We are moving forward to the weekend of December 6-7 and Bitcoin  $86,989.86 While the stock market is in good shape, it continues to cause pain to investors with its decline. The main reason for the decline was the sales from old investors that had been going on for weeks. However, afterwards we saw many negative developments such as FUD on MSTR and discussions on interest rate hikes in Japan. So, have the old investor sales at least stopped?

$86,989.86 While the stock market is in good shape, it continues to cause pain to investors with its decline. The main reason for the decline was the sales from old investors that had been going on for weeks. However, afterwards we saw many negative developments such as FUD on MSTR and discussions on interest rate hikes in Japan. So, have the old investor sales at least stopped?

Former Cryptocurrency Investors

These investors were the reason for the BTC price fluctuation on the on-chain side. They sold too much, and it was their conversion to cash, combined with excessive leverage, that accelerated the decline. Since investors generally had no appetite due to the news flow, the price fell further as the sales continued. At this point today, BTC is struggling to hold on to over 90 thousand dollars and we have seen many attempts at 80 thousand dollars.

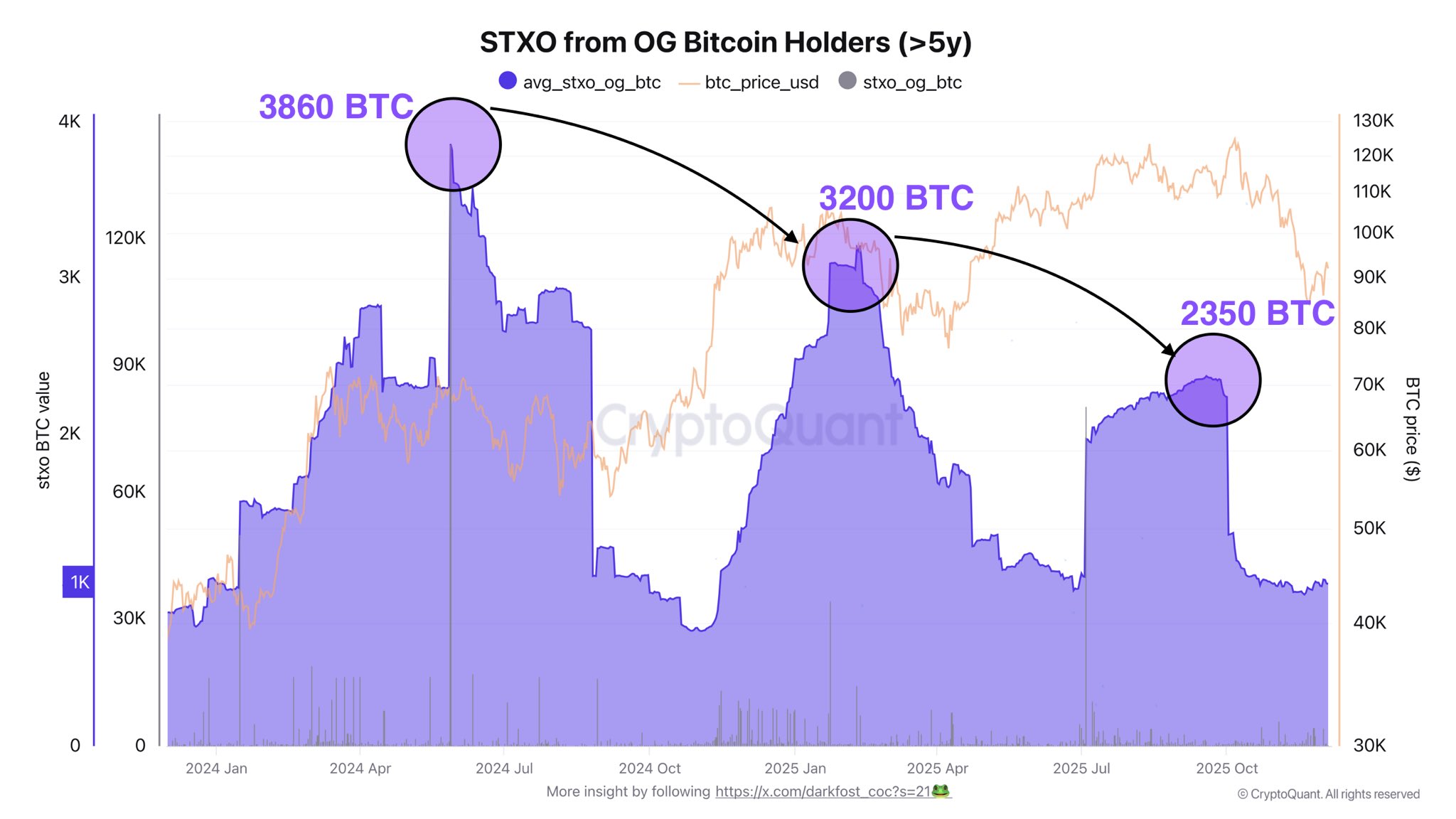

But the good news is even if Bitcoin isn’t rising, old investors are running out. Darkfost, one of CryptoQuant analysts, confirms this with the chart he shared a few hours ago, tracking investors older than 5 years. So the numbers speak.

“Old Bitcoin Sales activities of investors (OG) have decreased significantly in the last few weeks.

While the 90-day daily average was previously around 2,350 BTC, these OGs’ spent UTXOs have now returned to a more normal level, averaging around 1,000 BTC.

In this chart, I only took into account UTXOs older than 5 years. This corresponds to a maximum of BTC originally purchased at around $30,000. Tracking spent UTXOs gives us insight into the selling pressure from these long-term holders. When BTC this old starts to move, it is usually about to be sold. When we see a UTXO’s BTC move, we call it “spent” and those are the moves we follow here.

As a result, this data shows that the selling pressure of OGs has decreased, giving the market some more breathing room. It is worth noting that as the cycle progresses, selling pressures decrease and the STXO tops (90-dma) of these OGs become increasingly lower.”

It’s important to stay updated these days, as news flow-related fluctuations will continue no matter what. CryptoAppsy The news section can make your job easier at this point.

Why Aren’t Cryptocurrencies Rising?

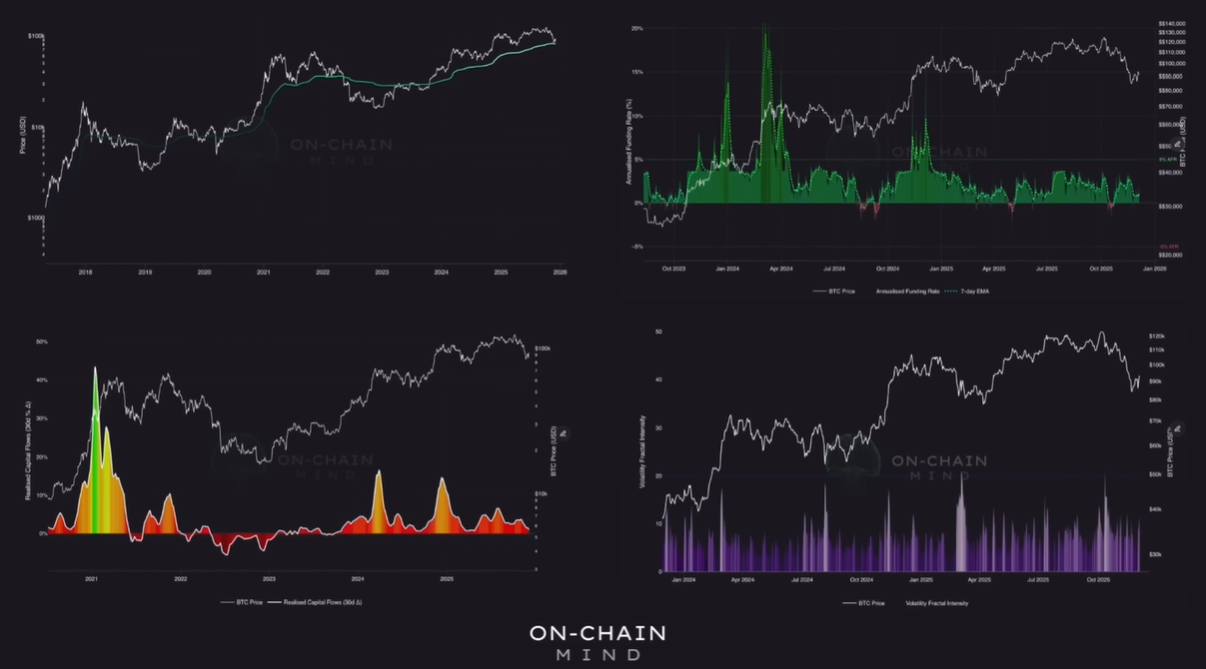

$81,000 is the key zone for Bitcoin and this figure is no coincidence. The realized price, that is, the average cost of the market, is exactly at this point. The analyst, pseudonymous OnChainMind, created a new cost metric by focusing on the trading market (taking out the stagnant supply) to find the true market average. Because it shows the cost of the active market Bitcoin He is attracted to this balance point. Since we are above this for now, the bulls still have the advantage. (Source)

Alright capital inflow how is it? Although not as crazy as at the beginning of the year, the flow is still positive. If we also look at the ETF channel, the net inflow of $22 billion is a great stabilizer. What we see in bear markets is that almost everyone sells and turns everything upside down, turning capital inflows negative. It is at this point that we realize that the old bear markets are behind us and that we need to get used to the new era.

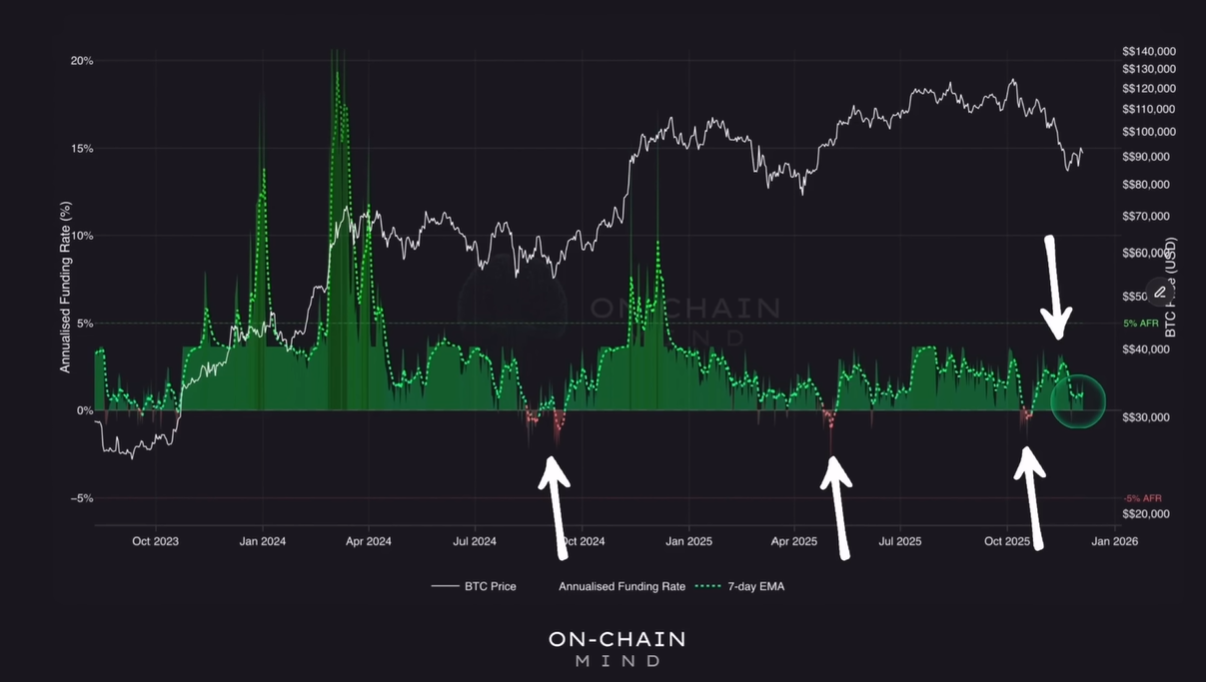

cryptocurrencies One thing it needed was lever cleaning. When funding rates are too high we see large swings to clear out those who take excessive risks. This is balancing leverage. We have witnessed this fate for long positions for weeks. In fact, this cleansing is what the market needs to move more healthily.

The most important thing we need is to wait for volatility to stabilize. The first three issues above are positive. Now the last piece of the painting needs to be completed. Either after a deeper decline, Bitcoin will take a break, that is, it will stop extreme movements, or it will linger at current levels. Time will tell.