The Fed meeting was the most important event of the week and yet Bitcoin  $86,989.86 He’s back where he started. stalling at 90 thousand dollars BTC Cryptocurrency prophet Roman Trading, who has been sharing his decline target for months for months and has been right so far, shared today that “it is time”. So where will cryptocurrencies go?

$86,989.86 He’s back where he started. stalling at 90 thousand dollars BTC Cryptocurrency prophet Roman Trading, who has been sharing his decline target for months for months and has been right so far, shared today that “it is time”. So where will cryptocurrencies go?

Cryptocurrency Oracle Prediction

Roman Trading made 2 important posts and in the last one he said, “The best thing you can do now is the next BTC rise “It is to prepare a plan for the future,” he said, adding that hopes should no longer be extinguished. The analyst, who is seen as the PlanB of 2021 and the Capo of 2022, is called the cryptocurrency prophet of 2025, as many of his predictions have come true this year.

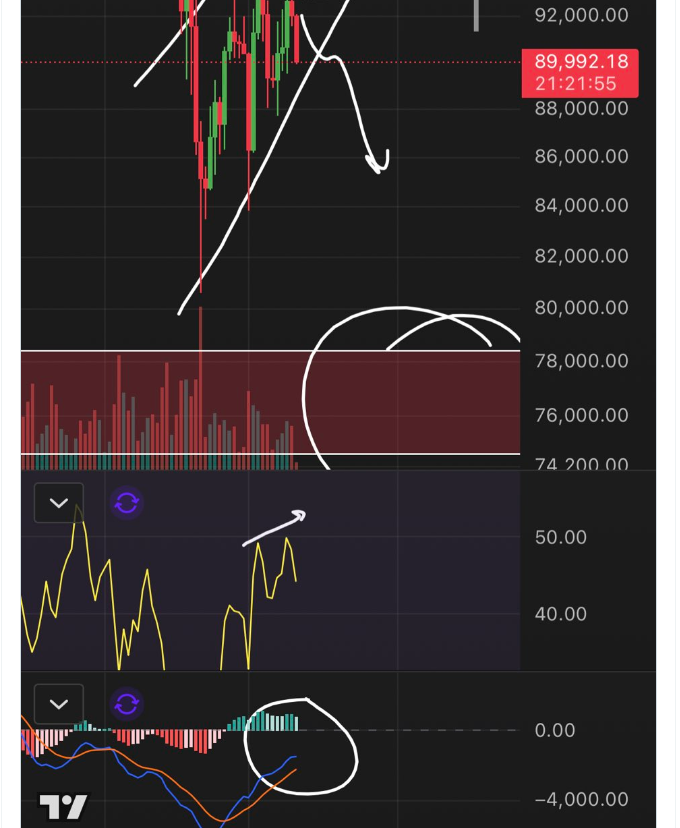

The analyst said that he will save around 50 thousand dollars with DCA for months, that is, he will make gradual purchases when BTC reaches the target price. Fed After the meeting, he shared his current chart and wrote that the decline will now accelerate. Although he mentioned in his previous evaluations that there could be a dead cat bounce up to $104,000, he now seems confident about the direction.

“Bitcoin Daily Chart.

Let the decline begin to the 76 thousand level. Bear waves + bear price movements prove their worth.

“But interest rates fell!” you say.

Interest rates are falling and it doesn’t matter. “The price will drop even further.”

If the $76,000 level cannot be held, BTC may move to the bottom of the cycle near $50,000. However, this will create an environment in which the ATH level of the previous cycle cannot be maintained as support in 2022 and altcoins It will be devastating for. According to historical data, the point that BTC should protect as support is the range between $66,000 and $69,000. This level is considered to be 20 thousand dollars in 2022.

Cryptocurrency ETF

Despite yesterday’s Fed fluctuation cryptocurrency ETFs The results were good. Bitcoin ETFs had a net inflow of $223.5 million, and there was an inflow of $151 million on December 9, giving investors hope that the outflow might have ended. However, we will see that the general risk market decline due to the Oracle report will likely cause a net outflow in the ETF channel today.

TKL is satisfied with the current situation and points out that the losses of the previous month have been compensated.

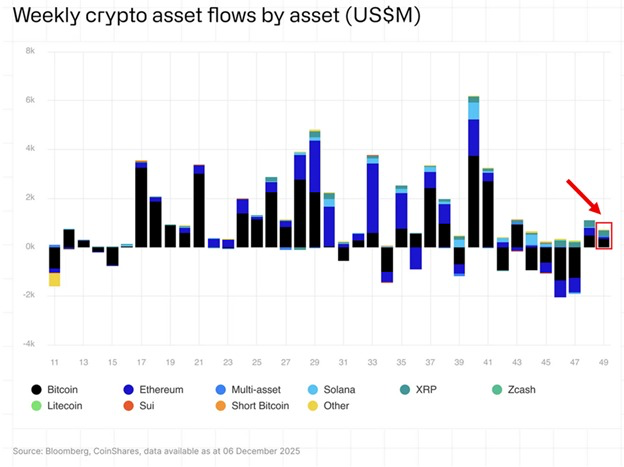

“Crypto ETFs are recouping last month’s losses: Crypto funds recorded inflows of $716 million last week, the second highest inflows in 6 weeks.

This brings the total inflows in the last 2 weeks to $1.8 billion. As a result, total AUM (total asset value) jumped 7.9% from its November lows to $180 billion, but remains well below its all-time high of $264 billion.

Overall, Bitcoin ETFs recorded inflows of $352 million, while XRP recorded inflows of $245 million and Chainlink

$12.11 recorded a record inflow of $52.8 million, representing 54% of its total AUM.

Meanwhile, short Bitcoin ETPs saw outflows of $18.7 million, the highest figure since March. “Cryptocurrency market sentiment is improving.”