Matt Hougan is one of the names followed closely by cryptocurrency investors and his company is the largest crypto ETF from its issuers. The AI bubble in November was extremely bad, with court battles over tariffs and claims that Strategy would be delisted by MSCI. However, cryptocurrencies are known for quickly pricing bad developments, and Hougan is hopeful for the future.

January 15 Cryptocurrency Crash

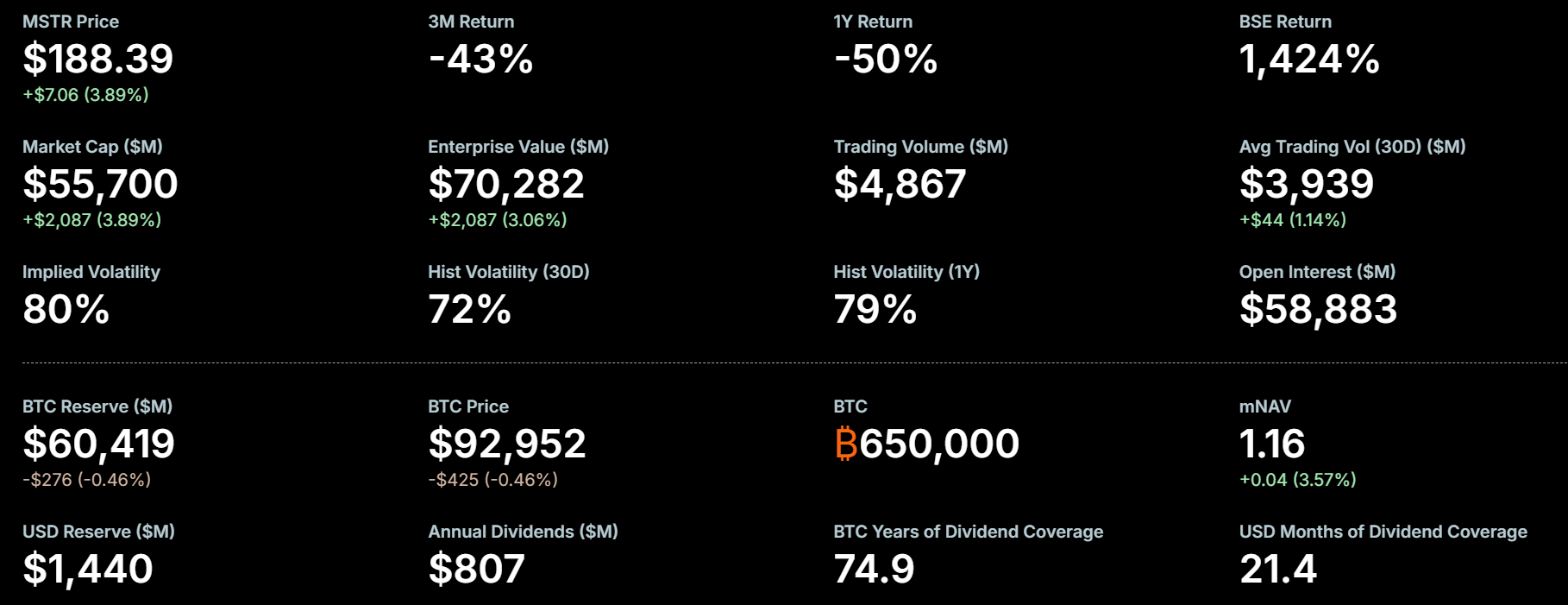

Matt Hougan, Chief Investment Officer of Bitwise of cryptocurrencies He made a comprehensive assessment of the future specifically for Strategy. Claims that Strategy will sell its huge reserve of 650 thousand BTC especially worry short-term cryptocurrency investors. Bitwise His CIO thinks this is completely wrong.

Even if Hougan Strategy were to be removed from MSCI indexes, it would not happen, he says in his latest market assessment note to clients. MSCI announced last month that Strategy and other crypto reserve companies may need to be treated differently than stocks, as they could be viewed as fund companies due to their massive crypto investment. He will make his decision on January 15, and an adverse decision will mean the withdrawal of billions of dollars of passive investments from Strategy.

JPMorgan said such a decision Strategy announced that it would cause an outflow of $2.8 billion from its shares in the first stage. If it is treated as a fund rather than a stock, MSTR will automatically be removed from many of its portfolios of stocks to which it is added, and even Hougan puts a 75% chance of that.

Cryptocurrencies Will Not Crash

Houngan gave an example from the past, reminding Strategy’s addition to Nasdaq-100 last year. The funds were supposed to demand $2.1 billion in MSTR, but prices remained almost unchanged. He also thinks that the decline in Strategy (Stock Ticker: MSTR), which has continued since October 10, is already MSCI pricing.

However, continued anxiety among investors could lead to a downward spiral and “from MSCI He does not deny the thesis that “the removal will reduce the stock, the share price will fall far below the net asset value, then Strategy may have to sell some BTC.”

The company filed an application with the SEC at the beginning of the week to curb these concerns and included the following details in the file;

“Strategy’s current intention is to maintain a US dollar reserve sufficient to fund at least twelve months of dividends, and Strategy plans to strengthen its US dollar reserve over time with the aim of ultimately covering 24 months or more of dividends.”

In other words, the cash reserve required for the emergency has already been created and Strategy has made the necessary preparations to get through this process “in order not to have to sell BTC”.

Michael Saylor said:

“Bitcoin to finance dividends

$86,989.86 There are skeptics and cynics who think we can’t sell, won’t sell, or don’t have the will to sell, and sometimes that becomes a negative vignette. I think it’s important that we dispel this perception. “Not only can the company sell bitcoins to pay dividends, it can sell the appreciated bitcoins to pay dividends and then continually increase its bitcoin holdings each quarter.”

Hougan underlines that Strategy’s dividend and interest payments are not a serious financial concern in the short term, and says that the large decline expected to be triggered on January 15 will not occur. Additionally, the company’s first debt maturity is in February 2027. Compared to the reserves of approximately 1 billion dollars and over 60 billion dollars, this figure is almost a small amount of money. By the end of last year, the company was announcing over $1 billion worth of BTC purchases every week.

In summary, MSTR is not doing that badly and the panic is largely priced in. Well cryptocurrencies The expected decline may never come.