The crypto market enters the final month of 2025 on a very unstable footing as the BTC price deepens its retreat and drags major altcoins with it. Despite improving expectations for easier U.S. monetary policy, the panic was triggered today by the Yearn Finance hack incident and rising global macro risks has weighed heavily on Bitcoin crypto, Ethereum crypto, and XRP crypto.

Bitcoin: Can the Market Leader Hold Above Key Support?

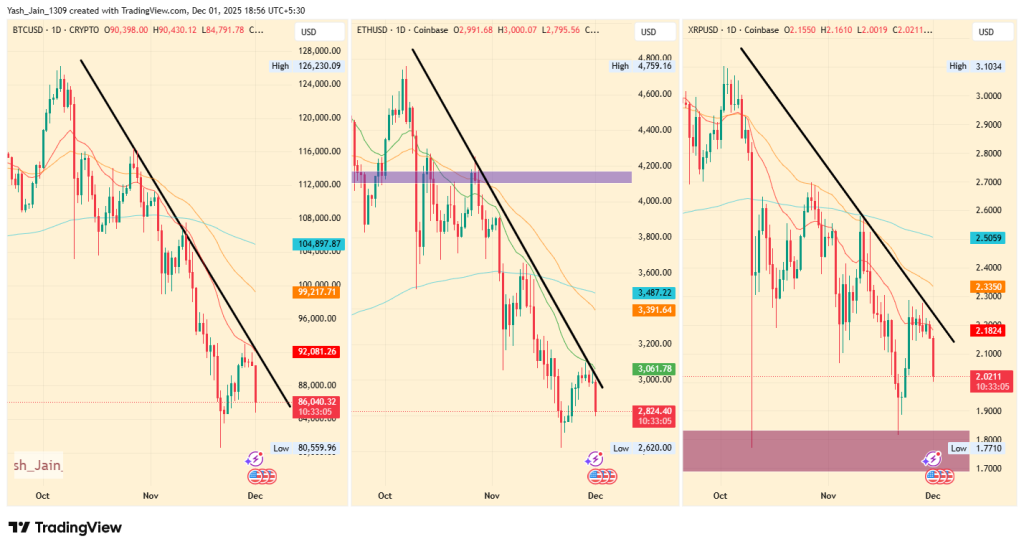

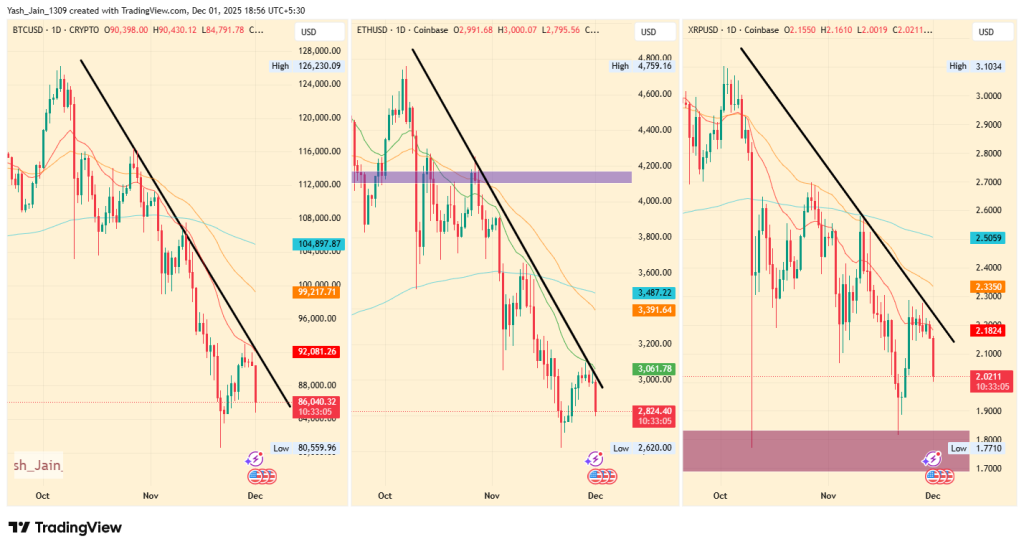

As of writing, BTC price today has slid over seven percent, dropping toward $85,395 after a turbulent start to the month. The decline follows a steep November pullback, even as traders price in an 87% probability of a Federal Reserve rate cut at the December meeting. Cooling inflation and softer economic data had initially supported a risk-asset rebound, but fear surrounding the Yearn Finance exploit erased much of that optimism.

According to the BTC price chart, if bearish pressure continues, Bitcoin could weaken toward the $80,000 region, and in a more extended decline, the BTC price USD could revisit the $74,458 zone. Yet, a recovery remains possible. Should BTC reclaim and close above its downward trendline, a fresh BTC price prediction signals the potential for a renewed bullish cycle heading into mid-December. This trendline now acts as the most important level in the broader BTC price forecast outlook.

Ethereum: Liquidity Shock Meets Macro Risk

The sudden panic from the Yearn Finance exploit added direct pressure on Ethereum, too. As ETH is next to BTC and major altcoin markets depend on it, its decline has shaken the crypto core.

This attack was a critical blow to the sector because it occurred at a time when caution was already excessive, with previously BTC slipping to $80,600 and ETH to $ 2,620, and the hack has added another worrisome factor to the declining market.

In a recent event, an attacker minted excessive yETH in a single transaction, draining liquidity and contributing to a wider market sell-off. With the ETH price today down over 7.5% to $2,825, traders remain cautious despite supportive macro conditions.

Meanwhile, beyond the concerns of this hack another broader backdrop is being shaped that’s rising concern far greater and this from Japan, where the Bank of Japan signaled it may consider a rate hike in December. Such a move could unwind global carry trades, shake risk markets, and heighten volatility.

If the downturn deepens, the ETH price chart suggests a path toward $2,105, aligning with a conservative ETH price forecast. However, if Ethereum breaks above the black trendline alongside BTC, an ETH price prediction scenario opens for renewed upside momentum.

XRP: Closely Tracking BTC Price and Ethereum Weakness

Judging from the fact how BTC and ETH have been the XRP price crashes mirrors the broader crypto market’s stress, falling over 8% to $2.027. The current sentiment shows sensitivity to macro uncertainty and DeFi-related security events. Based on the XRP price chart, a slide toward $1.90 remains plausible if declines continue.

Still, XRP/USD often rebounds sharply when market structure shifts. Should BTC and ETH reclaim bullish structure simultaneously, XRP price USD could stage a synchronized recovery. A favorable XRP price prediction aligns with a trendline break, too. This suggests potential upside through December, provided volatility stabilizes.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.