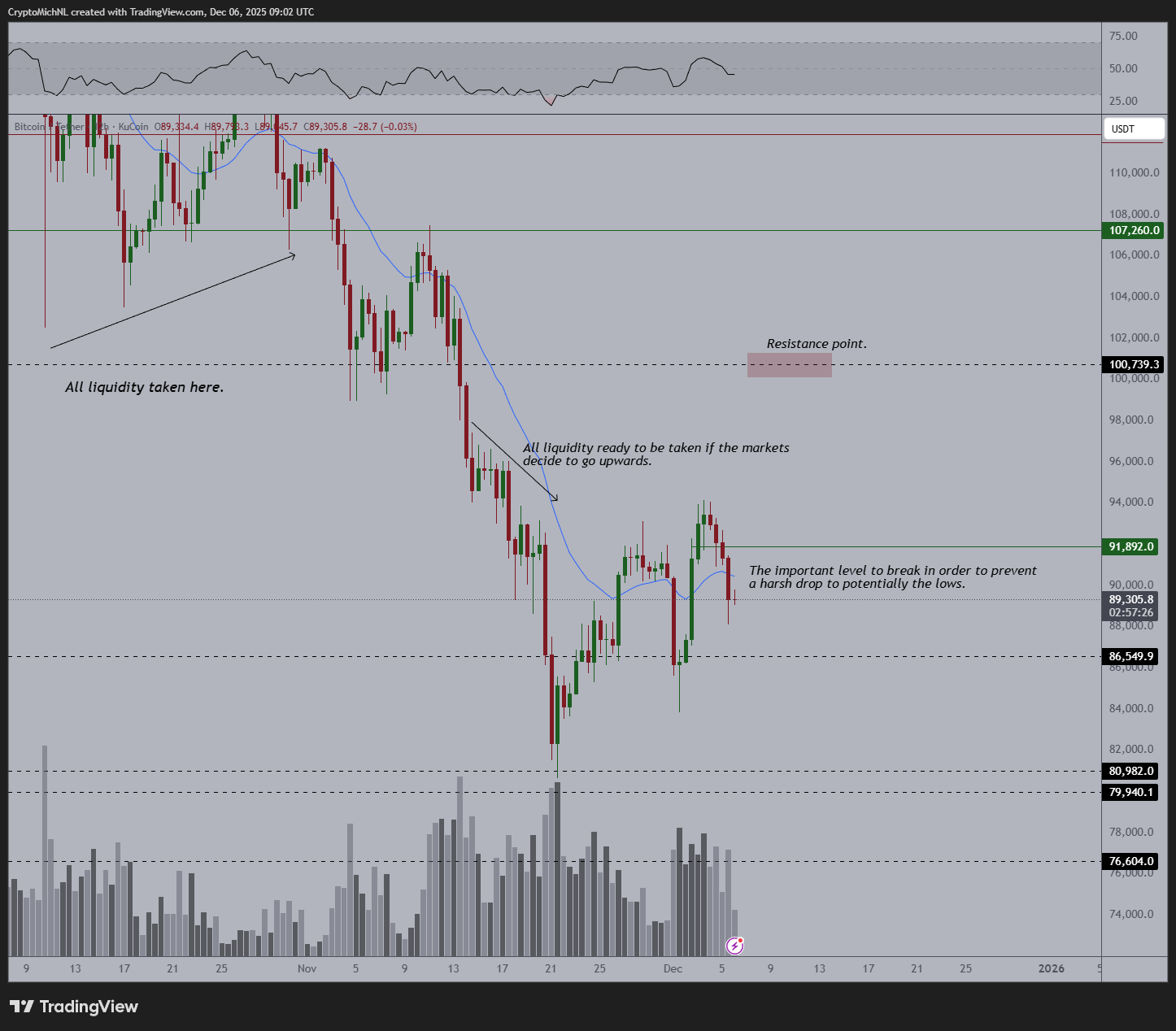

Bitcoin  $86,989.86Analyst’s price compression structure Michaël van de PoppAccording to e, it marks the last line of defense separating the market from a deeper correction. biggest cryptocurrency It is having difficulty surpassing the $90,000 resistance after recent losses. Poppe, dated 6 December X In his post, he stated that if the $ 92,000 level is not regained, the price may retreat sharply towards the $ 80,000 band.

$86,989.86Analyst’s price compression structure Michaël van de PoppAccording to e, it marks the last line of defense separating the market from a deeper correction. biggest cryptocurrency It is having difficulty surpassing the $90,000 resistance after recent losses. Poppe, dated 6 December X In his post, he stated that if the $ 92,000 level is not regained, the price may retreat sharply towards the $ 80,000 band.

The Region That Will Determine the Fate of the Trend is the $92,000 Threshold

According to Poppe Bitcoin‘s movement in the range of $ 86,000-92,000 is an indicator of lack of direction. The analyst emphasized that investors could not find a clear direction by saying, “This region is just noise, the market is unstable.” He noted that liquidity has cleared below previous highs, while upside liquidity will only be accessible if the bulls regain control.

In the technical view, the $100,700 level stands out as a strong resistance band, while the region around $89,300 stands out as the critical pivot point. According to Poppe, falling below this level may cause sales to accelerate. If Bitcoin fails to test $92,000, it is possible that the price may drop to the $80,000–82,000 range. Past support layers in the $80,900–$76,600 range are a possible double bottom formationIt can form the base of .

Weak Technical Outlook Amid Fed Expectations

Bitcoin investors US Federal ReserveWhile we wait for the (Fed’s) 2026 monetary policy signals, stagnation prevails in the market. At the time of writing, Bitcoin is trading at $89,808. This corresponds to a decrease of 0.5 percent in the last 24 hours and 2.2 percent on a weekly basis.

According to technical indicators BTCThe price is trading below its 50-day average of $100,131 and its 200-day average of $103,640, continuing its long-term downtrend. The 14-day RSI value is at 43.04. This shows that there is no strong directional signal in the short term. According to Poppe, despite the current decline, the market may be close to the bottom zone, and a strong reaction from the lower supports could trigger the beginning of a new rally that will spill into the first quarter of 2026.