Today in cryptocurrencies To understand the bull cycle, we will consider 2 important charts. Moreover, AAII’s latest survey gives us an important signal about the risk appetite of individual investors. Today is the big Fed decision day and the evaluations here will make your job easier to understand what stage we are at.

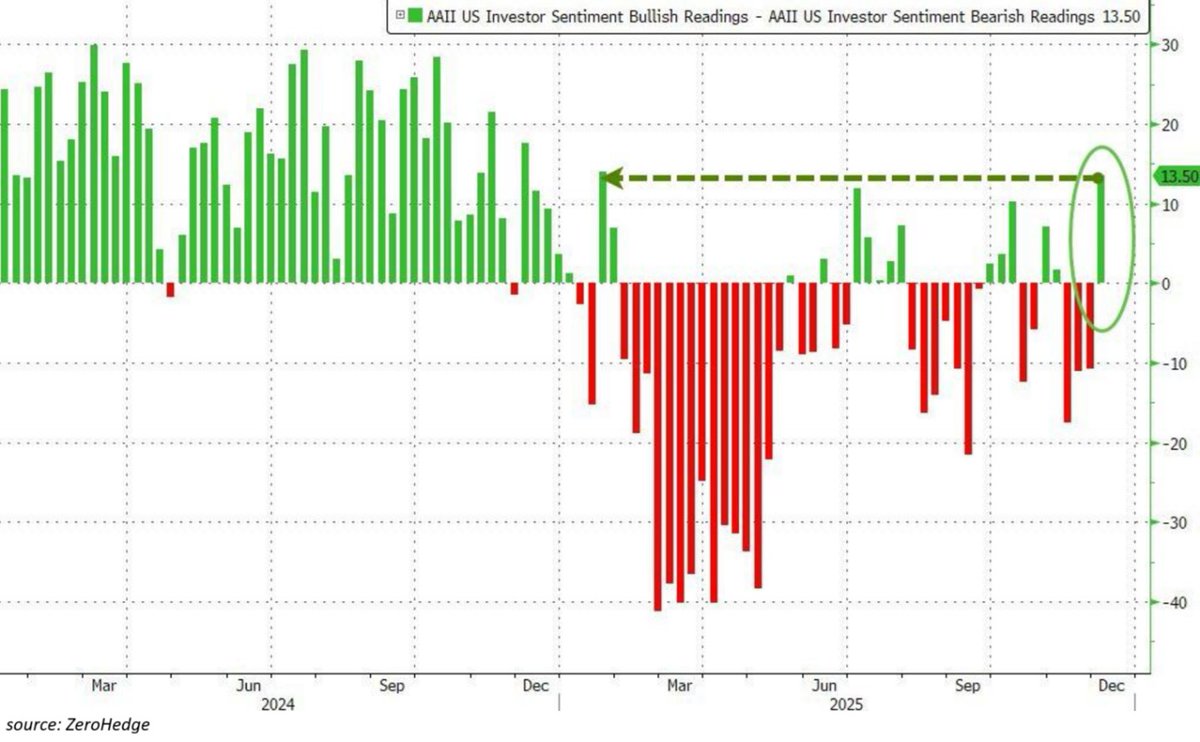

AAII Survey and Risk Appetite

AAII, known for its sentiment surveys, has published its latest report. This survey tells us that individual investors’ risk appetite is increasing. At the time of writing, the Bank of Canada kept interest rates constant. This decision was important as many central banks are now talking about ending the easing cycle. Now all eyes will be on Japan on December 19 after the Fed.

Going back to our topic, sensitivity is improving. If you take a look at the chart below you will see one of the strongest measures of risk appetite in recent times and fear is reversing. 44.3% of individual investors are optimistic about the stock market for the next 6 months. The best number since October 8th. The highest level in the last 12 months was 45.9%. Sentiment has improved in the last 3 weeks and is up 12.7 points.

TKL addressed the current situation and wrote the following;

“During the same period, the proportion of individual investors with bearish expectations decreased by 18.3 points to 30.8%, reaching the lowest level since January 23. As a result, the difference between bullish and bearish expectations jumped to 13.5 points, the second highest level this year.

“Everyone wants to get a share of this market.”

At What Stage Are Cryptocurrencies?

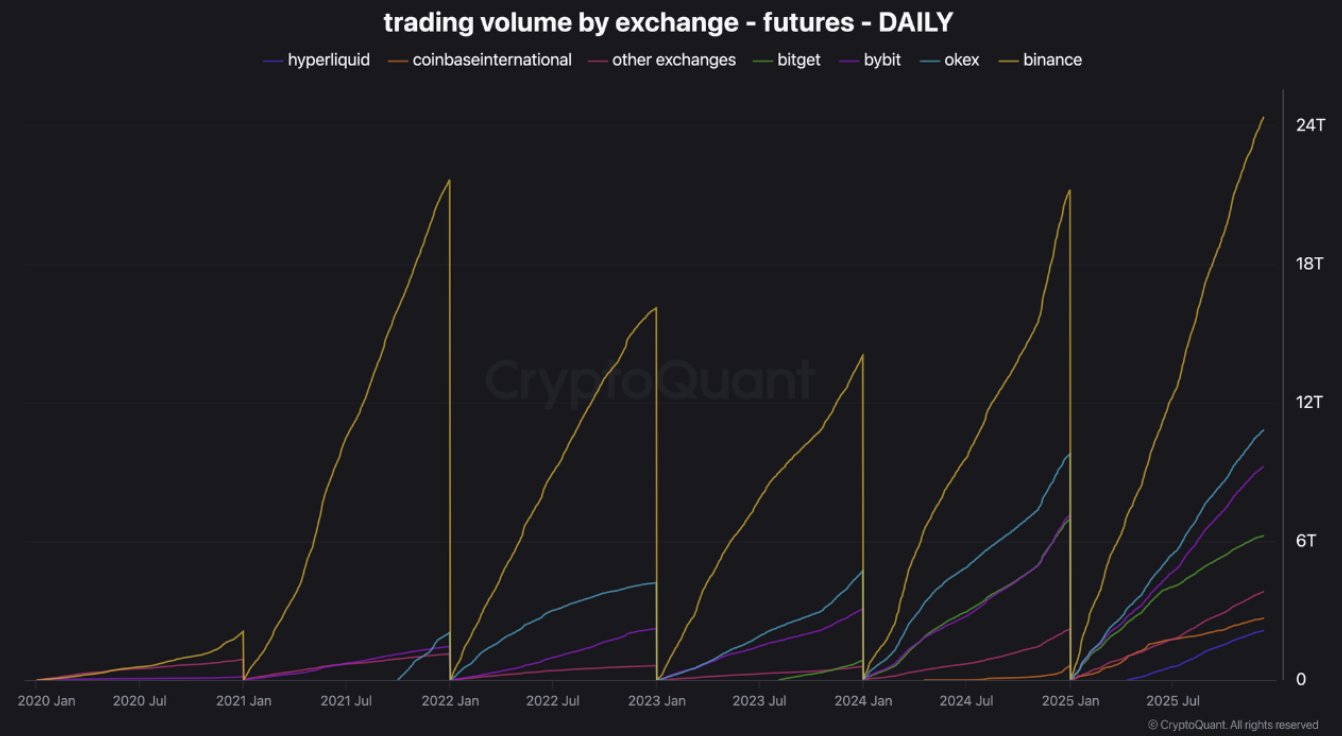

Bitcoin  $86,989.86 It is moving away from $92,000 as the Fed decision approaches and gains in altcoins are limited. ETH It diverged positively and exceeded the $ 3,300 target, which is a good development. Darkfost, one of the CryptoQuant analysts trying to understand the reason for the current fragility, drew attention to the power of liquidations in futures.

$86,989.86 It is moving away from $92,000 as the Fed decision approaches and gains in altcoins are limited. ETH It diverged positively and exceeded the $ 3,300 target, which is a good development. Darkfost, one of the CryptoQuant analysts trying to understand the reason for the current fragility, drew attention to the power of liquidations in futures.

“2025 is not over yet, but it has already broken an all-time record for futures trading volumes. Binance dominates the space with more than $24 trillion in futures trading volume, more than twice the volume of OKX, which reached $11 trillion, and almost twelve times the volume of Hyperliquid.

Such imbalance reveals how aggressive and speculative the crypto market has been this year.

“Investors have placed high priority on the use of leverage for short-term trading rather than spot buying for long-term positions.”

The general trend is in this direction, and exchanges have already been aiming for this with UI improvements for years. So is this good for cryptocurrencies? No, CryptoQuant analysts say this makes markets more fragile. The analyst said that volatility is “no longer determined only by spot supply and demand, but also by forced liquidations and the domino effects they trigger” and reminded the October 10 devastation. So what will happen?

“Leverage has become the main driver, and as long as this driver prevails, Bitcoin thrives in an environment where prices become more unstable and harder to predict.”

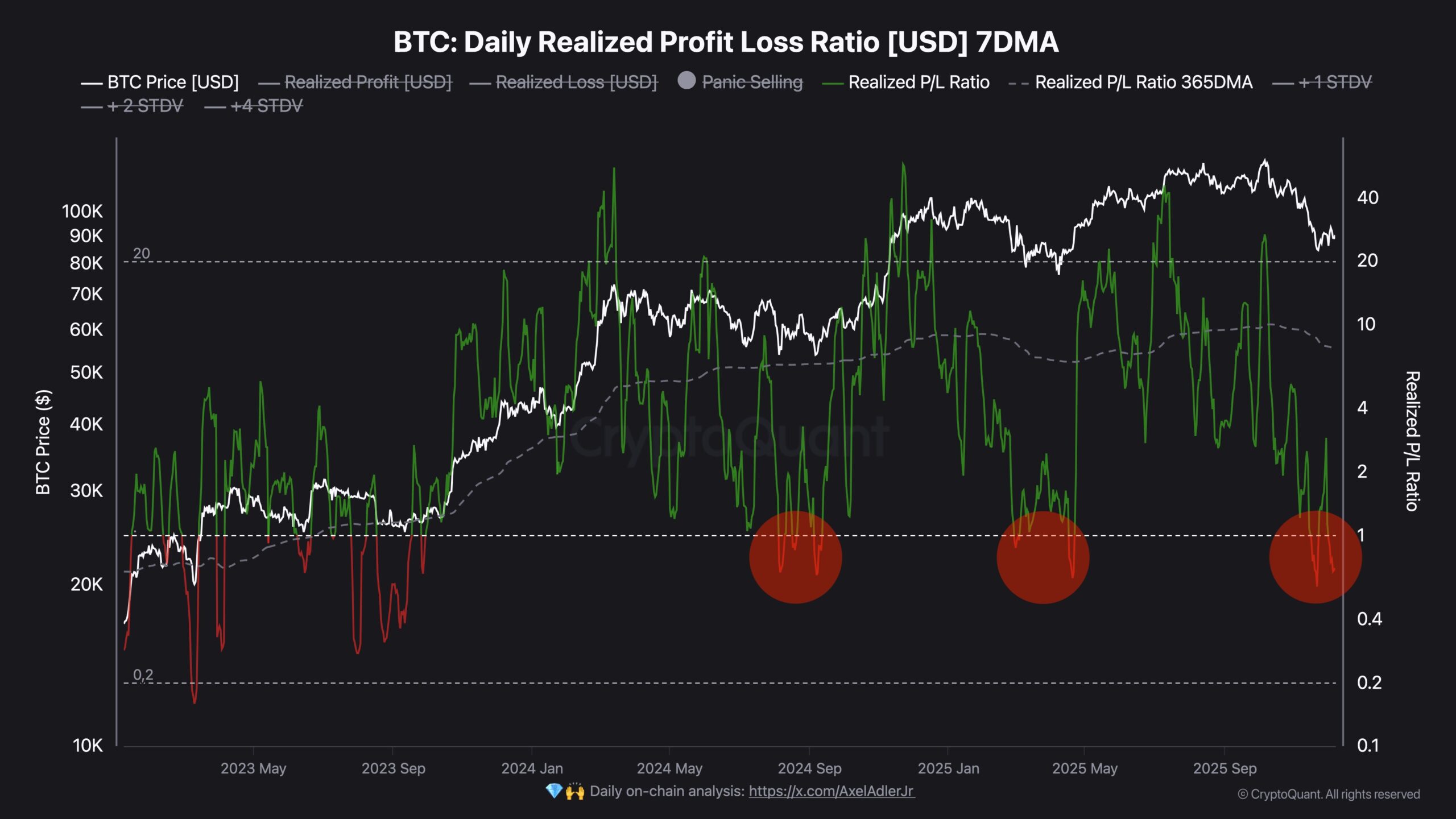

The second important chart is above. By looking at this chart, Darkfost says we are still in the middle of the cycle and in a temporary correction. The Profit/Loss ratio (7-dma) has fallen below 1, which means realized losses have exceeded realized gains over the last few weeks. This is what we have seen in previous corrections, and historically it is a sign that the bottom is approaching or has passed. Let’s see if historical data will work in favor of the bulls this time.