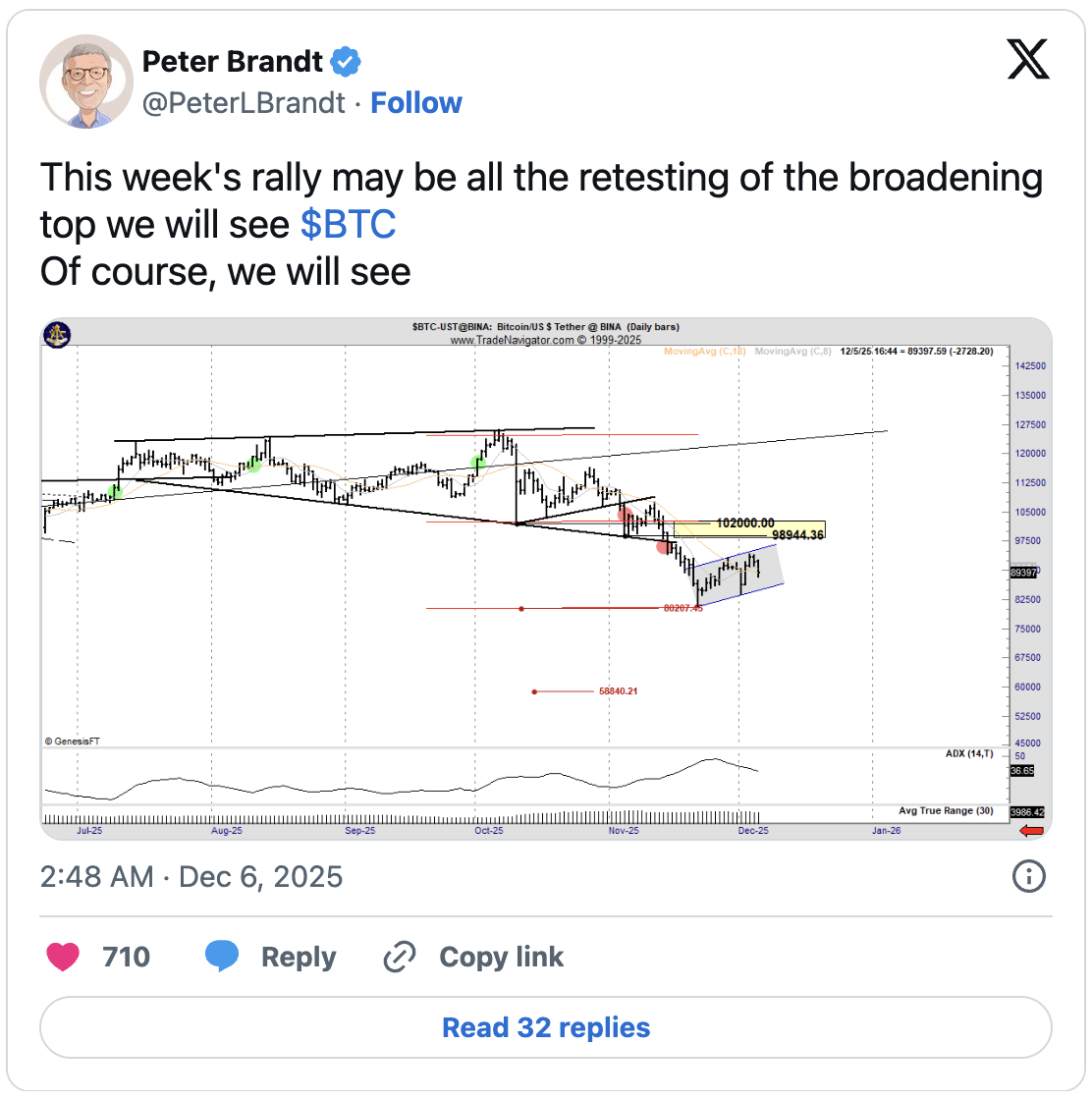

Famous investor and technical analyst Peter Brandt, Bitcoin  $86,989.86Despite the recovery in recent weeks, the table is approached with caution. In his latest assessment from his X account, he stated that the rally could only be a final retest of the “expanding top” formation, also known as the megaphone structure. In technical analysis, this formation is considered a signal that the uptrend is approaching its peak and preparing for a possible decline.

$86,989.86Despite the recovery in recent weeks, the table is approached with caution. In his latest assessment from his X account, he stated that the rally could only be a final retest of the “expanding top” formation, also known as the megaphone structure. In technical analysis, this formation is considered a signal that the uptrend is approaching its peak and preparing for a possible decline.

Discussions Reignited

According to Brandt, Bitcoin’s failure to reach the upper band of the long-term price channel during this year’s rise was often a precursor to sharper declines in past cycles. For this reason, the experienced analyst marks the region starting below $ 70,000 and extending to the $ 45,000 band as a “possible target area”. Brandt evaluates the probability that Bitcoin has already peaked in the current cycle as 30%.

Using a hand-drawn “dead cat bounce” pattern in the chart he shared at the end of November, he described the price correction, which started above $120,000 and extended to $80,000, as a typical five-wave decline. According to the analyst, the region that currently interests the market the most is the $88,000-$92,000 range.

What Awaits Bitcoin in 2025?

Bitcoin, which started December at around $85,000, quickly gained momentum and climbed to the level of $94,000. This sudden rebound revived investors’ hopes for a “Christmas rally.” The $97,000 resistance targeted by retail investors has still not been overcome; This area is seen as both a psychological and technical profit taking point.

However, Bitcoin continues to lead the entire industry. Mainly Ethereum  $2,804.64 Many major altcoins, including BTC, follow BTC’s movements closely. The Fear & Greed index, which is the sensitivity indicator of the crypto market, started to move into the orange zone, gradually moving away from the “extreme fear” zone that has been going on for two months.

$2,804.64 Many major altcoins, including BTC, follow BTC’s movements closely. The Fear & Greed index, which is the sensitivity indicator of the crypto market, started to move into the orange zone, gradually moving away from the “extreme fear” zone that has been going on for two months.

In addition to Brandt’s warnings, the fluctuating entry and exit movements in Bitcoin ETFs in the USA in recent days also attract attention. The slowdown seen especially in BlackRock’s IBIT fund shows that institutional investors remain cautious against short-term uncertainties. According to experts, the weakening of ETF flows is among the factors limiting Bitcoin’s upward momentum. This picture, combined with the megaphone formation mentioned by Brandt, causes the market to produce unstable signals.