Bitcoin  $86,989.86 It enters the weekend below 90 thousand dollars and the Fed will announce its new interest rate decision on Wednesday. Fed decision weeks are generally periods when we see high volatility in both directions, and FUDs such as MSTR, ETF, Japan in crypto say that we may experience bearish days. Of course cryptocurrencies It doesn’t always run in the expected direction and is full of surprises. So what happened in the last 24 hours?

$86,989.86 It enters the weekend below 90 thousand dollars and the Fed will announce its new interest rate decision on Wednesday. Fed decision weeks are generally periods when we see high volatility in both directions, and FUDs such as MSTR, ETF, Japan in crypto say that we may experience bearish days. Of course cryptocurrencies It doesn’t always run in the expected direction and is full of surprises. So what happened in the last 24 hours?

Latest Developments Regarding Cryptocurrencies

This is not surprising, as Bitcoin has now moved into the upper league as it becomes more linked to macroeconomics. In the previous cycle, we did not care about PMI or PCE figures, but they have a great impact on the graphics in the new period. That’s why cryptocurrency investors have turned into macro monsters. Since the agenda is dizzying, we will summarize the important developments of the last 24 hours for you.

- Financial services giant Cantor Fitzgerald cut its price target for Strategy (MSTR) shares by 60% to $229 amid the recent MSCI delisting controversy and MNAV decline. Cantor Fitzgerald analysts seem to have made this decision as the potential for the MSCI Index to exclude companies with more than 50% of their total assets from the index triggers the risk of forced sales of passive funds. An MSTR outflow of up to $8 billion is possible. In the first phase, an outflow of close to $3 billion (JPMorgan) is anticipated.

- Italy today announced the deadline for cryptocurrency companies to comply with MiCA regulations. Companies must complete compliance requirements before December 30.

- Ripple

$2.01 CEO Brad Garlinghouse announced that he is targeting $180 thousand for Bitcoin in 2026.

$2.01 CEO Brad Garlinghouse announced that he is targeting $180 thousand for Bitcoin in 2026. - Ethereum

$2,804.64 Layer 2 network Base, Chainlink

$2,804.64 Layer 2 network Base, Chainlink  $12.11Bridged directly with the Solana network using ‘s interoperability protocol.

$12.11Bridged directly with the Solana network using ‘s interoperability protocol. - Although Bitcoin has fallen 30% from its peak, analysts point to 2017 and 2021 and think that corrections of 30-40% may not break the trend.

- Ethereum is preparing for a new update next year to reduce the dominance of large staking pools on the network. This update, planned to preserve the decentralized structure of the network, triggered discussions within the community as it was understood as an intervention in the free market.

- Twenty One Capital, managed by Jack Mallers, has become the last Bitcoin-focused company to be listed on the NYSE, with approval to merge with Cantor Equity Partners. The Tether and Sofbank-backed company holds 42 thousand BTC on its balance sheet and will rival MSTR.

- In its latest assessment, JPMorgan talked about the importance of Strategy for Bitcoin in the short term. MSTR should not sell and continue buying. Additionally, the report mentions that restrictions in China and the increase in miner costs forced them to sell BTC.

- XRP Coin Social media sentiment for has fallen to October levels. Although this silence generally indicates a rise for XRP Coin and altcoins, the uncertainty in the general market sentiment (and the dominance of fear) leaves investors discouraged.

- Tom Lee continues to say that the ETH price will reach 20 thousand dollars with the asset tokenization revolution that will occur in 2026. This week, BlackRock CEO’s statements that “tokenization is inevitable” were very important, but fear digested this big detail.

- 1000 to 10,000 ETH Ether whales (this class is often called sharks) made $1.4 billion worth of purchases during the decline. The appetite of medium-sized investors is positive.

- CZ and Saylor met face to face for the first time.

- Aster made 77.8 million tokens. This step was taken due to the previously announced buyback program.

- JPMorgan says stablecoins will not cause a realistic increase in demand for US treasury bills. Tether holds more US bonds than most countries, although the latest report says stablecoin reserves still account for a small share of the bond market.

- Facebook (META) announced that it can cut spending by up to 30% for the metaverse, which it relies on very much (and which makes a lot of money). The company, which took this step to spend its energy on productive artificial intelligence, is criticized for “suddenly changing its vision to catch up with market trends.” However, Meta shares welcomed this development positively (due to capital efficiency).

- Singapore-based DBS Bank was chosen as the best bank in the world. Its AI fraud prevention efforts and blockchain work make it stand out. (Euromoney also selected it as the best bank in 2022, 2021, 2020. Global Finance also gave similar awards before) (Source)

- The book The Thinking Machine, which describes the rise of Nvidia, won the business book of the year award.

- The decline in weekly unemployment benefit applications to 191,000 in the USA supports the soft landing scenario, but different metrics point to the worst figures in employment in the last 4-5 years.

- Trump, who announced that he is considering Kevin Hassett as Fed President, is accused of undermining the independence of the institution. Many economists think Chris Waller should be elected.

- A recent study of the “expert networks” used by hedge funds and institutional investors for market research found that 30% of experts are incompetent. The quality of financial intelligence and analysis is being questioned these days.

- A new botnet network called Aisuru threatens websites (and crypto interfaces) by generating massive traffic of 29.7 terabits per second (Tbps). CloudFlare also experienced outages on December 5. This has been happening a lot in the last 10 days and seems to be linked to Aisuru.

- Latest data Japan While it points to a decline in household expenditures, that is, stagnation, high inflation feeds the risk of stagflation (an environment where recession and inflation go hand in hand). If the Bank of Japan increases interest rates on December 19, it will feed the recession, and if it keeps it constant, inflation. This situation concerns cryptocurrencies closely due to the “carry trade collapse” discussions. Nikkei 225 index fell.

- September P.C.E. The figures came within expectations, and although they have increased slightly in recent months, the limited increase is considered positive.

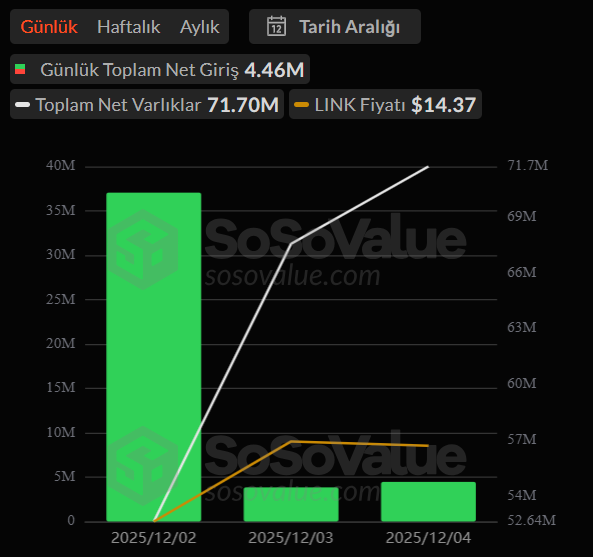

Chainlink (LINK) ETF

We need to open a separate topic for this because LINK Coin It launched an ETF that could be a signal of opportunity. This is exactly why we mentioned that I would be watching to see if ETF inflows remain strong even in an environment of fear. According to Sosovalue data, the first day’s $37 million entry was not continued. On December 3, there was an inflow of 3.84 million dollars, and on Thursday there was an inflow of 4.46 million dollars.

The detail here is that while BTC ETF sees rapid outflows and the general market sentiment is negative, inflows continue to increase, albeit weakly. The picture will become a little clearer when the December 5 data arrives. LINK Coin ETF GLNK reached net assets of $71.7 million, which is 0.72% of LINK market cap. It’s still good in such difficult days. While SOL Coin ETFs have seen outflows in recent days, XRP Coin has not experienced any outflows and its total net assets have exceeded $881 million, meaning it has already surpassed SOL Coin in total inflows (by nearly $200 million).