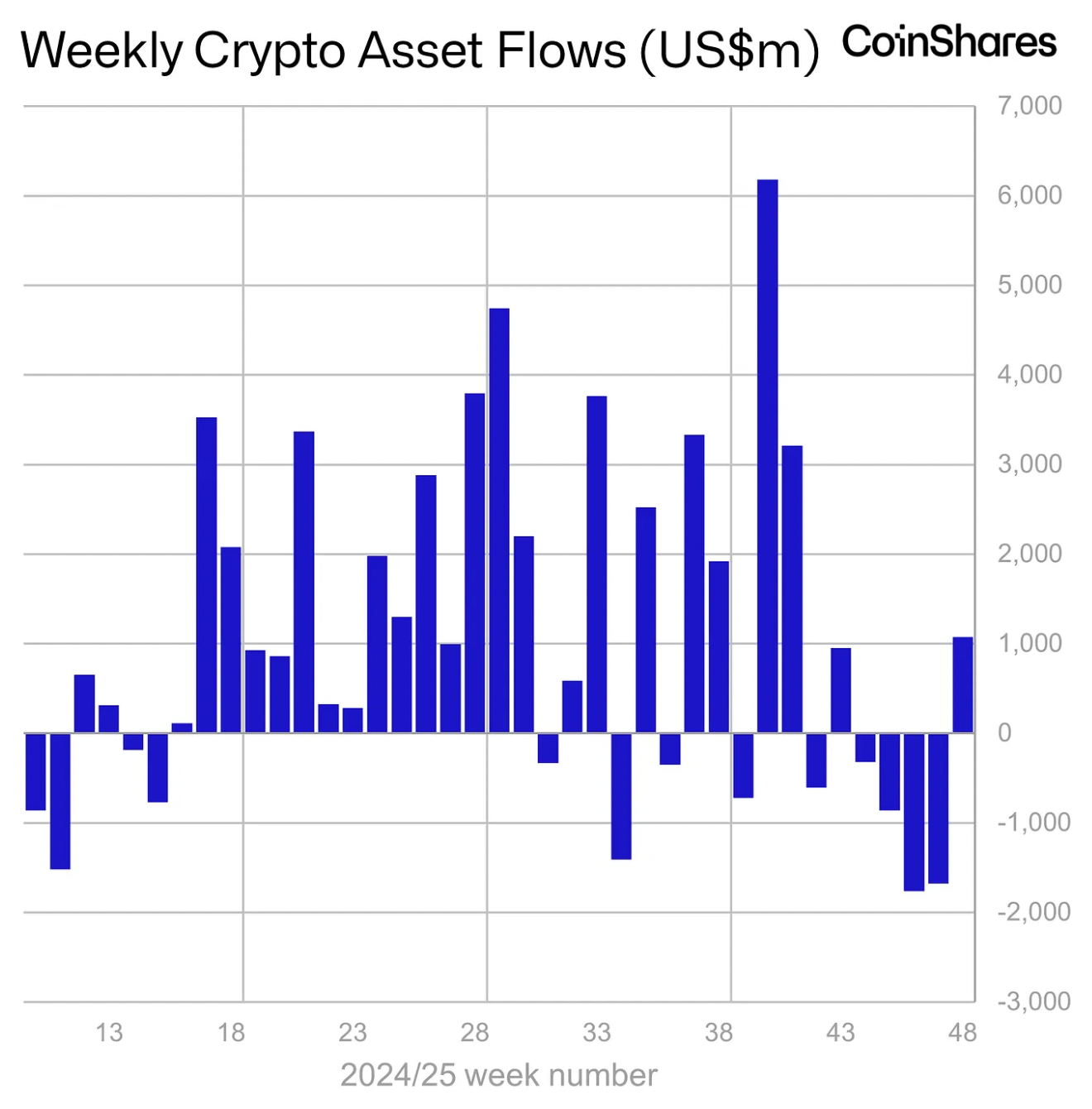

Spherical cryptocurrency -based investment products attracted $1.07 billion in net inflows last week, ending a four-week streak of outflows. Recovery in investor interest, according to CoinShares data FedIt was supported by expectations of a possible interest rate cut from , but the optimism was overshadowed by the sharp price drops at the beginning of the new week.

Strong Recovery in Cryptocurrencies Led by the USA

CoinSharesAccording to the weekly report published by BlackRock, Fidelity, Grayscale, ProShares And 21Shares Funds entering into products managed by large asset managers such as have reached 1.07 billion dollars in total. This return, which came after a series of outflows that lasted for four weeks and reached $5.7 billion during this period, revealed that investors have regained their appetite for risk. Research Director James ButterfillHe stated that the recovery was triggered by Fed member John Williams’ statements that monetary policy was still restrictive.

The US claimed the bulk of total flows, with $994 million inflows despite the Thanksgiving holiday. Canada 97.6 million dollars, Switzerland While it attracted an inflow of 24.6 million dollars, GermanyAn outflow of 55.5 million dollars was seen in . The transaction volume in cryptocurrency-based investment products decreased to 24 billion dollars due to the holiday week, remaining well below the record level of 56 billion dollars in the previous week.

Investors Focus on Bitcoin, Ethereum and XRP

Largest share in terms of assets Bitcoin  $86,219.53 took it. While there was a net inflow of $461 million into Bitcoin-based investment products, there was an outflow of $1.9 million from short-Bitcoin products. US based spot Bitcoin ETF‘s attracted $70.1 million in net inflows, $230.5 million of which came from Fidelity’s FBTC ETF.

$86,219.53 took it. While there was a net inflow of $461 million into Bitcoin-based investment products, there was an outflow of $1.9 million from short-Bitcoin products. US based spot Bitcoin ETF‘s attracted $70.1 million in net inflows, $230.5 million of which came from Fidelity’s FBTC ETF.

Ethereum  $2,830.62 -based investment products also showed a strong recovery. In ETH-based products, which recorded an inflow of $308 million on a global scale, US-based ETFs accounted for almost the entire volume with $312.6 million. The most striking move is XRP It happened on the side. XRP-based ETFs reached 29 percent of total managed assets in the last six weeks, with record inflows of $289 million. CoinShares attributed this rise to the launch of spot XRP ETFs in the US.

$2,830.62 -based investment products also showed a strong recovery. In ETH-based products, which recorded an inflow of $308 million on a global scale, US-based ETFs accounted for almost the entire volume with $312.6 million. The most striking move is XRP It happened on the side. XRP-based ETFs reached 29 percent of total managed assets in the last six weeks, with record inflows of $289 million. CoinShares attributed this rise to the launch of spot XRP ETFs in the US.