JPMorgan Chase, Ethereum, in line with growing institutional demand for blockchain-based financial products  $3,142.88 It is launching the first tokenized money market fund on its network. This new product, called My OnChain Net Yield Fund (MONY), is launched with an initial investment of $100 million provided by the bank’s asset management unit.

$3,142.88 It is launching the first tokenized money market fund on its network. This new product, called My OnChain Net Yield Fund (MONY), is launched with an initial investment of $100 million provided by the bank’s asset management unit.

The global bank, which manages approximately $4 trillion in assets, According to the Wall Street Journalplans to open the fund to qualified external investors as of this week. MONY aims to combine the return offered by traditional money market funds with the advantages such as speed and transparency provided by blockchain.

This move by JPMorgan stands out as the latest link in the wave of large financial institutions turning to tokenized funds. Previously, Franklin Templeton stepped into this field with the BENJI fund in 2021, while BlackRock managed to collect approximately $ 2 billion in assets through the BUIDL fund it launched in cooperation with Securitize in 2024.

Tokenized money market funds offer investors the opportunity to earn returns by investing their idle cash on the blockchain. This structure; It differs from traditional funds with its features such as faster clearing processes, 24/7 transaction processing and instant monitoring of ownership information. Additionally, such assets are increasingly used as reserves or collateral in decentralized finance (DeFi) protocols.

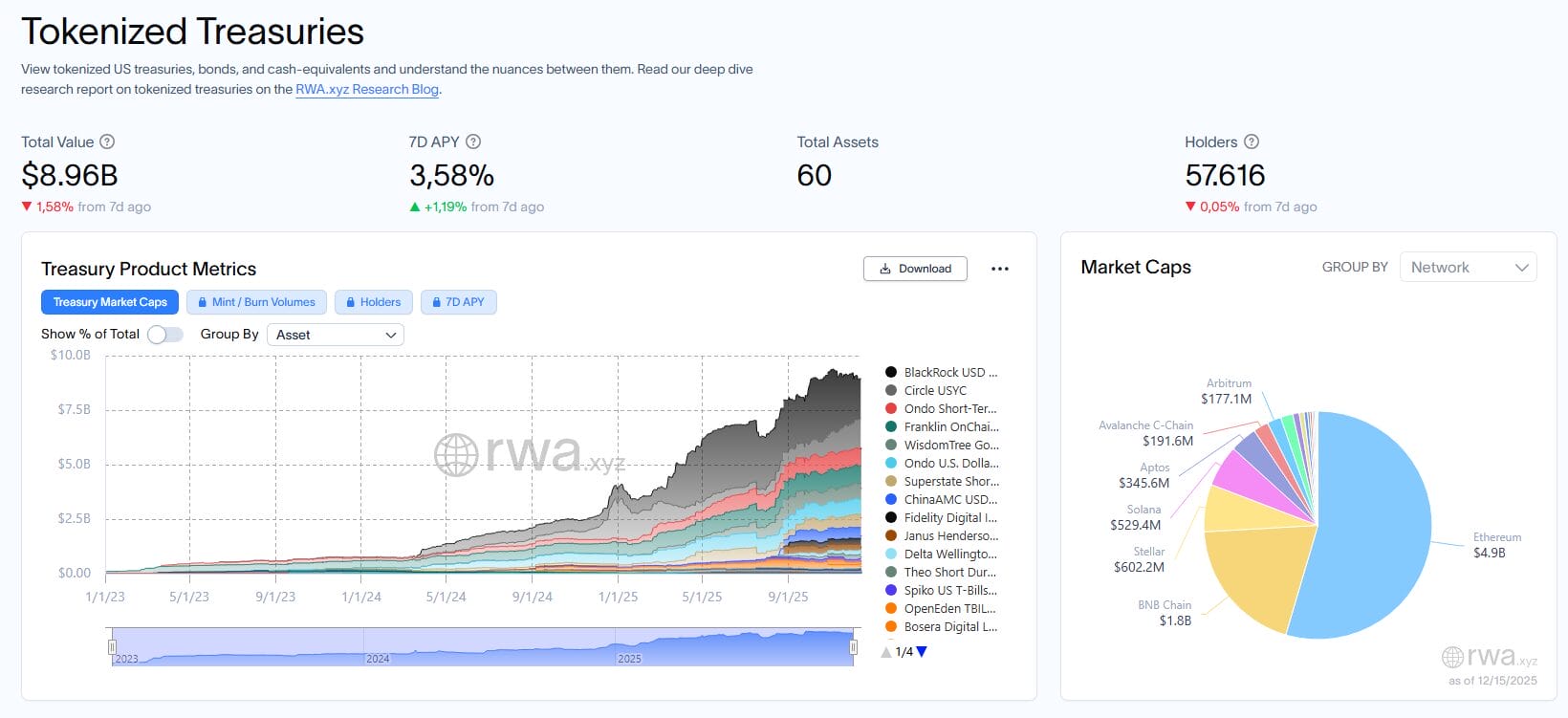

According to RWA.xyz data, the total size of tokenized money market funds increased from $3 billion to $9 billion in one year. RWA.xyztokenized on the blockchain real world assets (RWA) It is a tracking data and analysis platform. Tokenized money market funds, bonds, treasury bills and similar on-chain financial products total size, growth rates and distribution It shows transparently. It is used by institutional investors and DeFi projects to monitor the current status of the RWA market and perform comparative analysis. The list includes platforms such as Arbitrum, Avax and Circle. Boston Consulting Group and Ripple  $1.97 A report published by predicts that the tokenized asset market could reach $18.9 trillion by 2033.

$1.97 A report published by predicts that the tokenized asset market could reach $18.9 trillion by 2033.

John Donohue, Head of Global Liquidity at JPMorgan Asset Management, stated that they received intense interest from customers for tokenized products and emphasized that the bank aims to be a pioneer in this field. MONY is built on JPMorgan’s in-house developed Kinexys Digital Assets platform and is a test case for the bank to expand its on-chain product portfolio.

The fund will invest in short-term debt instruments and offer daily interest payments, just like classic money market funds. Investors will be able to redeem their shares in cash or USDC stablecoin. Only qualified investors can participate in MONY and the minimum investment amount is set at 1 million dollars.

Considering that JPMorgan Chase has had a cautious and at times negative attitude towards cryptocurrencies in the past, MONY The move marks a remarkable shift in strategy. While the bank stays away from speculative crypto assets, it is turning to tokenized financial products where it can use blockchain technology in a controlled and regulation-compliant manner. This approach suggests that rather than rejecting crypto, JPMorgan prefers to redefine it within its own rules and framework of traditional finance.