Bitcoin  $86,219.53 It fell below $86,500 again, causing $144 billion to be deleted from the global cryptocurrency market in four hours. Macroeconomic pressures and the hack attack on the Yearn Finance platform have pushed investors to become risk averse again. CryptoAppsy According to data, the largest cryptocurrency decreased by 5.34 percent in the last 24 hours to $ 85,910, while Ethereum

$86,219.53 It fell below $86,500 again, causing $144 billion to be deleted from the global cryptocurrency market in four hours. Macroeconomic pressures and the hack attack on the Yearn Finance platform have pushed investors to become risk averse again. CryptoAppsy According to data, the largest cryptocurrency decreased by 5.34 percent in the last 24 hours to $ 85,910, while Ethereum  $2,830.62 It dropped to $2,827, XRP dropped to $2.02, and Solana dropped to $126.

$2,830.62 It dropped to $2,827, XRP dropped to $2.02, and Solana dropped to $126.

Macro Pressure and ETF Outflows Deepened Selling

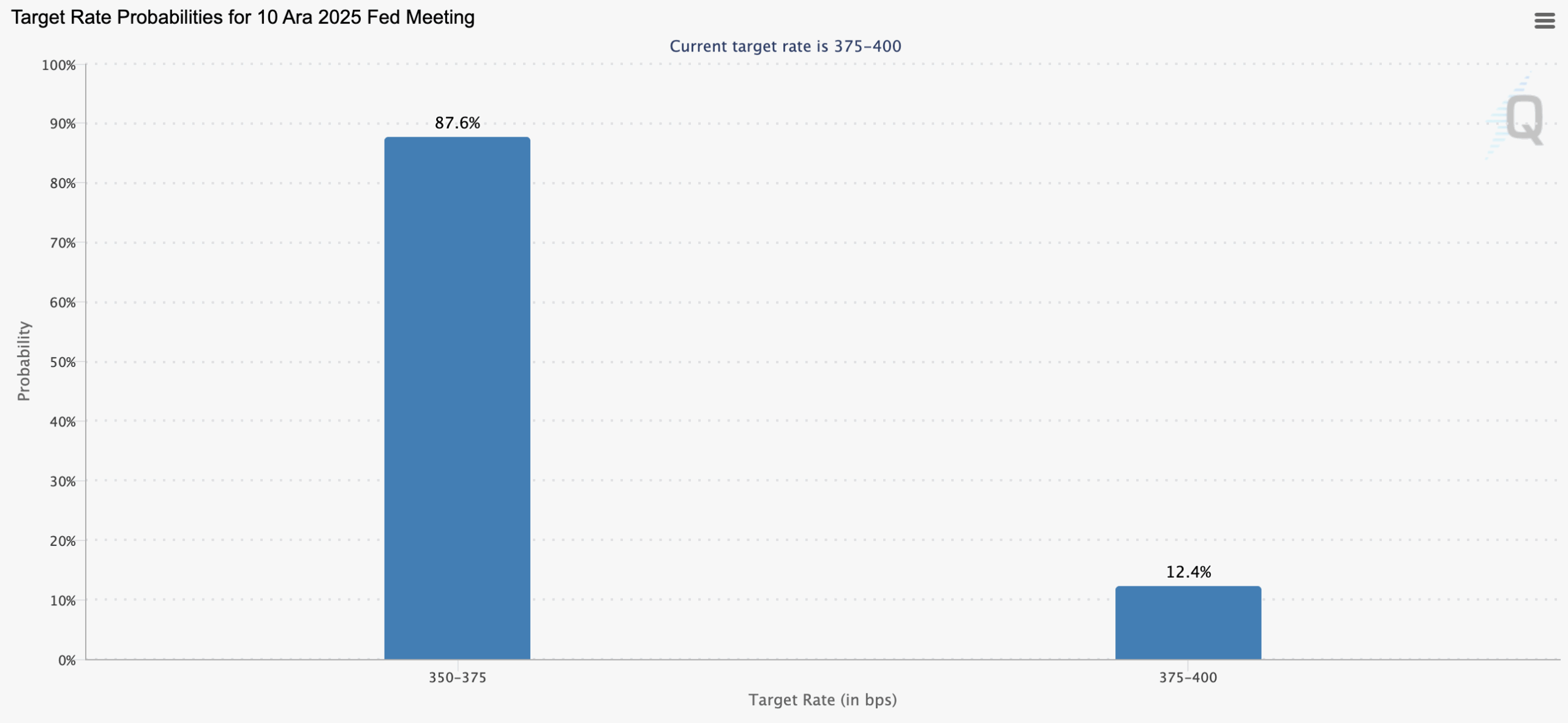

According to analysts, the sales wave that hit Bitcoin and other cryptocurrencies created a “position clearing” effect in the market, despite the interest rate cut expectations in the background. CME FedWatch Tool data shows the probability of a 25 basis point cut in December as 87.6 percent. However, BTC Markets analyst Rachael LucasAccording to , the hope of a rate cut alone is not enough to turn the tide. Lucas noted that high inflation and tariff rumors suppressed risk appetite, with an outflow of $3.5 billion from ETFs throughout November.

Lucas: “Bitcoin is high again beta entity “It behaves like a real liquidity injection, not just a ‘dovish’ expectation,” he said. According to the analyst, $ 87,000 is the critical threshold in the short term. If this level is maintained, a recovery towards the $ 95,000-100,000 band is possible, but if it is lost, there is a risk of a decline to $ 80,400 or even $ 75,000.

Attack on Yearn Finance Increased Panic

Another factor that accelerated sales on Sunday night is the DeFi protocol Year Finance‘s yETH pool was hacked. While the attackers transferred 1,000 ETH via Tornado Cash, the incident created chain concerns in the world of decentralized finance. BTSE COO Jeff MeiRecalling that Yearn is an active aggregator in protocols such as Aave, Compound and Curve, he said, “Investors’ fear of mass dissolution triggered panic sales.”

Analysts last week upbit He states that the perception of trust in the market was damaged with the hacking attack on the stock exchange, and this situation multiplied its effect during low volume hours on the weekend. On the other hand, US President Donald Trump’s announcement that he has chosen the new Fed chairman strengthened the hopes for an interest rate cut. Tribe Capital manager Boris RevsinAccording to , markets have not yet priced in the possible new president’s adoption of a liquidity-friendly approach.