BlackRock, Fidelity and eventually Vanguard got into cryptocurrencies. The fourth is on the way. The total amount of assets under management of the four of them is over $45 trillion, we are not talking about billions, we are talking about the world’s largest companies with tens of millions of customers and managing tens of trillions of dollars of assets.

Trillion Dollar Giants and Crypto

Three major giants have already entered cryptocurrencies, and BlacRock and Fidelity have even launched their own products. Vanguard, on the other hand, has allowed investments in cryptocurrency products for now, but the end of this will probably be the issuance of their own ETFs. And as of the beginning of 2026, it is one of the world’s largest companies with assets worth $12 trillion. Charles Schwab will also launch a cryptocurrency service.

Charles Schwab Bitcoin  $86,989.86 And Ethereum

$86,989.86 And Ethereum  $2,804.64 trade launches its services in the new year. Regarding this major development, Bloomberg ETF analyst Eric Balchunas said:

$2,804.64 trade launches its services in the new year. Regarding this major development, Bloomberg ETF analyst Eric Balchunas said:

“We knew this would happen, but there’s one big question: How much will these commission fees be? Schwab makes ETF and stock trading free. If crypto becomes free too, watch out for Coinbase (COIN). I think anything under 50 basis points is a big threat to crypto exchanges. ETFs, on the other hand, are already traded for free and have 1-2 basis point spreads, so it’s almost impossible even for Schwab to beat this deal (ETFs come with exp ratio, owning it outright (If it does not come)

4 major companies with over $45 trillion in assets to over 100 million professional investors cryptocurrency will provide the service. This may be the highest point cryptocurrencies can reach. The next phase for cryptocurrencies in terms of access to liquidity will be rapid adoption by pension funds and passive investments exceeding tens of billions of dollars.

What Will Happen to Cryptocurrencies?

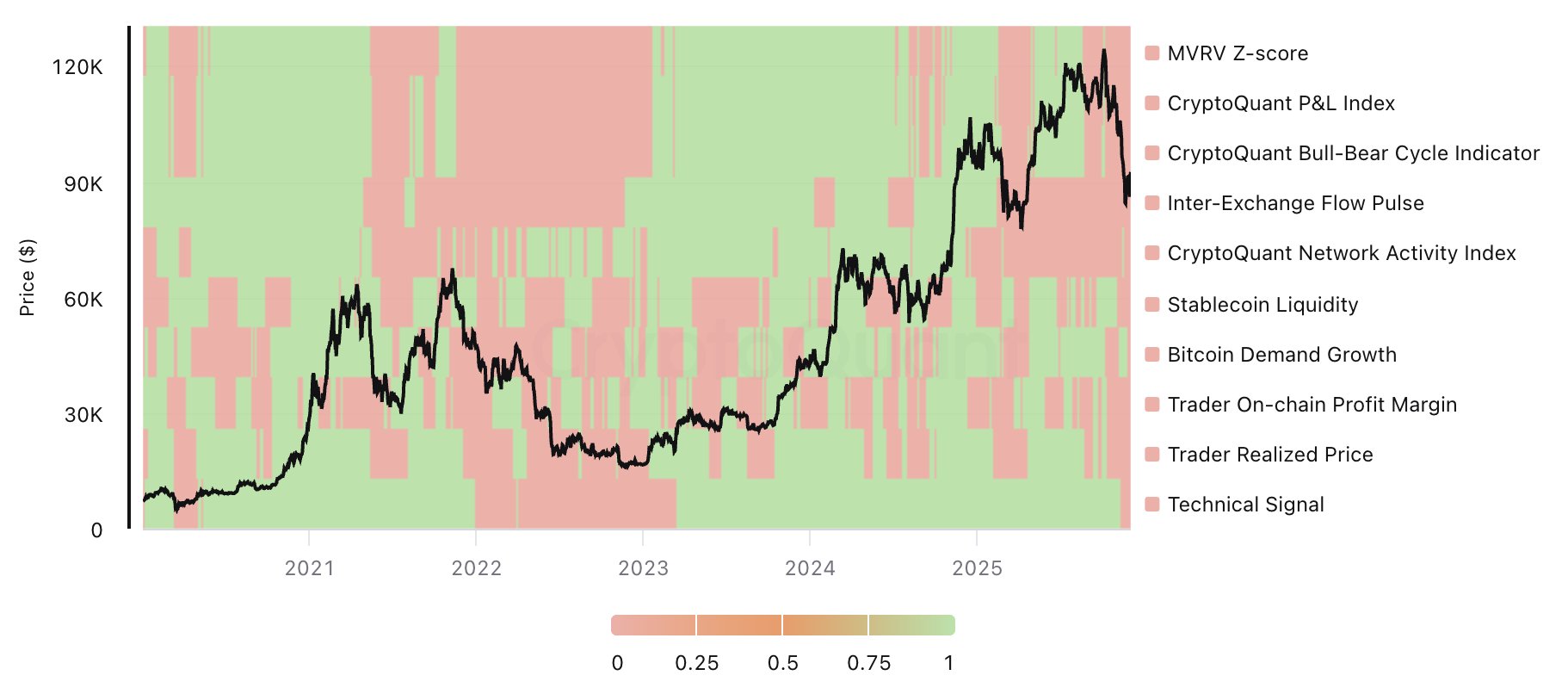

on-chain Ki Young Ju and a few others are among the most talked about people. CryptoQuant CEO looked at many metrics and said that bear markets started in March. But after ETFs He realized that he had changed the game and that the story of the four-year cycle had come to an end. Although the name, which quickly adapted to the new era, is optimistic in the long term, it is cautious as many metrics point to a decline in the short term.

“Most Bitcoin on-chain indicators are bearish. If there is no macro liquidity, we enter a bearish cycle.

It’s very simple. If you think the macroeconomy will be better next year, buy. Otherwise, buy it. I’m not a macroeconomics expert, so find macroeconomics experts. New ETF entries are key. At this stage, it’s more important to react than to predict. Determine your scenarios and act accordingly.”

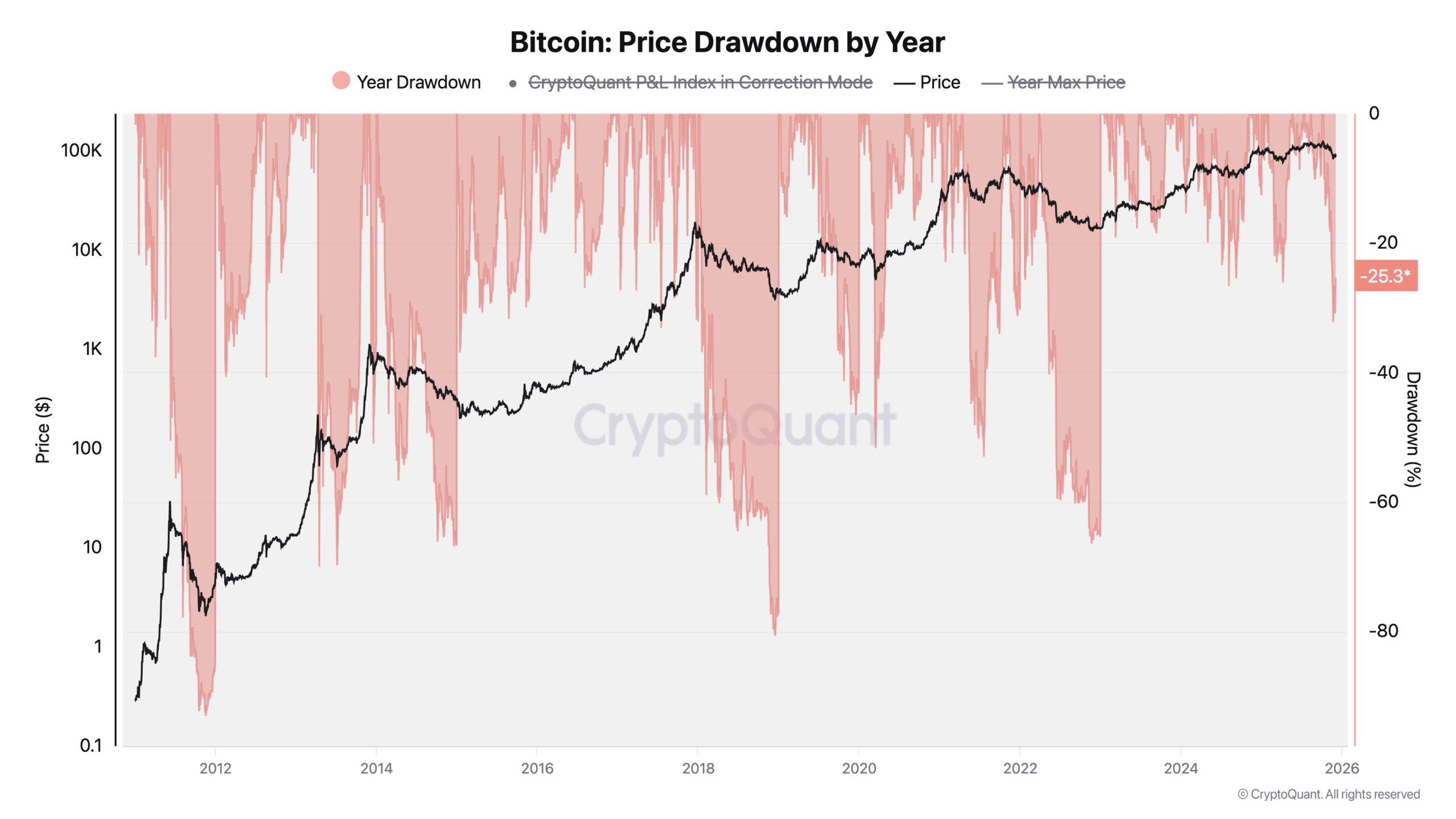

Ki Young Ju, who shared the chart above, is quite bold that if Strategy can stay strong in this cycle, we will not see huge declines.

“If Strategy holds (or sells very little) 650k BTC this cycle, there will be no 65% decline like in 2022. We are currently down about 25% from ATH, and even if a bear cycle were to come, the decline would likely be smaller and look more like a wide sideways range.

Long-term investors should avoid panic selling. Bitcoin now has more liquidity channels, so the long-term outlook is clearly strong (in my opinion).”