The world’s largest corporate Bitcoin  $89,546.31 Amid FUD on investor Strategy, it has again announced its massive BTC purchase. The company is expected to be removed from MSCI indices after 1 month, and many institutions such as JPMorgan say that this will have major consequences on the company. Some even mention that they may sell BTC for Strategy.

$89,546.31 Amid FUD on investor Strategy, it has again announced its massive BTC purchase. The company is expected to be removed from MSCI indices after 1 month, and many institutions such as JPMorgan say that this will have major consequences on the company. Some even mention that they may sell BTC for Strategy.

Bitcoin Breaking News

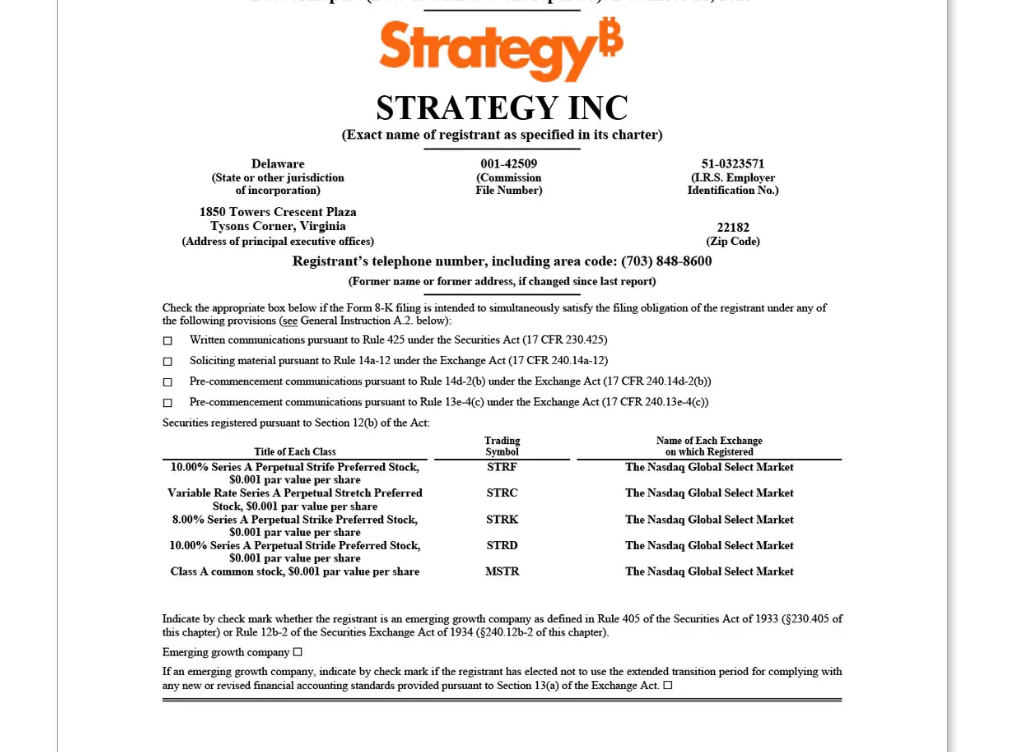

Strategy It just announced its latest acquisition last week. 10,645 for $980.3 million BTC The purchasing company made this purchase at an average cost of $92,098. The company, which achieved a 24.9% BTC return this year, holds 671,268 BTC as of December 14. The company, whose average cost for all purchases is $74,972, has made billions of dollars in purchases since the November election victory, and it is promising that it continues to do so.

MNAV is at 1.14 and MSTR Its shares find buyers below the ATH level. The company, which also has a cash reserve of 1.4 billion dollars, has guaranteed its debt payments for at least 1 year. So, unless MNAV experiences an abnormal decline, even the January 15 decision will not force them to sell BTC.

The acquisition announced today shows that the company can still easily raise cash, as the MNAV is above 1. According to the document filed with the SEC, the purchases were financed with proceeds from the sale of stock. The total value of the company’s assets, which was purchased at a cost of approximately 50 billion dollars, is over 60 billion dollars. The company, which alone holds 3% of the 21 million BTC supply, is doing a great job in breaking the sales pressure.