Although December did not start well for cryptocurrencies, many important developments indicate that volatility will increase. Moreover, despite the massive BTC sales, the stock market supply is running to a new low. We are now living in the last days of 2025, the new year will be full of surprises for cryptocurrencies. Here are the latest developments and important overlooked details.

Bitcoin Supply Shortage and Cycle

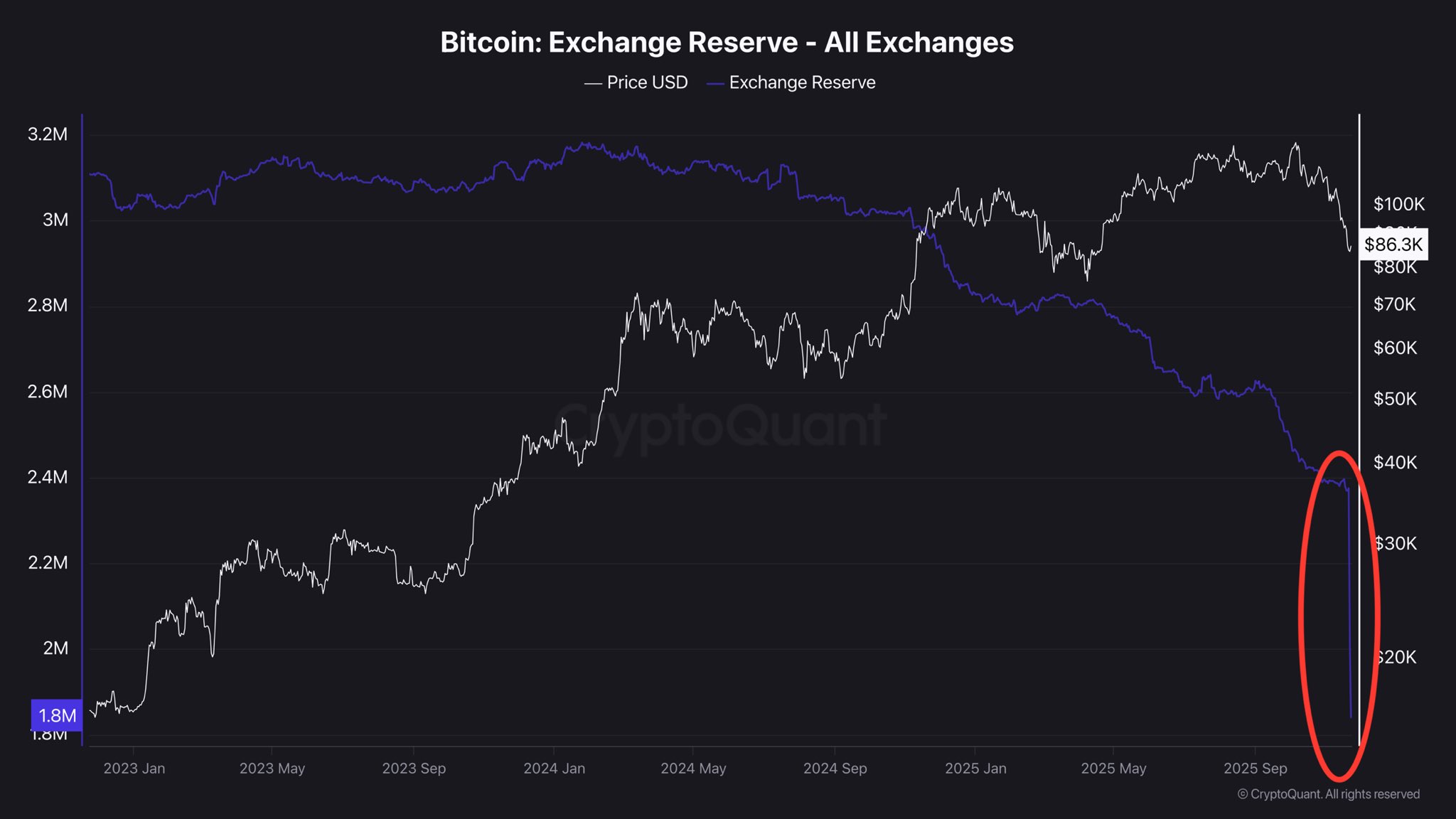

BTC It is close to its daily peak but is still stalling below $90,000. At the time of writing, there are still 2 hours left for the US market opening and ETF volume Vanguard It is a matter of curiosity how much it will change and how the entries will be affected. On the other hand, although we see large sales and declines, the amount of BTC on the exchanges continues to decrease. The supply on the stock exchanges decreased to 1.8 million.

All cryptocurrency The supply on exchanges is less than 3 times Strategy’s reserve of 650 thousand BTC. So Strategy alone holds more than 33% of the supply on all cryptocurrency exchanges. This figure fell from over 3 million at an incredible rate. (Source CryptoQuant)

The analyst with the pseudonym Quinten once again reminded that this cycle is different from the previous ones and said;

“Everyone is expecting a classic subseason like 2017 or 2021.

But the entire market structure has changed.

In 2017, several hundred coins were competing for capital.

In 2021, there were several thousand coins.

By 2025, there will be more than 11 million tokens, memecoins and worthless experiments. Gone are the days when everything went up because “altcoins go up in bull markets.”

This is the toughest cycle in crypto history.

“You have to have a portfolio of real projects with real demand, or you will perish.”

Today, I drew attention to the 20 altcoins shared by the CEO of CryptoQuant, and it was mentioned that it would be difficult for altcoins without ETF, ETP and DAT support to survive. Quinten says similar things.

8 Major Developments

Vanguard has reversed its long-held anti-crypto stance and began offering crypto ETFs to its clients starting today. China’s central bank doubled down on its crypto ban by taking stricter measures on stablecoins, which hasn’t been a very supportive development. Grayscale first spot Chainlink today  $12.11 He’s launching his ETF.

$12.11 He’s launching his ETF.

The fourth important development of the day is from Japan. Japan will impose a flat 20% crypto tax, the same as stocks and trusts. FDIC this month to regulate stablecoin issuers GENIUS Act will implement the framework. Ripple  $2.01has received MAS approval to expand licensed payment services in Singapore. Kalshi Solana has launched event conventions on its network. Sony Bank announced that it will launch USD stablecoin in the US by fiscal 2026. In addition to these 8 major developments, there is also the Fed’s policy change.

$2.01has received MAS approval to expand licensed payment services in Singapore. Kalshi Solana has launched event conventions on its network. Sony Bank announced that it will launch USD stablecoin in the US by fiscal 2026. In addition to these 8 major developments, there is also the Fed’s policy change.

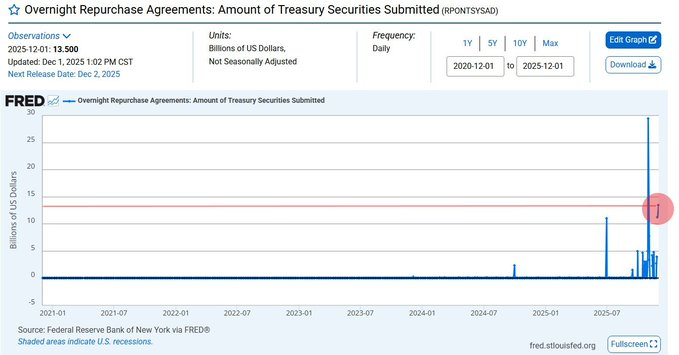

“WOW!! Fedinjected $13.5 billion into the market as an overnight repo operation. “This is one of the LARGEST liquidity injections since COVID and exceeds any overnight repo amount seen in the dotcom era.” – Lark Davis

There are many reasons to be hopeful about the future of cryptocurrencies.