As cryptocurrencies reach new historical highs, investors lament the missed opportunities. However, during the downturn, investors tend to stay away from altcoins as prices rush to new lows. That’s why profits in crypto are only satisfactory in the long run in the right projects. Bloomberg ETF analyst Eric Balchunas Chainlink  $12.11He drew attention to . How many dollars will LINK Coin be?

$12.11He drew attention to . How many dollars will LINK Coin be?

Chainlink (LINK) Future

Altcoin ETF launches began following the government shutdown and many cryptocurrencies were listed on the exchange. Although DOGE had a terrible launch, XRP and SOL Coin managed to attract attention despite the negativity in the market. Chainlink (LINK) It was the last successful ETF.

Chainlink DeFi It shoulders almost all of the price feeds and provides blockchain services to the world’s largest financial companies. He even has collaborations with giants like Swift. Although its technology and services such as CCIP were extremely useful, LINK Coin did not attract the expected attention.

However, with the launch of the ETF, a new process has begun in which those who want to invest in the Chainlink brand will have to buy LINK Coin. Bloomberg ETF analyst wrote the following about the new ETF (GLNK:NYSE) yesterday;

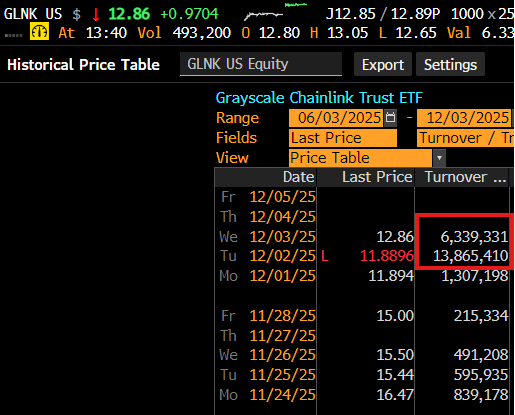

“New Grayscale spot Chainlink ETFdid a really solid volume of $13 million on its first day, and looks like it could achieve the same volume today (well above the volume it was trading at as a trust). Additionally, $41 million was streamed on the first day. “Another instant hit from the crypto world, the only failure so far has been Doge but it is early days.”

BTC and of ETH on the contrary LINK Coin has a much lower market value. FDV is only 14 billion dollars. In other words, 1 million dollars inflow attracted by Ether creates an impact of 20 million dollars here. Compared to Ether, which has a market value of over $300 billion, Chainlink’s $14 billion is at least a 20-fold difference. And although it is still very new, it attracted a net inflow of $40.9 million in 2 days. Total net assets are over $67 million. This means billion-dollar impact compared to Ether.

Chainlink is an initiative that may attract the attention of professional investors. If investors who want to invest in the trillion-dollar tokenization market at an early stage can trigger satisfactory entry in the first month, ETF performance combined with the rise of Chainlink can create hype and lead to an upward spiral. This detail can be monitored for investors pursuing short-term opportunities.

Yesterday we saw inflows of $3.84 million and acceleration is essential here. We’ll be keeping a close eye on today’s entries.

LINK Coin Forecast

Since it is one of Michael Poppe’s favorite altcoins, the analyst is extremely pleased with the current situation. Poppe says that LINK Coin currently represents a good alternative to BTC. Taking a break from the ETF rally, LINK Coin is still just below the key support at $14.5.

“This, of LINK A higher low against BTC. To me, this is a great sign, especially considering it shows more resilience and strength than other protocols.

The Clarity Act is on the horizon, and I think the impact of CRE is vastly underestimated. “A higher low has been reached and I think we will start to gain more strength.”