Strategy announces last BTC purchase of November BitMine and continues to grow. There are 2 major reserve companies for BTC and ETH. It is important for these to remain strong for institutional demand to revive and ETH flow to turn positive again.

BitMine Ethereum Good News

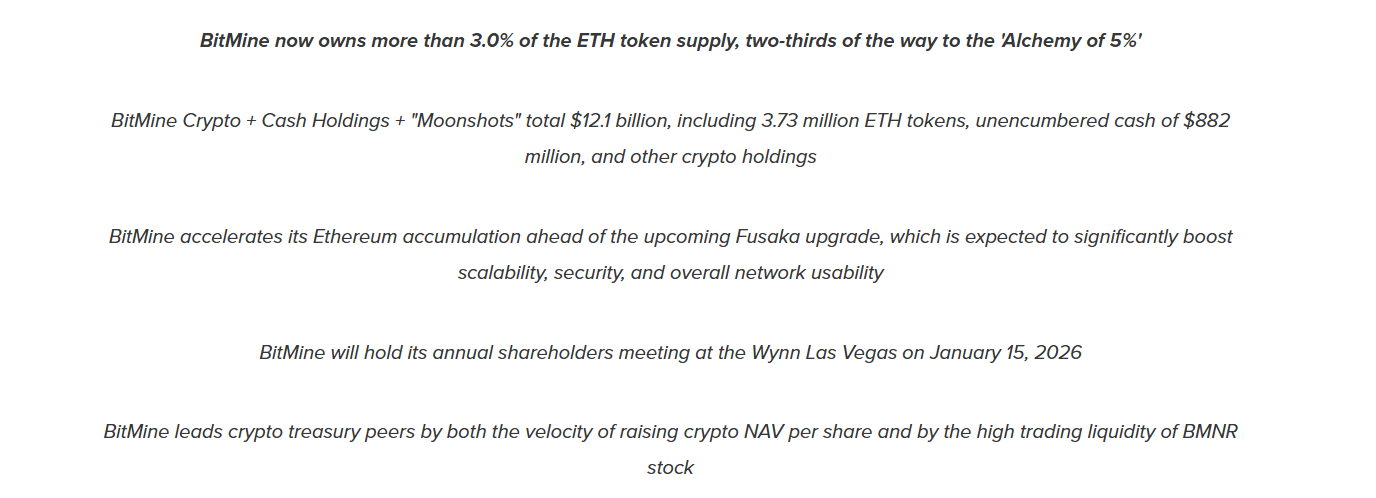

The company started saving in June and rapidly increased its reserves. ETH The company, which alone holds more than 3% of its supply as of today, is one step closer to its 5% target. BitMine officials announced that two-thirds of its target has been achieved. Crypto + Cash Assets + “Moonshots” gave the good news that they have reached a total reserve size of 12.1 billion dollars.

BitMine Acquisition Announcement (Source)

BitMine, which announced that it will hold its annual shareholder meeting at Wynn Las Vegas on January 15, 2026, thinks it is in good shape despite FUD, with both the speed of increasing crypto NAV per share and the high transaction liquidity of BMNR shares. BMNR, the 39th most traded stock in the US, has an average daily volume of $1.7 billion.

The company’s crypto assets consist of 3,726,499 ETH and cost $3,008 per ETH. Even though new purchases have reduced the cost, they are currently at a loss of roughly $200 per ETH.

Tom Lee said;

“Last week, BitMine purchased 96,798 ETH. Looking ahead to December, the Fusaka upgrade, also known as Fulu-Osaka, will go live on December 3 and will deliver a number of improvements in terms of scalability, enhanced security, and usability. Federal Reserveis taking several important steps, including ending QT (quantitative tightening) in December, and is expected to cut interest rates again on December 10. More than 7 weeks have passed since the liquidation shock event on October 10, which means the crypto market is starting to rebalance. Altogether, we think these represent a positive tailwind for ETH prices, which is why we increased our weekly ETH purchases by 39%.”