On Thursday, the heads of the largest banks in the USA will meet with the cryptocurrency agenda. Cryptocurrencies are becoming widespread around the world and continue to grow. Although charts are choppy, adoption is strong. Today we will discuss both the newly announced meeting of bank CEOs and the current situation of cryptocurrencies.

Cryptocurrency Meeting of Banks

The CEOs of three major banks will meet with Senators to discuss cryptocurrency market structure legislation. According to Punchbowl’s announcement, the heads of the world’s largest financial companies will express their ideas for the rules to be introduced to the crypto market. The full list of those who will attend the meeting is as follows:

- Citigroup CEO Fraser

- Bank of America CEO Moynihan

- Wells Fargo CEO Scharf

Trump’s with cryptocurrencies The relevant decrees signed and crypto-friendly managers appointed by important institutions broke the pressure on the market. However, what is really important is the enactment of supportive cryptocurrency laws that will have long-term consequences for cryptocurrencies.

If you remember, recently Trump suddenly canceled all of Biden’s presidential decrees that were put into effect with e-signature. About 3 years later trump The same thing can happen when he loses the elections, and the new president, especially if he is a Democrat, can cancel all of Trump’s cryptocurrency decrees with a single stroke. But it requires Senate and House approval to eliminate or tighten laws. Therefore, other cryptocurrency laws such as GENIUS must also be completed.

Latest Situation in Cryptocurrencies

USA, Nvidia News that will allow the export of the H200 chip to China BTC Even though it moves above 90 thousand dollars again, BTC falls below the key threshold at every opportunity. With each new day that it fails to overcome the $94,000 resistance, investors’ concerns that a deeper bottom will be seen increase.

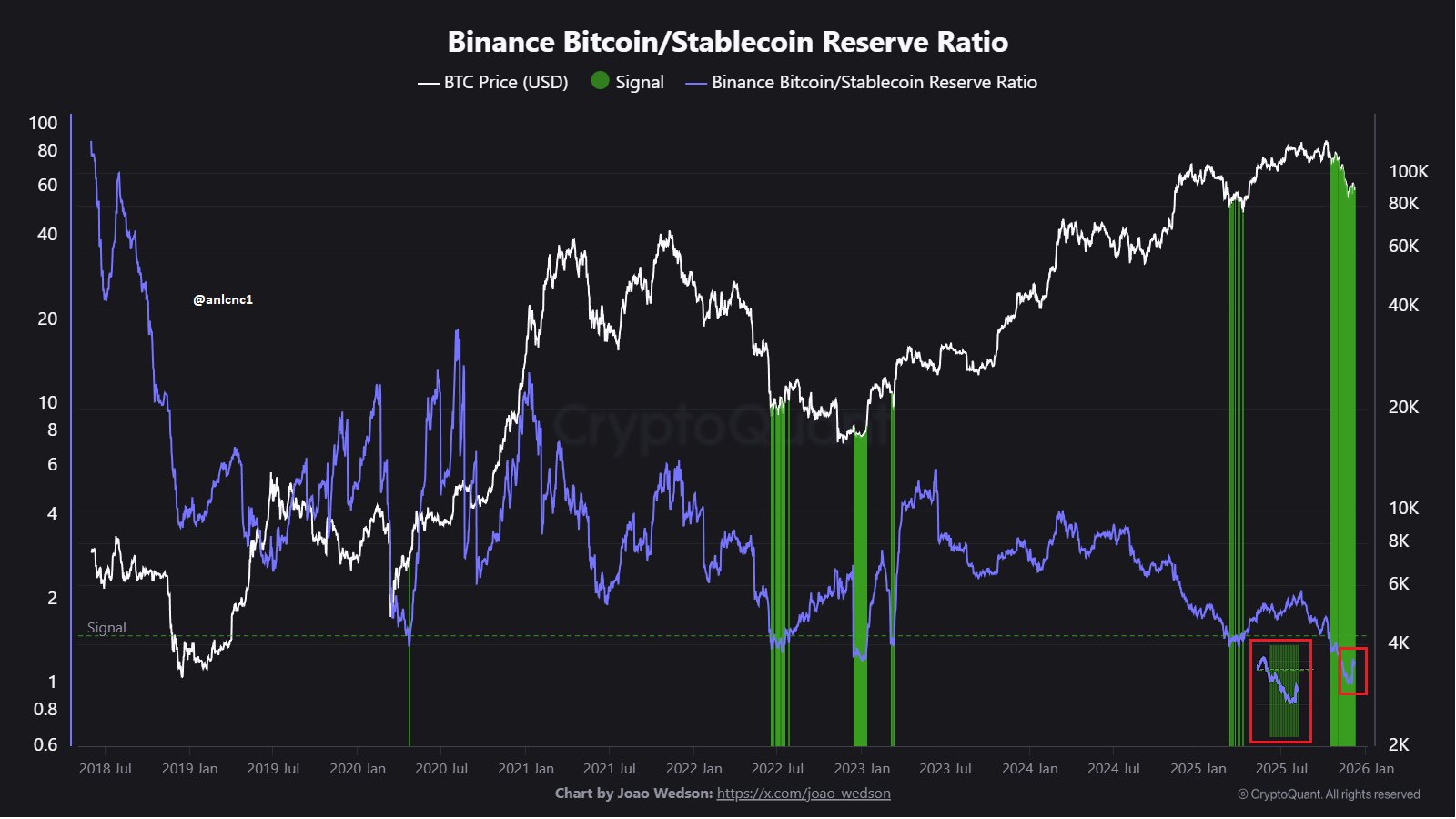

Turkish on-chain analyst anlcnc1 points out the possibility of a bottom forming by looking at the Binance BTC/Stablecoin Reserve Ratio chart. But it’s too early to be sure.

“Binance The BTC/Stablecoin Reserve Ratio has started to turn upwards after forming a bottom in the $86–$88K region. This is the Bitcoin I mentioned when I first shared it.

$86,989.86 > It shows that Stablecoin negative transitions have now slowed down and the Stablecoin > Bitcoin positive transition has started again after December 1. If we look at the base, it clearly falls after December 1, that is, it spreads over 1 week.

The most critical point here, as in all data, is whether there will be continuity. It is necessary to give time and patience to such metrics because these are data that directly show trends. It is based on direct closing, not on sharp ups and downs of the price during the day. Additionally, if the Reserve Ratio continues to rise even if the price pulls back, that is, if we see a Stablecoin > Bitcoin crossover even during declines, we say that classic dip buying behavior is starting to occur. For now, such an upward turn is a good thing for a start, we will follow and see if it continues. “We are living in a period where it forms a much more aggressive bottom compared to other bottom formations.”