Bitcoin  $86,989.86 The price is still at very high levels for those who are introduced to cryptocurrencies after 2022. While the recent drop may seem monumental for those who got into crypto after Trump won the election, most investors believe the price, which lingered well above the previous ATH level, has not been dealt a death blow. But on-chain data of Bitcoin He says he has reached the highest level of pain.

$86,989.86 The price is still at very high levels for those who are introduced to cryptocurrencies after 2022. While the recent drop may seem monumental for those who got into crypto after Trump won the election, most investors believe the price, which lingered well above the previous ATH level, has not been dealt a death blow. But on-chain data of Bitcoin He says he has reached the highest level of pain.

Cryptocurrencies Hit the Bottom

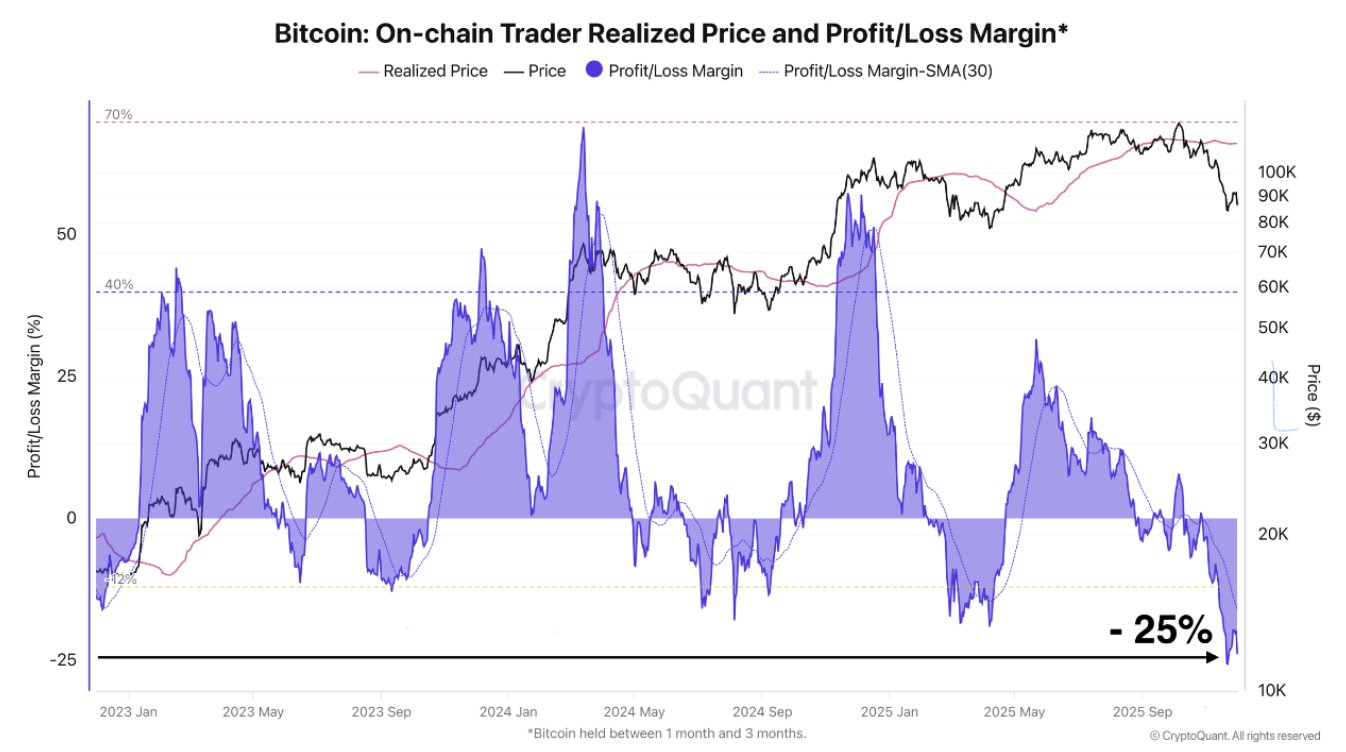

If it were possible to predict the cryptocurrency market bottom using a single metric, we could look at the chart below and say “yes, we have seen the bottom”. Because investors have been experiencing losses of 20% to 25% for two weeks, which clearly reflects capitulation behavior. Such rapid and large loss series mean that the bottom has now been detected in the uptrend and the reversal will begin.

CryptoQuant analyst Darkfost wrote:

“With the realized price of $113,692, BTC On-chain trading groups are experiencing the largest percentage loss this cycle. We are only talking about the spot market here. The idea is to isolate a very specific group of investors who speculate in the short term. On-chain traders are investors who hold BTC for 1 to 3 months. Investors in this category have been experiencing losses of 20% to 25% for two weeks, clearly reflecting capitulation behavior. In this cycle, these phases are often associated with bottom formation, as these traders often have to choose between two behaviors: sell or hold. As we have seen in recent weeks, when a large portion of these surrender, the accumulation opportunity often becomes interesting. However, this is only true if the long-term uptrend is not broken. For now, this still appears to be the case despite the current period of uncertainty, but it is important to remain cautious and vigilant at this stage.”

Although the environment is uncertain, this maximum pain warning is important in terms of stopping any significant rise or fall, at least in the short term.

The graph above shows us that nothing like this has ever happened since the beginning of 2023.

The Worst Since March

BTC It had its worst day since March, and its post-ATH return to March levels was even more painful. Monday’s decline was over 6 percent, and we don’t see that often. Losses since the October peak have exceeded 30%.

Patrick Horsman, investment director at BNB Plus, warned that the risk trend is reversing as pessimism about the market and economy increases. He also said that the nightmare that Bitcoin will reach 60 thousand dollars is not over. So not everyone agrees on the bottom.

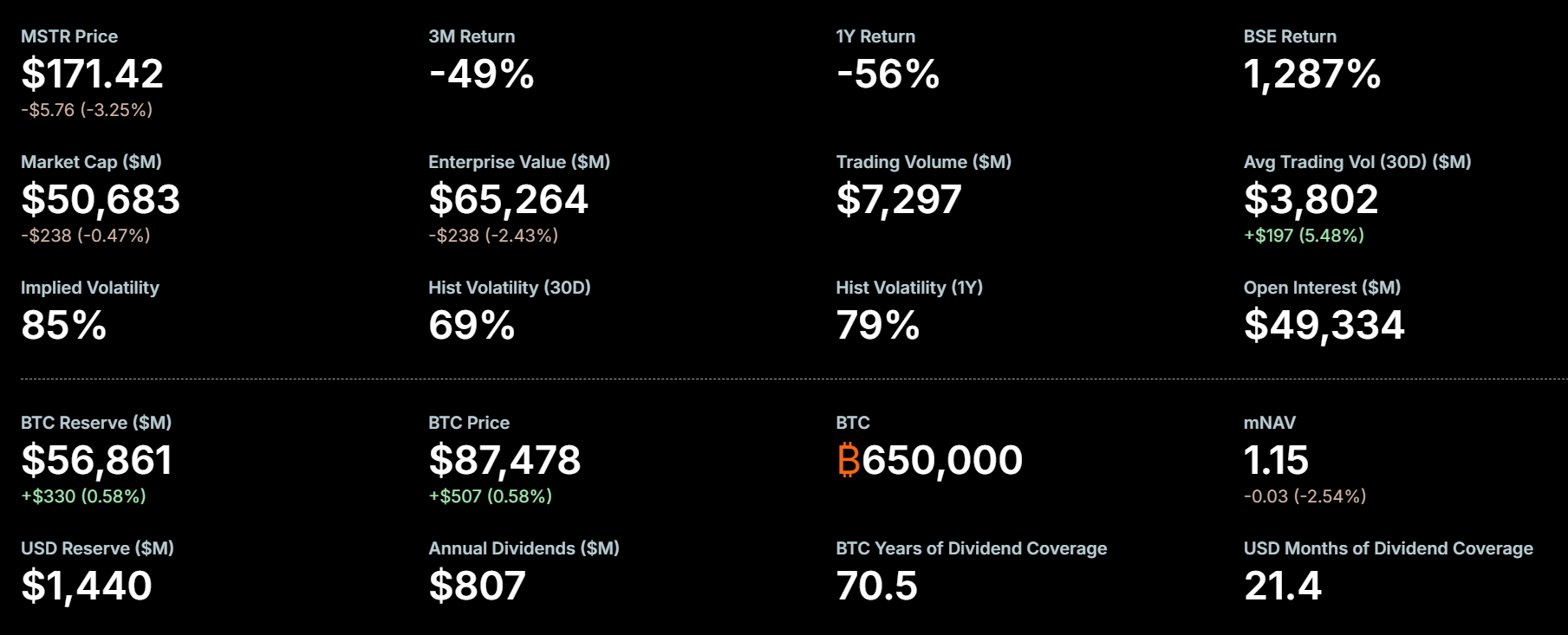

One of the things that fed the fear was the statement made by Michael Saylor in his last video presentation. This statement may have reassured shareholders, but it drew reaction from the cryptocurrency community.

“If mNAV falls below 1, we may sell some of Bitcoin and related securities. We will do so because it is in the best interest of shareholders.”

Strategy CEO Phong Le said the following last week;

“Right now, as we experience bitcoin winter, we’re seeing our mNAV drop. My hope is that our mNAV doesn’t drop below one. But if it drops and we have no other sources of capital, we will sell Bitcoin.”

Now I can almost hear you saying, “Fatih told me that mNAV did not fall below 1.” No, even though it dropped 7% yesterday, it is at 1.15 today. It is positive that at least some of the decline has been compensated.