Yes, it is definitely annoying and we experienced the same thing again on December 8th. After starting a strong reversal on Sunday, BTC reversed direction after the US market open. At the time of writing, there were approximately 3 hours until the daily candle close and BTC had returned to $ 90,900 after the US market close. There are those who claim to have found the reason for these declines. We will examine this now.

Why Are Cryptocurrencies Falling?

US markets open at 17:30 (Turkish time) on business days. for a long time cryptocurrencies The market turns downward immediately after the opening or a few hours later. This event repeated so many times that people were convinced that cryptocurrencies would decline with the US market opening. So tomorrow or the next day or the day after that you may see people who are sure of this and have prepared their short position.

Technical analysis is the mathematical translation of investor psychology, and that’s why it generally works. This event has now become something that should be taken seriously as it is something that has started to take its place in the minds of investors as the trigger of the decline. Since the beginning of November, BTC has been declining most of the time after the US market opens. The same thing happened in the 2nd and 3rd quarters.

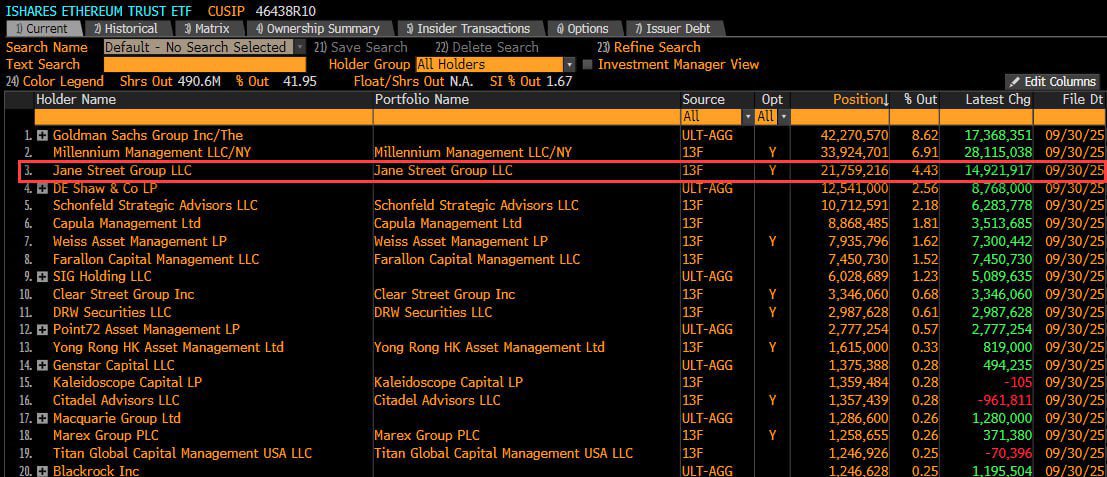

Zerohedge this of Jane Street He thinks it’s his job. When you look at the chart, this pattern cannot be ignored because it is so consistent. Here’s the thing: the market opens and in the next 1 hour a clean decline followed by a slow recovery. BullTheoryio also believes this was triggered by a high-frequency trading company.

Jane Street is one of the largest high-frequency trading companies in the world and they have the speed and, more importantly, liquidity to move markets in minutes. Where do we remember this story? Market makers, including Jane Street, who are trying to accelerate the 2022 crypto crash. In those days, they were undermining shaky companies and forcing them to decline in order to make money from volatility. What happened next? They, in turn, began to announce that they would move away from the crypto business because it would become the subject of investigation. Their role in the collapse was never officially proven and remained an allegation.

BullTheoryio wrote;

“The process is very simple. It consists of 4 simple stages.

Drop BTC at the opening.

Push the price into liquidity gaps.

Re-enter at a lower price.

Repeat every day.

Currently Jane Street, BlackRock in IBIT ETF It has $2.5 billion worth of positions, which is their 5th largest position. This means that most of the decline in BTC is not due to macroeconomic weakness, but rather to manipulation by a single large institution.

And when these big players complete their acquisitions, BTC “It will continue its upward momentum.”

The theory is that big players are trying to collect more spot BTC and that’s why the price will experience the same simple scenario for a while. Of course, the strategy cannot be that simple because there are also games where volatility increases and billions of dollars of liquidations occur on the futures side. While some people are losing billions of dollars, those who take the right positions make the same amount of money.

Are Cryptocurrencies at the Bottom?

He is considering any stock. You can guess why it weakens, why it rises, and what will happen next. Crypto is not that simple, speculators, whales, short-term investors’ tendencies, divergences in regional risk appetite (for example, while the USA has an appetite, Binance, that is, global investors, has no appetite?) and many other reasons move the price. Sometimes volatility is the result of 20-30 different reasons and people like Jane Street can move the charts just because the price is shaky for 30 reasons.

This is like moving a 100kg sack on the ground and moving the same sack in the air. Or, while it is very difficult to move a 100kg sack on Earth, the same sack on the Moon requires you to lift 16kg, so it is easier. There are factors that determine the environment, the conditions, and then there are those that move it. I think it was pretty self-explanatory.

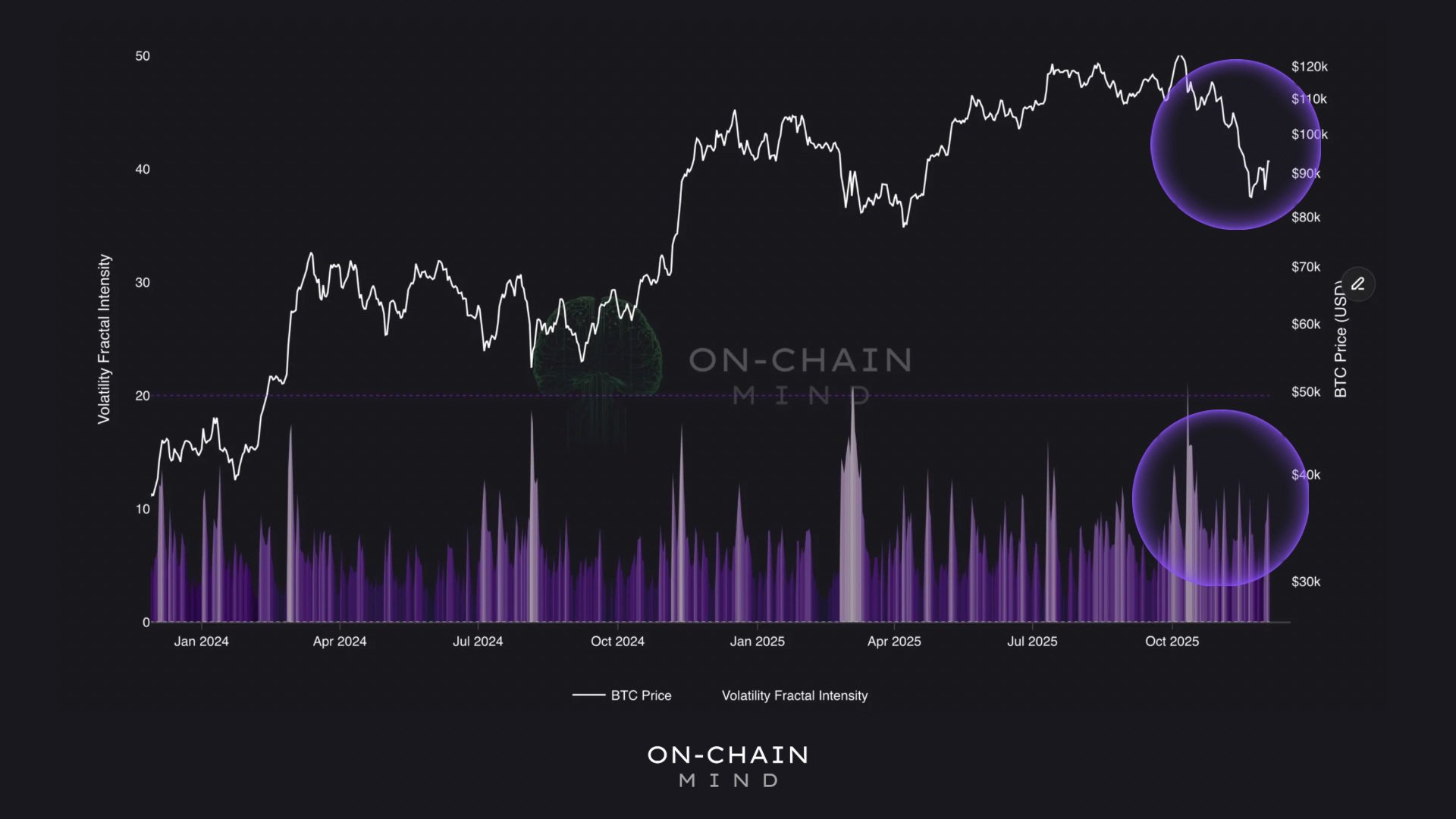

Looking at OnChainMind Volatility Fractals for one of 30 different reasons (this is a sample number) it says we are not at the bottom yet.

“One indicator still doesn’t show me that all is well: Volatility Fractals.

This tool maps BTC’s volatility into fractal defined high/low intensity waves.

Normally, we need to be in a low density environment for accumulation and rise to begin.

Currently, we are not in low volatility territory. We have moved away from the extreme rallies of October, but volatility remains high and persistent. “Not the calm squeeze you usually see in a true bottom formation.”

Again in cryptocurrencies Being aware of the 30 different reasons helps understand the direction the price is ready to run. That’s why it’s important to stay up to date with the news flow, CryptoAppsy The news section can make your work easier with both its summary and flow.