Bitcoin  $86,989.86 The business model of focused treasury companies is now entering a “Darwinian era”, according to a new analysis by Galaxy Research. The Digital Asset Treasury (DAT) strategy, once seen as the engine of rapid growth, has reached a critical inflection point as market dynamics reverse. Especially in October, Bitcoin’s decline from $ 126,000 to $ 80,000 led to a sharp decrease in risk appetite and a rapid withdrawal of liquidity in the sector.

$86,989.86 The business model of focused treasury companies is now entering a “Darwinian era”, according to a new analysis by Galaxy Research. The Digital Asset Treasury (DAT) strategy, once seen as the engine of rapid growth, has reached a critical inflection point as market dynamics reverse. Especially in October, Bitcoin’s decline from $ 126,000 to $ 80,000 led to a sharp decrease in risk appetite and a rapid withdrawal of liquidity in the sector.

Three Possible Paths: Consolidation, Squeeze, or Forced Wait

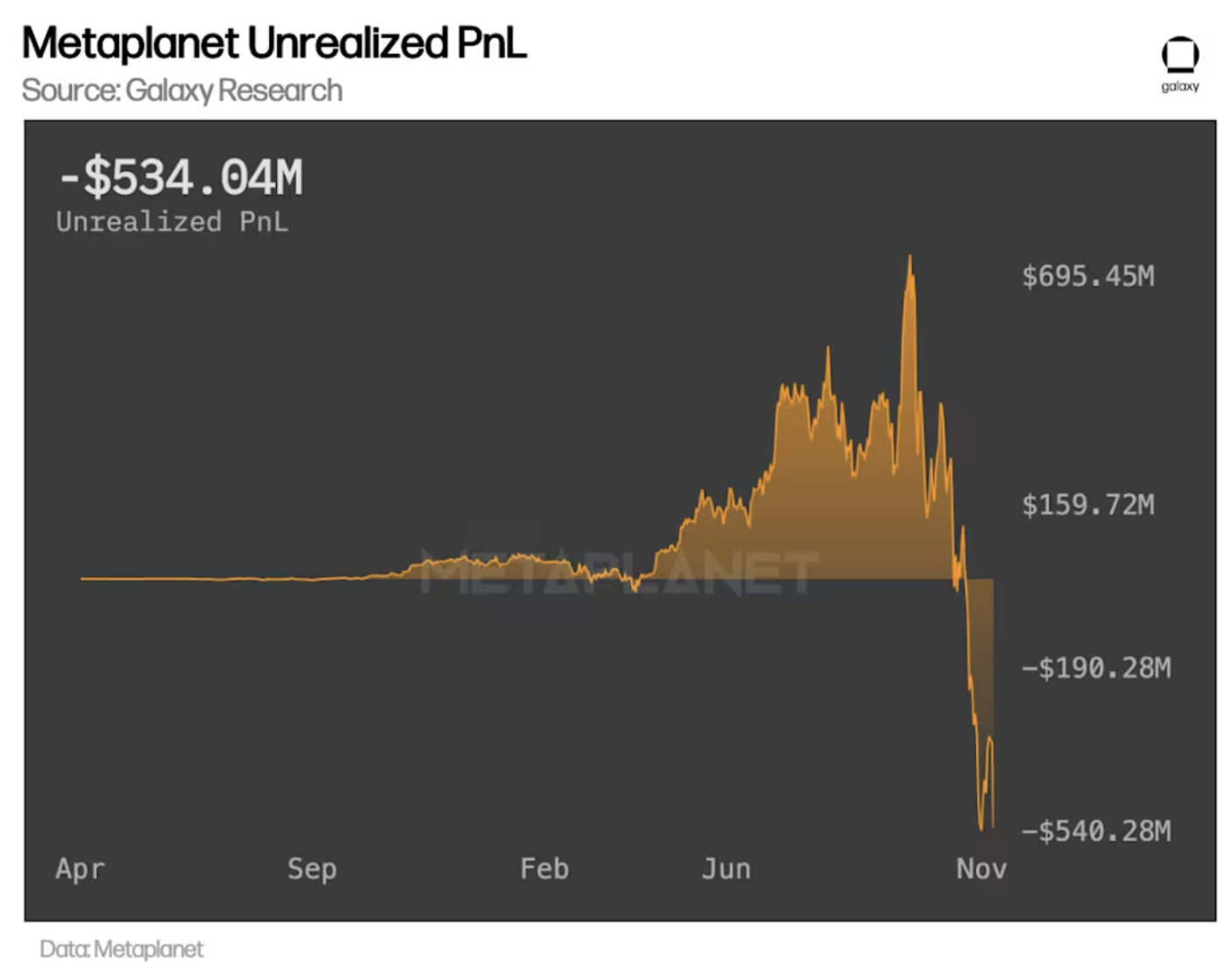

According to Galaxy’s report, shares of treasury companies traded at a premium to Bitcoin’s net asset value (NAV) for a long time, functioning as a type of leveraged Bitcoin position. However, when this structure began to collapse, the same financial engineering became a disadvantage that magnified the decline. It is stated that companies such as Metaplanet and Nakamoto in particular incurred serious losses in their BTC positions, which they purchased at an average value of over $ 107,000. NAKA’s 98% decline from its peak is described in the report as “an extinction similar to the memecoin collapses”.

According to Galaxy Research, there are three possible scenarios for the future of the DAT model. In the first scenario, which is considered the most likely, premiums will remain low for a long time and companies’ BTC growth per share will virtually freeze. In this case, DAT shares will carry higher risk than Bitcoin itself.

In the second scenario, consolidation stands out. Companies that issue excessive shares during high premium periods, inflate their balance sheets by purchasing BTC at peak prices, or have a high debt burden may face solvency risk. This may open the door to mergers, bankruptcy processes or restructurings.

In the third scenario, the ray of hope may arise again as Bitcoin reaches new highs. However, this is only possible for companies that maintain their liquidity, do not engage in aggressive issuance, and keep their risks limited.

In parallel with this picture, another development that affected the crypto market during the week was the new capital increase plan of the US-based crypto investment company Marathon. The company announced that it is trying to increase its cash reserves to make its operations sustainable during periods of volatility. This statement is considered an important signal that the financial pressure on DAT companies is not limited to just a few players.

$1.44 Billion Shield from Strategy Company

On Friday, Strategy CEO Phong Le tried to allay investors’ concerns about dividends and debt payment capacity by announcing that they had created a new cash reserve of $1.44 billion. It was announced that this reserve, financed by the issuance of shares, would secure dividend payments for at least 12 months, which would then be increased to 24 months. Bitwise CIO Matt Hougan stated that Strategy would not have to sell Bitcoin even if its share price dropped, and said, “Those who claim otherwise are completely wrong.”

In other words, the future of DAT companies has become dependent on a structural transformation much deeper than Bitcoin’s price movements. If the market does not stabilize and companies do not turn to more cautious capital management, it will remain a big question mark whether the current model is sustainable in the long term. However, it may also be a period when new doors of opportunity may open for players who have a strong cash position and manage risk correctly.