The long-awaited “altcoin season” expectation in the cryptocurrency markets seems to have been largely postponed to 2025 with new macroeconomic data from the USA. Bitcoin  $86,989.86 The ongoing stagnation in industrial production and insufficient global liquidity are the reasons why the sub-season, which defines the periods when foreign assets come to the fore with sharp increases, did not materialize this year. Analysts describe the last wave of sales as; The natural price correction after months of rise is evaluated together with the record-breaking gold prices, the quiet but tense course in the stock markets, and the concern about unlimited supply in the crypto market.

$86,989.86 The ongoing stagnation in industrial production and insufficient global liquidity are the reasons why the sub-season, which defines the periods when foreign assets come to the fore with sharp increases, did not materialize this year. Analysts describe the last wave of sales as; The natural price correction after months of rise is evaluated together with the record-breaking gold prices, the quiet but tense course in the stock markets, and the concern about unlimited supply in the crypto market.

Critical Indicator Predicting Altcoin Season

According to new analysis, the US ISM Manufacturing PMI data stands out as one of the most powerful macro indicators that foretells past sub-seasons almost without error. The latest data for November was announced at 48.2 levels, falling below expectations and confirming that the contraction in the manufacturing sector continued. This index, which is based on the responses of more than 400 companies regarding new orders, production, employment, stock and delivery times, remains below 50, indicating a slowdown in the economy. Since the 50 level could not be exceeded throughout 2025, there was no strong signal of recovery on the industrial side.

Looking at historical data, it can be seen that the ISM index was above 55 in the 2017 and 2021 bull periods. This suggests that altcoin markets can generally only experience a strong rally during periods of economic expansion. Today, although many altcoins make short-term jumps from time to time, it seems that the necessary macro basis for a permanent trend change has not been formed.

Market Psychology, Bitcoin Dominance and New Developments

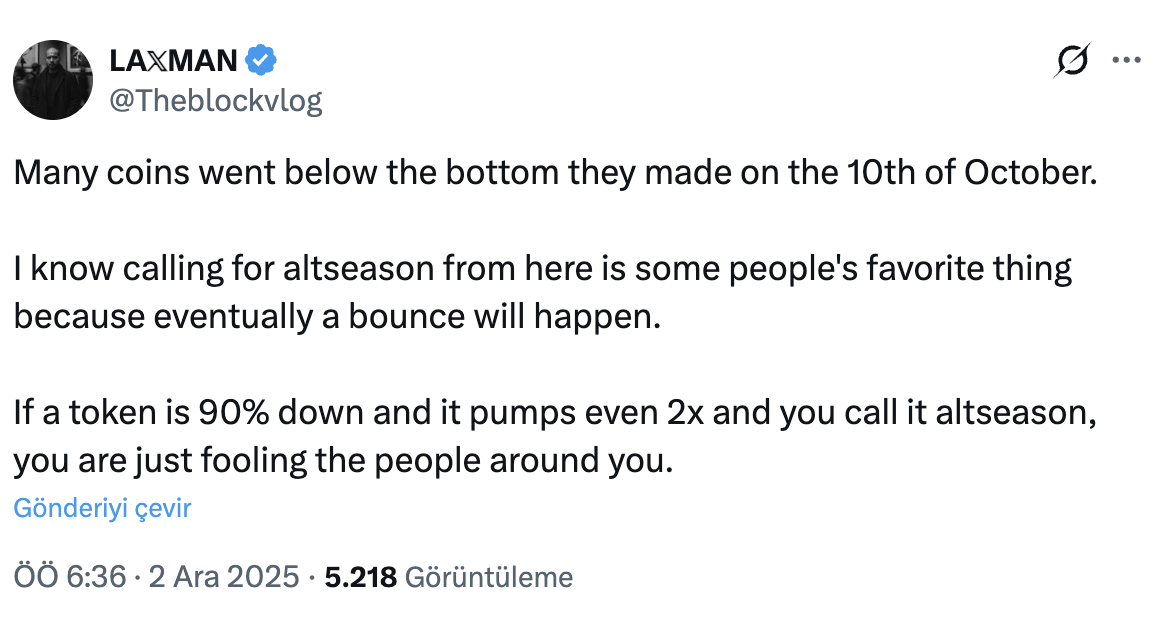

There is a serious difference of opinion among crypto investors. Some people find it unhealthy to interpret projects that have lost 90 percent of their value but doubled from the base as “altcoin season has begun”. Other investors argue that altcoins have been suppressed for a long time and that a major capital rotation is inevitable. On the technical analysis side, the reversal of Bitcoin dominance from the 50-week average is similar to patterns seen in the past before altseasons.

One of the comments talked about in the markets is the macro expectations for the second half of the year. Interest rate cuts, an increase in global liquidity and a more supportive regulatory environment are predicted for 2026. If this scenario occurs, it seems possible that the ISM index will enter the expansion zone again and a more solid upward basis will be formed in the altcoin market.

In addition to this picture, the strong outflows from spot Bitcoin ETFs in the USA last week were another development that limited risk appetite. The cautious attitude of institutional investors continues to pressure not only Bitcoin but also the altcoin market. On the other hand, news of blockchain-based payment systems and central bank digital money coming from some Asian countries are among the factors that may revive interest in altcoin projects in the medium term.

The year 2025 is recorded as a period where the patience test continues for altcoin investors. Although current macro data show that the necessary liquidity and economic expansion conditions for the lower season have not been met, expectations for 2026 are not completely extinguished. It seems that investors who follow global financial conditions and industry data rather than short-term price movements will have the chance to take healthier positions.