While cryptocurrency markets showed signs of recovery on Tuesday after the sharp correction in November, Bitcoin (BTC)  $86,989.86 It traded close to the $90,400 level. However, intense selling pressure from the European region still continues to be decisive on the direction of the market. New data shows that the biggest driver of November’s decline was by far Europe.

$86,989.86 It traded close to the $90,400 level. However, intense selling pressure from the European region still continues to be decisive on the direction of the market. New data shows that the biggest driver of November’s decline was by far Europe.

Europe’s Pressure Shakes the Market

According to CoinGecko data, BTC decreased by 1% in the last 24 hours, while Ethereum  $2,804.64 showed a limited decrease of 0.2%. There was a mixed picture for altcoins: BNB fell almost 1.5%, SOL fell 2%, and XRP experienced a small pullback. The fact that liquidity remains weak reveals that the market is waiting for the Fed decision to be announced on Wednesday.

$2,804.64 showed a limited decrease of 0.2%. There was a mixed picture for altcoins: BNB fell almost 1.5%, SOL fell 2%, and XRP experienced a small pullback. The fact that liquidity remains weak reveals that the market is waiting for the Fed decision to be announced on Wednesday.

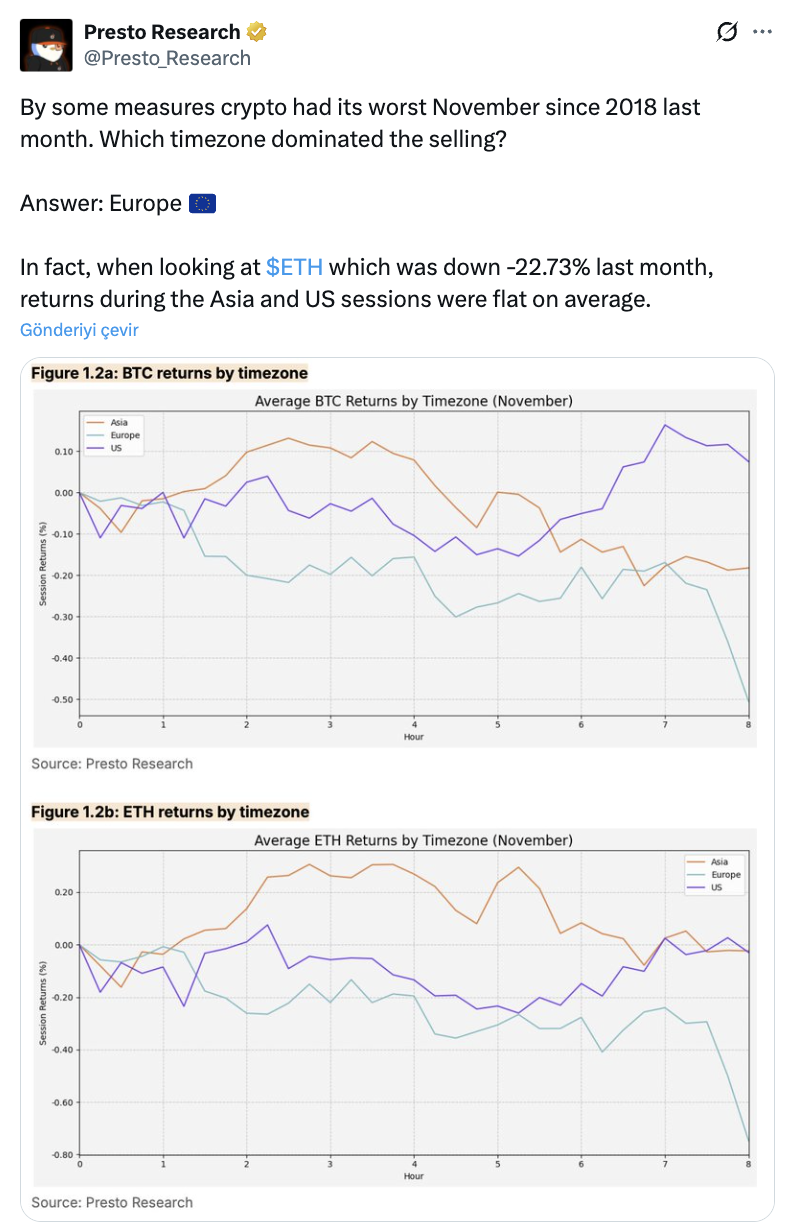

A new timeframe segmented data set published by Presto Research shows that the 20–25% BTC and ETH losses in November were largely driven by the European sessions. Average returns during European trading hours turned significantly negative throughout the month, while Asian and US sessions were found to remain generally flat. This situation also reveals how regional investor behavior diverges sharply during the crypto deleveraging process.

The November selloff also triggered repositioning movements in crypto-related stocks. One of the industry’s leading companies announced the largest Bitcoin purchase in the last three months on Monday, purchasing 10,624 BTC with a total investment of $963 million. This acquisition increased the company’s total assets to approximately 660,600 BTC, or approximately $60 billion at current prices.

Although the company’s shares are traded around $180, the nearly 50% loss in value in the last six months makes investors nervous.

Fed Decision, Tense Wait for Global Bonds and Crypto

The macroeconomic outlook still remains the biggest driver in the crypto market. Asian stock markets fell slightly while waiting for the Fed’s messages regarding the interest rate cut and the easing process extending to 2026. As global bond yields remain at high levels despite the decline experienced the previous day, the pressure on risky assets continues to increase.

Market sentiment also remains fragile. CryptoQuant’s Bull Score index fell to zero for the first time since January 2022, revealing that bearish signals dominate most of the BTC on-chain data. Still, there are some promising developments in the medium term. 401(k) retirement plan regulations, which are expected to change at the beginning of 2026, especially in the USA, may pave the way for trillions of dollars of savings to access Bitcoin.

In parallel with these developments, news from South Korea last week also attracted attention: The country’s financial regulatory authority has completed a draft law that includes new compliance obligations for crypto exchanges. It is stated that this step may increase transparency and institutional investor interest in the Asian region. Experts think that clarification of regional regulations could bring stability to global crypto markets in the medium term.

Bitcoin was last traded at $90,300. Investors are closely watching whether the price can make a move towards the $94,000–$98,000 range or whether European watches will continue to increase selling pressure in the year-end position adjustments.