Sui (SUI), one of the notable projects of recent days in the cryptocurrency markets, has become the focus of investors with both on-chain data and derivative market dynamics. According to CoinGlass data, approximately $17.17 million in SUI withdrawals from exchanges last week indicate a strong accumulation trend in the market. This suggests that current price levels are seen as an attractive buying opportunity by some investors. On the other hand, the decrease in transaction volume while the price is rising shows that the market is proceeding cautiously.

ETF Support and Increased Institutional Interest

One of the key factors behind the recent rise in SUI price has been the token’s inclusion in the Bitwise 10 Crypto Index ETF (BITW). BITW, which started trading on NYSE Arca as of December 10, 2025, allocated a 0.24% share to SUI in its current portfolio distribution. This allocation, which amounted to approximately $2.4 million at launch, created new, corporate-driven demand for SUI.

The positive atmosphere created by the ETF news also coincides with the recovery process in the general crypto market. Similarly, Solana and Avalanche recently  $13.37 The fact that some major altcoins, such as , are subject to corporate products, stood out as another development that supports medium-term optimism in the altcoin market. In this context, SUI’s ETF move is considered an important threshold not only in terms of price movement but also in terms of project perception.

$13.37 The fact that some major altcoins, such as , are subject to corporate products, stood out as another development that supports medium-term optimism in the altcoin market. In this context, SUI’s ETF move is considered an important threshold not only in terms of price movement but also in terms of project perception.

Derivative Markets, Accumulation and Critical Levels

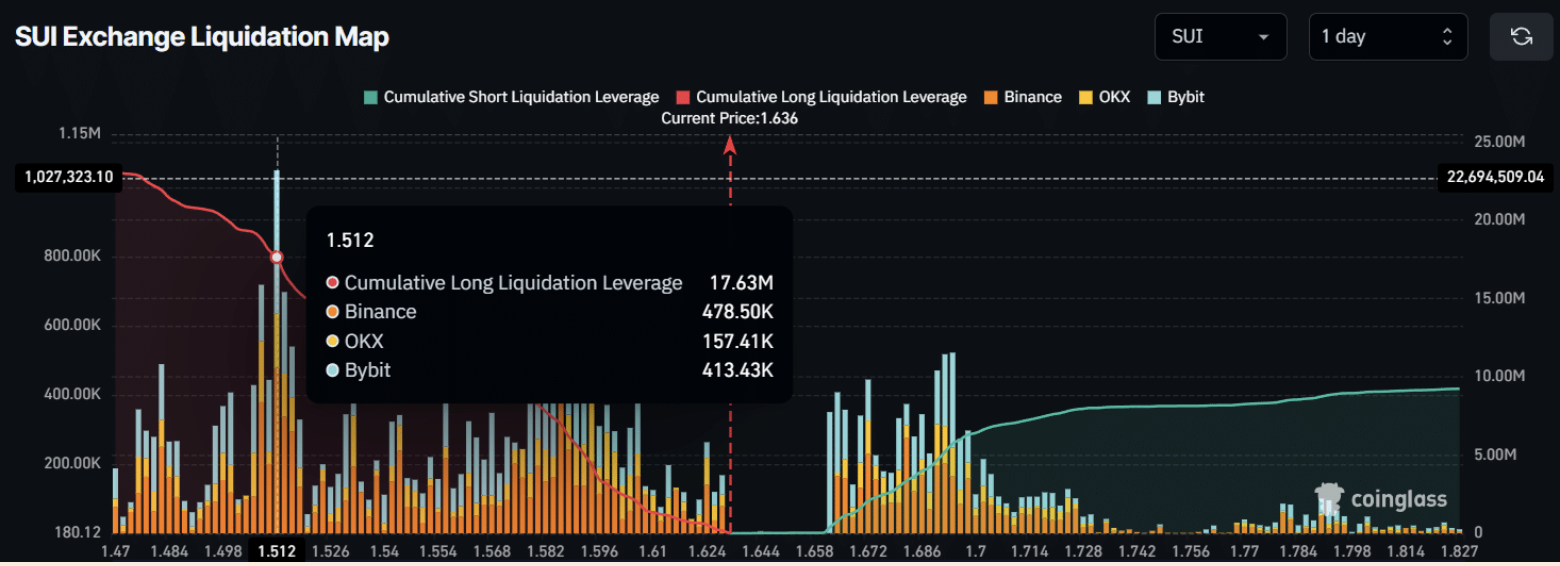

Derivative data clearly reveals the bullish expectation around SUI. According to the CoinGlass liquidation map, investors are particularly watching the $1,512 level as a strong lower support and the $1,694 level as a short-term upper resistance. While it is seen that the market is over-leveraged in this band, it is noteworthy that long positions stand out significantly.

According to current data, at these levels, there is only a short position of $ 5.72 million compared to a long position of approximately $ 17.63 million. This imbalance shows that bullish expectations prevail in intraday transactions. In addition, the amount of SUI leaving exchanges in spot markets suggests that long-term investors are withdrawing the asset to their wallets rather than holding it in exchanges and selling pressure may be limited.

From a technical perspective, SUI has regained the important support zone around $1.60. The Average Directional Index (ADX) on the daily chart is at 26.68, confirming that the current trend is strong. According to analysts, if the price closes daily above $ 1.75, a new rise of 26% may reach $ 2.20 levels.

Finally, another development on the SUI front draws attention. In recent weeks, the Sui Network team announced a new ecosystem fund and developer support program to encourage DeFi applications on the network. While this step contributes to increasing the total value locked (TVL) on the network, it is considered a structural move that can support SUI demand in the long term.