Everyone is now starting to accept the idea that the four-year cycle story is over, and if we don’t start the new year with a big crash, that’s what we’re going to see. While the article was being prepared, BTC became active again and fell below 90 thousand dollars. Spot price is moving lower while volume is recovering weakly. So why won’t we see a repeat of 2013, 2017 and 2021? What will the new era be like for cryptocurrencies? We are looking for the answer to this today.

Old Bulls Are Gone

Markus Thielen, one of the important names of 10x Research, said, “four year cycle He argues that discussions of “it’s over” are wrong. He still argues that the effect of the halving continues, but argues that the focus is now on politics and liquidity. Bitcoin  $90,306.27After ‘s establishment as a new asset class, the transformation that has been awaited for years took place.

$90,306.27After ‘s establishment as a new asset class, the transformation that has been awaited for years took place.

halving It’s less important now, and the cycle for cryptocurrencies will revolve around three things.

- US election calendar.

- Central bank policy.

- Capital flows into risk assets.

Drawing attention to the peaks in 2013, 2017 and 2021, Markus actually believes that this is related to the elections. Last year’s rise was due to the election, but this year Trump did such things that, while improving things for cryptocurrencies, he also ruined them.

“There’s uncertainty that the incumbent president’s party is going to lose a lot of seats. I think it’s about the same probability that Trump or the Republicans are going to lose a lot of seats in the House of Representatives. So maybe he’s not going to push a lot of the issues on his agenda anymore.” – Markus

Accordingly, if Trump adopts a calmer attitude, cryptocurrencies may experience better days next year and the real bull period may begin in this period. Of course, as M2 supply increases, net liquidity entering the markets should strengthen, the Fed should make more than 2 interest rate cuts and Trump should start one of his usual election economic fairs.

Why Aren’t Cryptocurrencies Rising?

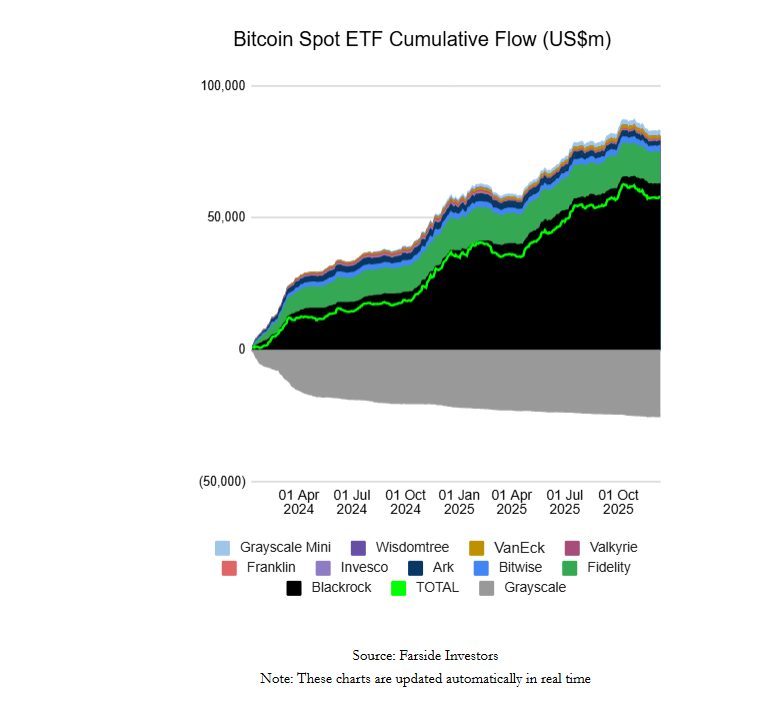

Fed 3 interest rate reduction He did, and it happened one after another. Moreover, QT has ended and as of this month, they are starting to buy short-term bonds ($40 billion), even if it is for liquidity balancing (this is not monetary expansion, that is, QE). Thielen says institutions, which are now the dominant force in crypto, are squeezing the price due to mixed signals from the Fed. Just a little reminder, all ETFs are now cryptocurrency There are more Bitcoins than there are on exchanges.

So what we’ll be keeping an eye on will be more signals about ETF flows and institutional direction. Additionally, the “US dollar and Chinese yuan liquidity slowdown” that Hayes recently pointed out should be reversed and we should see strong capital flows into risk markets in an environment where money is truly abundant. cryptocurrencies so it can rise. However, it looks like we will not experience a 2022 or 2018 crash.