While short-term price fluctuations in cryptocurrency markets challenge investor psychology, long-term expectations are put on the table again. According to CoinMarketCap (CMC) Research Director Alice Liu, the next major crypto bull cycle will begin in the first quarter of 2026. This prediction, Bitcoin  $90,186.24 and indicates that, unlike the current price pressure experienced in altcoins, the market has not yet seen its long-term peak. In particular, institutional investor behavior and regulatory developments are among the main bases for this expectation.

$90,186.24 and indicates that, unlike the current price pressure experienced in altcoins, the market has not yet seen its long-term peak. In particular, institutional investor behavior and regulatory developments are among the main bases for this expectation.

Volatility in the Short Term, Selective Appetite on the Corporate Side

Although Bitcoin briefly regained the $90,000 level recently, it is still trading approximately 30 percent below its peak in October. According to CNBC host Dan Murphy, approximately $20 billion in leveraged positions were liquidated during the recent decline. In the same period, funding rates in continuous futures transactions turned negative, showing that investors turned to stablecoins by avoiding risk.

CMC data reveals that the total crypto market cap increased by 1.1 percent in the last 72 hours. In this increase, especially Ethereum  $3,108.81Corporate entries for attract attention. While there was an inflow of $53 million into BlackRock’s ETHA ETF, outflows were seen from Bitcoin ETFs. In the same period, thanks to the expansion in the BNB Chain ecosystem, the market value of the network recovered by $8.3 billion.

$3,108.81Corporate entries for attract attention. While there was an inflow of $53 million into BlackRock’s ETHA ETF, outflows were seen from Bitcoin ETFs. In the same period, thanks to the expansion in the BNB Chain ecosystem, the market value of the network recovered by $8.3 billion.

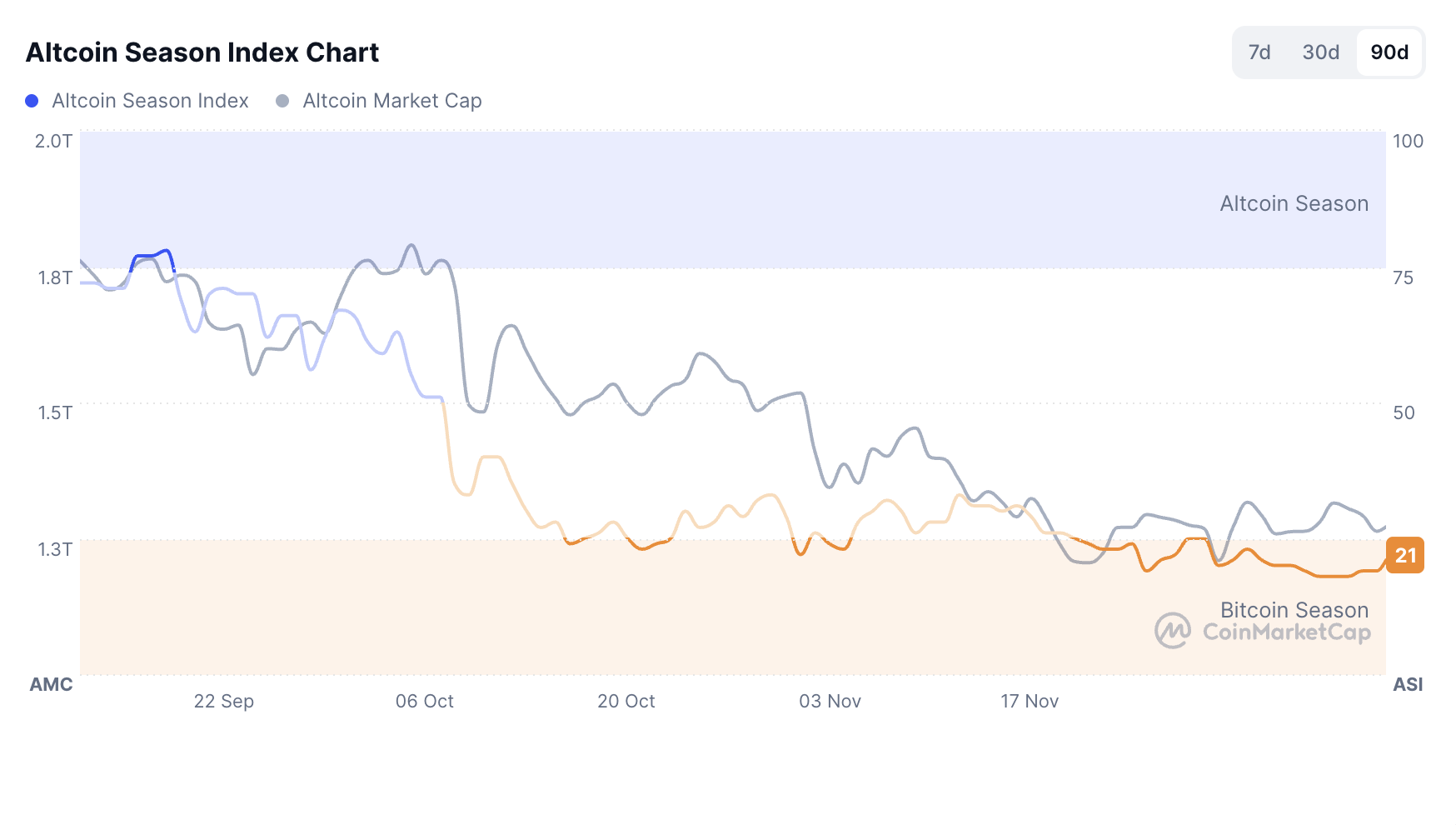

Despite this, the appetite for leverage in the market is still limited. While open interest increased by only 1.14 percent, correlation signals between macroeconomic indicators and crypto do not give a clear direction. Altcoins continue to remain weak against Bitcoin. CMC Altcoin Season Index is at 22/100, indicating that there is still a “Bitcoin season” in the market. While Bitcoin dominance is at 58.55 percent, Ethereum stands out among large-scale projects with its weekly performance of 6.49 percent.

Long-Term Perspective: Regulation and ETF Impact

Corporate names speaking at the CNBC panel are quite optimistic in the long term, despite short-term volatility. Binance CEO Richard Teng described the long-term outlook as “extremely bullish,” noting that global regulatory clarity is rapidly improving and institutional participation is expanding. Ripple  $2.02 CEO Brad Garlinghouse also argued that regulatory changes and ETF adoption in the US are still underpriced by markets.

$2.02 CEO Brad Garlinghouse also argued that regulatory changes and ETF adoption in the US are still underpriced by markets.

Solana Foundation President Lily Liu emphasized that cyclical corrections are a natural part of the exponential growth nature of crypto. In his view, volatility does not undermine underlying adoption. Indeed, the Solana ETF has seen net inflows every day since its launch, indicating continued selective institutional confidence.