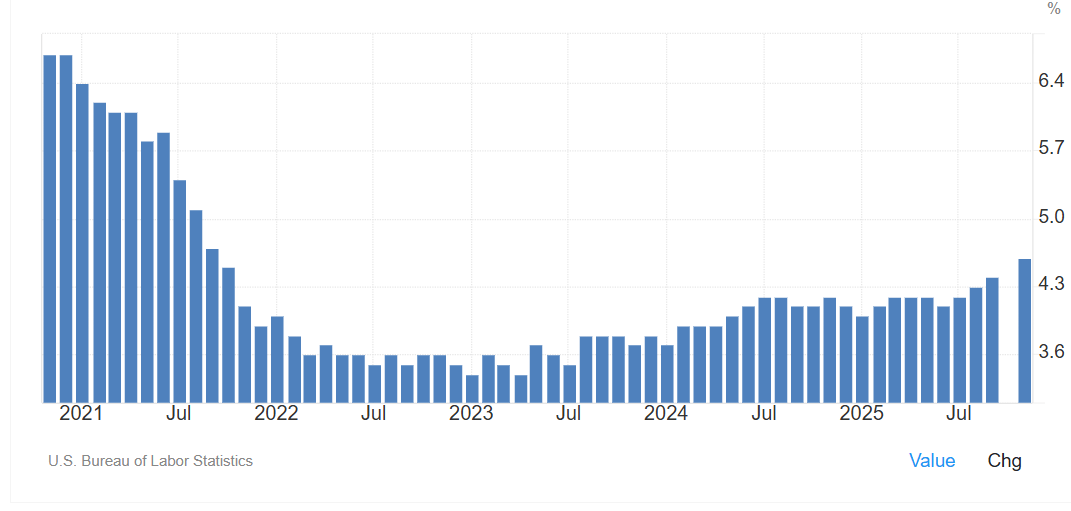

Yes, the unemployment rate has reached the highest level since September 2021. The level of 4.6% will not be reached until 2025. Fed It was a level that the member did not foresee and shows how justified the interest rate cuts were. While Powell and his team focus on inflation unemployment rate It constantly reaches new peaks and inflation remains stable during the same period. The Fed has two main missions: maximum employment and fighting inflation. They have focused so much on inflation since 2022 that now employment is raising an alarm.

US employment data was revised down by a total of 33 thousand in the August-September period. Powell said this was likely, and new reports confirming that employment is worse than reported is positive for further rate cuts. However, cryptocurrencies continue to decline instead of rising in this environment.

Japan interest rate decision coming on Friday, weakening interest as we are in the last days of the year, MSCI and Supreme Court Tariff Decision Things like shock undermine risk appetite.

US Data Bombing

The BLS says the November response rate was below normal at 64%, meaning the data is not as reliable as it was before the shutdown, but the weakening of employment is evident. US interest rate futures forecast two rate cuts in 2026 following employment and retail sales data; 58 basis points of easing is priced in next year. Interest rate cut expectation in January increased from 22% to 33%.

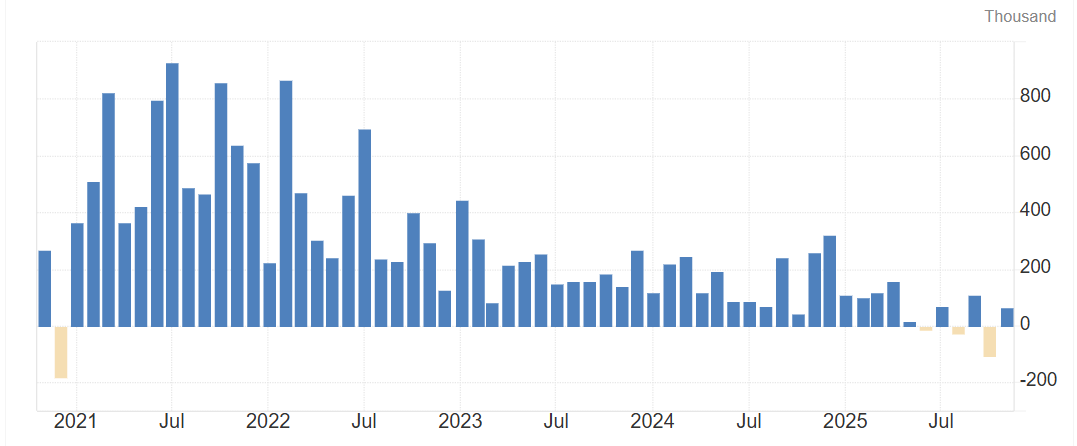

for October Non-Farm Employment The expectation was at -25K, but it came to -105K. August employment data was revised from -4K to -26K. Unemployment figures for September were revised down from 119 thousand to 108 thousand. Non-agricultural employment came in at 64K in November, while it was expected to be 50K. The unemployment rate reached its new peak at 4.6%, against the expectation of 4.4%.

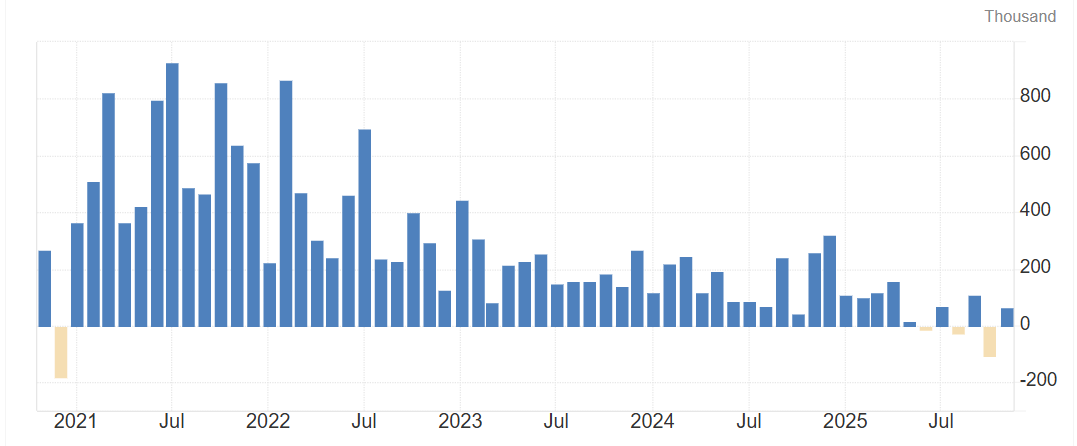

While the decline in average earnings highlights the potential for further weakening for employment, the chart below shows us how much unemployment has increased since March 2023.

But since it was above 6% at the end of 2020, we will probably continue to see those within the Fed saying they can keep the current situation under control.

You can see the 5-year change in non-agricultural employment data in the graph above and the decline in 2025 is obvious. All this tells us that if the new data does not exceed expectations, there may be a discount in January as well. But none of this helps the rise as it does not eliminate crypto’s unique and general pressures. BTC is below $ 87 thousand.