Fed Chairman Jerome PowellThe fact that he did not mention monetary policy in his speech at Stanford University created a temporary relief for the markets. However, the fact that the possibility of a rate cut was not clarified at the December meeting pushed investors to be cautious. Bitcoin  $86,989.86In an environment of uncertainty, it started to rise again and exceeded the $87,000 level.

$86,989.86In an environment of uncertainty, it started to rise again and exceeded the $87,000 level.

Powell Skips Economy and Monetary Policy in His Speech

Powell, late economist at Stanford University George ShultzIn his speech at the event held in memory of , he did not make an assessment of the current economic conditions or monetary policy. “To be clear, I will not be talking about current economic conditions or monetary policy.” Fed He remained silent as we entered decision week.

Powell’s failure to speak about the economy and monetary policy was in accordance with the “silence period” rule of Fed officials before the meeting. After giving the message “December discount is not certain” at the press conference in October, he chose not to direct the market with new statements. of speech quantitative tighteningIt increased concerns that a possible comment during the period when QT expired could affect liquidity flows. Therefore, the Fed Chairman’s silence was evaluated as a conscious strategy.

Weak Data Strengthens Interest Rate Cut Expectations

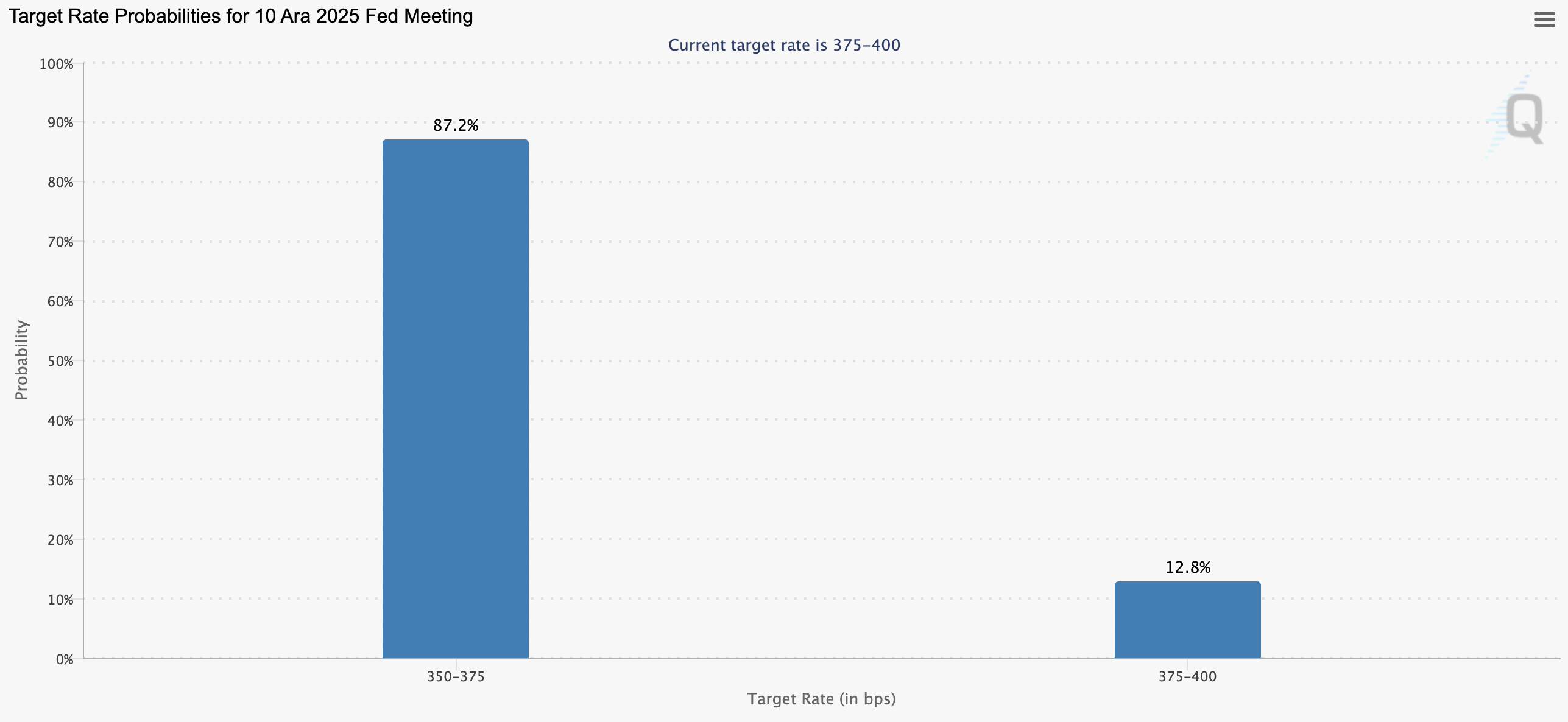

On the other hand, the latest manufacturing data announced in the USA economyIt also made the signs of slowing down clearer. ISM Manufacturing PMI data fell to 48.2 in November, reaching the lowest level in the last four months. The decline in orders and the increase in price pressures strengthened the expectation of a 25 basis point discount in the markets in December. CME FedWatch Tool According to data, the probability is at 87.2 percent.

ReutersSpeaking to , Head of Equity Market Structure Research Joe Saluzzi“I expect a gradual rise to continue until the end of the year,” he said. More White House Economic Advisor Kevin HassettThe fact that he stood out as a strong candidate to replace Powell increased expectations that a softer tone would be maintained in monetary policy.

CryptoAppsy According to data, Bitcoin rose nearly 1 percent in 24 hours with the revival of investor interest after Powell’s silence. While the price climbed to $87,325, trading volume remained high, confirming the “buy on the dip” approach. CoinGlass data reveals that open positions in futures increased to $57.7 billion. CMEWhile a small increase was observed in Binance And BybitThere is a decrease in . This indicates that the outlook in the derivatives market is mixed.