Trump for a while crypto coins He does not make new statements that will turn things upside down. For now, the markets are left to their own devices and everyone is focused on the words that will come out of Powell’s mouth since it is Fed week. Today, QCP Capital analysts shared their latest predictions for cryptocurrencies.

QCP Cryptocurrency Predictions

Bitcoin  $86,989.86 and ETH remains stuck in shallow levels. BTC cannot exceed 94 thousand dollars and altcoins have suffered a lot in the process. Even though BTC is above $90,000, many altcoins have returned to important support levels.

$86,989.86 and ETH remains stuck in shallow levels. BTC cannot exceed 94 thousand dollars and altcoins have suffered a lot in the process. Even though BTC is above $90,000, many altcoins have returned to important support levels.

QCP Capital analysts He believes Sunday’s price movements are an early indicator of continued volatility during the upcoming holiday season. In the last 24 hours, BTC fluctuated between $87,700 and $92,287. Ether recovered sharply from $2,919 to $3,150.

“Despite the speed and magnitude of the move, liquidations totaled only around $440 million, a relatively modest figure compared to typical levels seen this year. This may be due to fatigue, caution, or simple disinterest as investors wait for clearer direction.” to cryptocurrency It shows that general interest in the topic continues to decline. “There is a significant decline in the urge to take positions.” – QCP Capital Analysts

Referring to Google search data, analysts pointed out that the terms crypto and BTC have fallen to bear market levels. Moreover, open positions in futures transactions are declining. BTC perp open interest is down 44% from its peak in October, and for ETH it is over 50%.

“The dynamics are clear: with participation decreasing and liquidity deteriorating, smaller and smaller flows are required to create large movements.” – QCP Capital Analysts

Expectations in Cryptocurrencies

Institutions and whales continue to accumulate while individual and smaller investors calm down. StrategyEven though the purchases of companies such as Metaplanet have slowed down, there has been roughly 25K BTC outflow from the exchanges in the last 2 weeks. Bitcoin ETFs and corporate treasury companies all cryptocurrency holds more Bitcoin than exchanges. It is positive that the majority of the BTC supply available for sale is flowing out of exchanges and into long-term investor wallets.

Moreover, not only Bitcoin but also ETH exchange reserves are moving in the same direction and are at the lowest level in the last 10 years in the exchanges. ETH its supply lies. When we consider 10-year inflation and other details, this bottom is extremely interesting.

“Sunday’s moves highlighted how little depth the market has left as year-end liquidity dwindles. So it’s no surprise that institutional accumulators continue to buy on dips rather than chase the upside, especially as a sustained break above $100,000 could reignite large-scale treasury demand.”

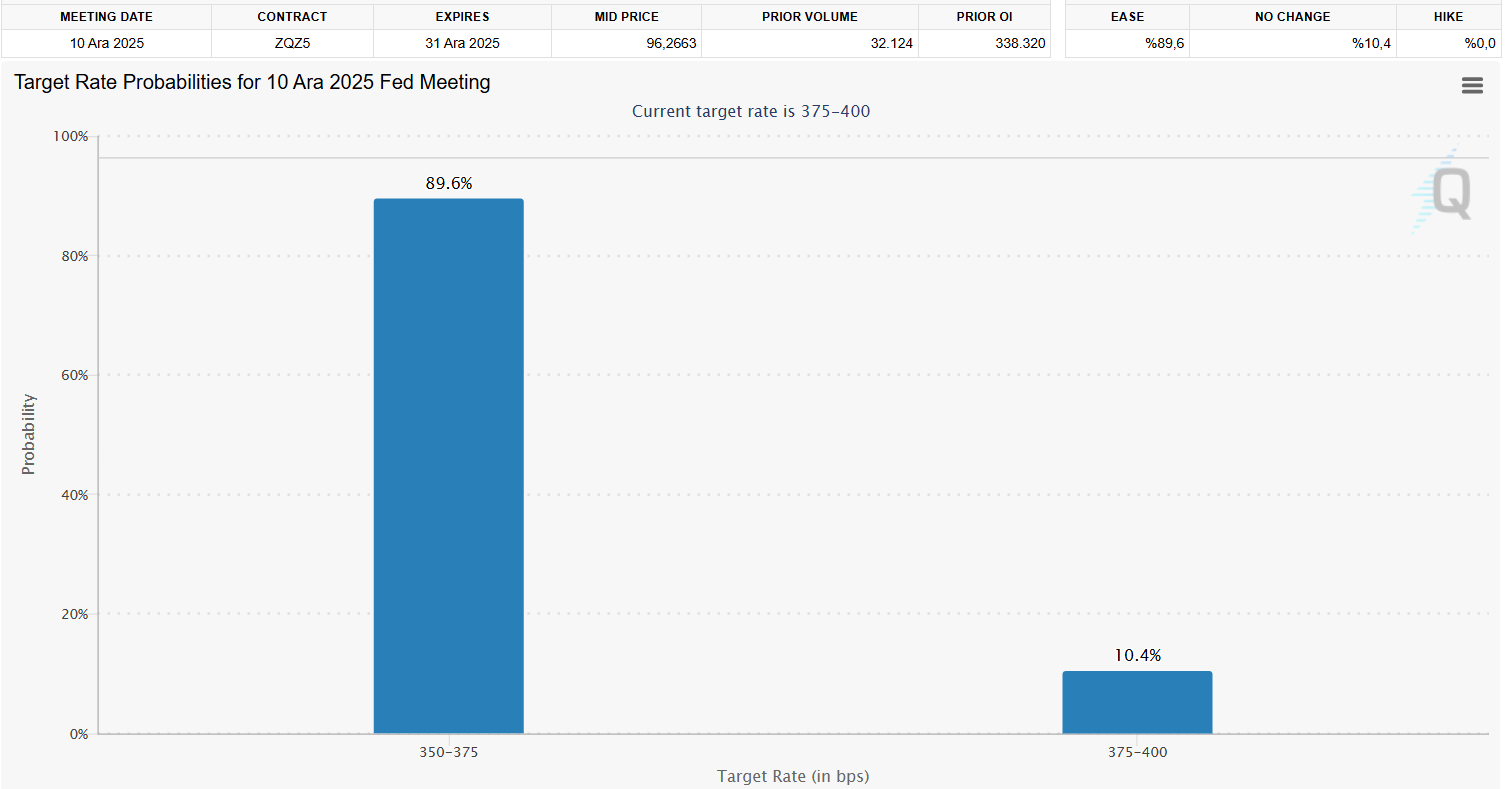

For cryptocurrencies, analysts wrote that their main focus is the Fed.

“While a 25 basis point cut is largely reflected in prices, markets will be focused on any guidance on the Fed’s balance sheet strategy. Any hints of future asset purchases could trigger additional rally in stocks and other risky assets, including crypto.”

For now, BTC is trending in range, and bullish and bearish sides will find evidence to confirm their views. Ultimately, a clear break below $84,000 or above the psychological $100,000 level will determine the next major trend. Options markets reflect this: Last Friday saw significant demand for the 25SEP26 50k/175k straddle, suggesting that some investors are positioning for a significant move when BTC breaks out of its current range.”