There are only minutes left until the new week and the weekly candle close will occur in approximately 3.5 hours. Bitcoin  $90,306.27 It has been preparing to breach the $88,000 support for the last few hours. We mentioned that there was a risk that losses would increase today and we would see big declines in the new week, as more worries awaited us in the new week. So in the longer term? Hedera (HBAR) What are the predictions for? How many dollars could HBAR be in 2026?

$90,306.27 It has been preparing to breach the $88,000 support for the last few hours. We mentioned that there was a risk that losses would increase today and we would see big declines in the new week, as more worries awaited us in the new week. So in the longer term? Hedera (HBAR) What are the predictions for? How many dollars could HBAR be in 2026?

Hedera (HBAR)

It is one of the popular altcoins especially among Turkish investors and has experienced very good times periodically. It ranks 22nd among the 25 largest cryptocurrencies, and with an FDV of nearly 6 billion dollars, it is one of the projects that has managed to survive despite major altcoin declines. Unlike countless cryptocurrency initiatives that entered our lives and disappeared in 2018, it has managed to survive for more than 7 years.

Having experienced many major developments in the last six months HBAR He had done 7x in the election rally. It formed a lower high at $0.305, just 23% below its major high this year due to Trump. Just like countless other cryptocurrencies. At the very least, it is well above its average price over the past year and close to the $0.124 support where it started the June 2025 rally. In other words, it is at the base point where it could start a major rally in the first quarter of 2026 if a rapid recovery in general market sentiment begins.

If we are talking about good things, we should also remember many events such as the ETF launch. Now let’s remember what happened in the last 2 quarters.

- In late October, Canary Capital’s Spot HBAR ETF was approved and began trading.

- At the beginning of December, the Georgian Ministry of Justice announced the Hedera network as its official infrastructure partner for the tokenization and transparent tracking of national real estate records. Public partnerships are important in the RWA space and this was a good development for HBAR.

- The Jumbo update came in July this year. Like this EVM Ethereum while increasing its compatibility

$3,125.43 Connections with the ecosystem have been strengthened.

$3,125.43 Connections with the ecosystem have been strengthened. - The co-founder took over as President of the Hedera Council in July. Mance Harmon also made progress on the Hiero project in those days.

- Tokenized money markets funds associated with BlackRock Hedera It started to build more volume on its network. The value that tokenization adds to the Hedera network is one of its biggest differences among its competitors.

- We have seen pilots for cross-border payments with Shinhan Bank and other Asia-based financial institutions.

- Transactions per second traffic has strengthened this year, which is good to see for long-term growth.

Hedera (HBAR) Future and 2026 Predictions

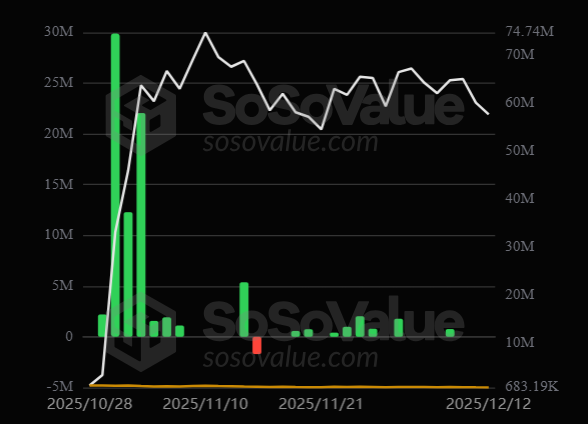

Ki Young Ju said that many altcoins will have liquidity problems and 20-30 of them will survive. That’s why Canary HBAR ETF It affects his future positively. So is there incredible demand in the ETF channel? No, most days the inflow was below 1 million dollars, but the striking detail was that there was no significant outflow except for November 14th.

Here’s a cool detail, cumulative net inflow is around $82 million but total net assets are .1.1% of HBAR. In other words, the ETF inflow rate to market value is higher compared to LINK Coin, which made a name for itself with its great ETF launch. This shows that HBAR attracts good liquidity despite its low market capitalization.

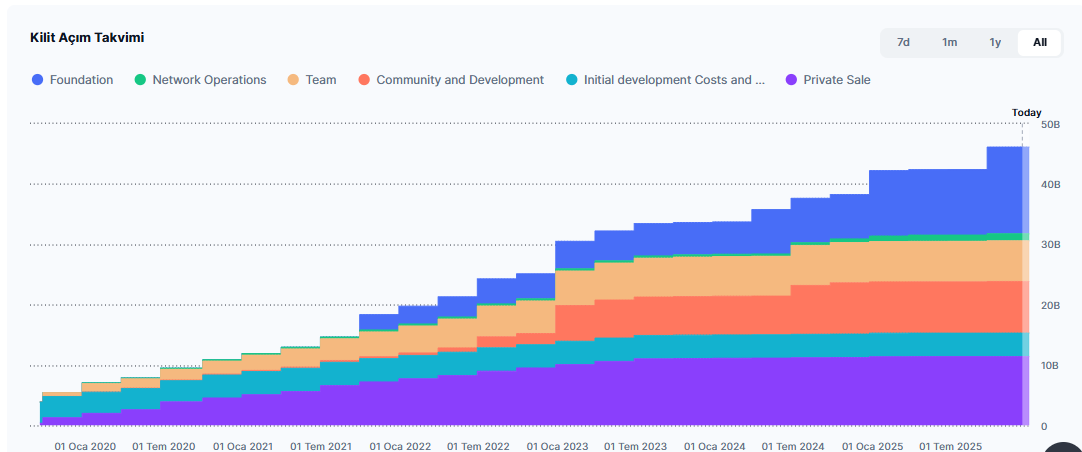

Another good news is the fact that the lock openings, which have been ongoing for years, have now been completed by the end of this year. No more token inflation. This is the case for altcoins that launched with low supply but then were/will continue to be hit by unlocking until 2027-2030 due to high inflation (e.g. ARB?) conversely shows that HBAR has recovered from the major price pressure factor.

The good news for the price is that, as we mentioned in the first part, it is stalling at the base point suitable for the rise. If the support is maintained, HBAR may move from $0.16 to the resistance at $0.207 and form a new top between $0.29 and $0.4. We can say that good days are ahead for HBAR if its partnerships support its long-term growth as expected and ETF and spot demand remains alive despite inflation resetting.

Now let’s move on to quick price evaluations. Sharing the chart above, Morecryptoonl says that a deeper bottom may still form here and points to $ 0.104. This target could be tested if the first quarter is as bad for general market sentiment as predicted.

CaptToblerone thinks the bullish wave will push the price to $4.5 by 2028. The long-term uptrend is maintained and the local bottom is expected to be followed by a temporary D top and then a B bottom of the main ABC move below what Morecryptoonl predicted.

Before the end of the year, timmi_arno targets above $0.14. If it succeeds in doing so, the reversal we mentioned above could be triggered as the streak of making lower local highs is punctuated.