The agenda is busy and the charts have been particularly painful for cryptocurrency investors over the last 24 hours. As the November candle closed, it fell like rubble on cryptocurrency investors, with many altcoins continuing the day with double-digit losses. Solana is at breakout point and the big 5 FUD is undermining sentiment. Additionally, SpaceX gave the crypto bear signal.

5 Big FUDs

cryptocurrency There are 5 major debates affecting investor sentiment. The last 2 of these flourished yesterday and today. Yesterday Hayes tried to fuel the Tether FUD that I explained in detail, but prominent figures in the community began to deny it with data, saying that he was “bullshit”.

Every day we see new discussions that cause fear and panic. FUD It is said. Even though crypto novices are not used to it, we have seen some over the years that even kept us up until the morning. James Bull says that all of these are fake and explains them one by one.

- FUD about MSCI indexing DATs. This is not actually that fake, because there may be a category change on January 15, and if it happens, billions of dollars of passive investments will be removed from MSTR, which means there will be a forced sale. This is not good.

- The claim that BTC reserve companies sell BTC. However, this on-chain cannot be confirmed. Blockchain is a beautiful thing.

- Microstrategy Bitcoin

$86,219.53their ‘s Fake FUD that they should sell at price x, which is not true because their debt only matures in 2027 and they have $60 billion worth of stocks they can sell if necessary. As a matter of fact, they created cash reserves for dividend payments. While MNAV is declining due to FUD, MSTR should not be considered that flimsy.

$86,219.53their ‘s Fake FUD that they should sell at price x, which is not true because their debt only matures in 2027 and they have $60 billion worth of stocks they can sell if necessary. As a matter of fact, they created cash reserves for dividend payments. While MNAV is declining due to FUD, MSTR should not be considered that flimsy. - of Tether The fake FUD that he had no solvency because he had gold and Bitcoin in his treasury was put forward by Hayes yesterday. They have a lot of excess reserves and they announce billions of dollars of earnings every quarter, so TETHER does not exist anymore and FUD does not have the taste it used to have anymore. Especially after the BDO reserve confirmation reports.

- James downplays discussions on Japanese Carry Trade, but the risk here could grow. For now, the carry trade still provides 2x the return on US treasuries at 3.6%, while its annual cost is only 1.8%. We’ll see what happens after Japan raises interest rates.

Solana (SOL) and SpaceX

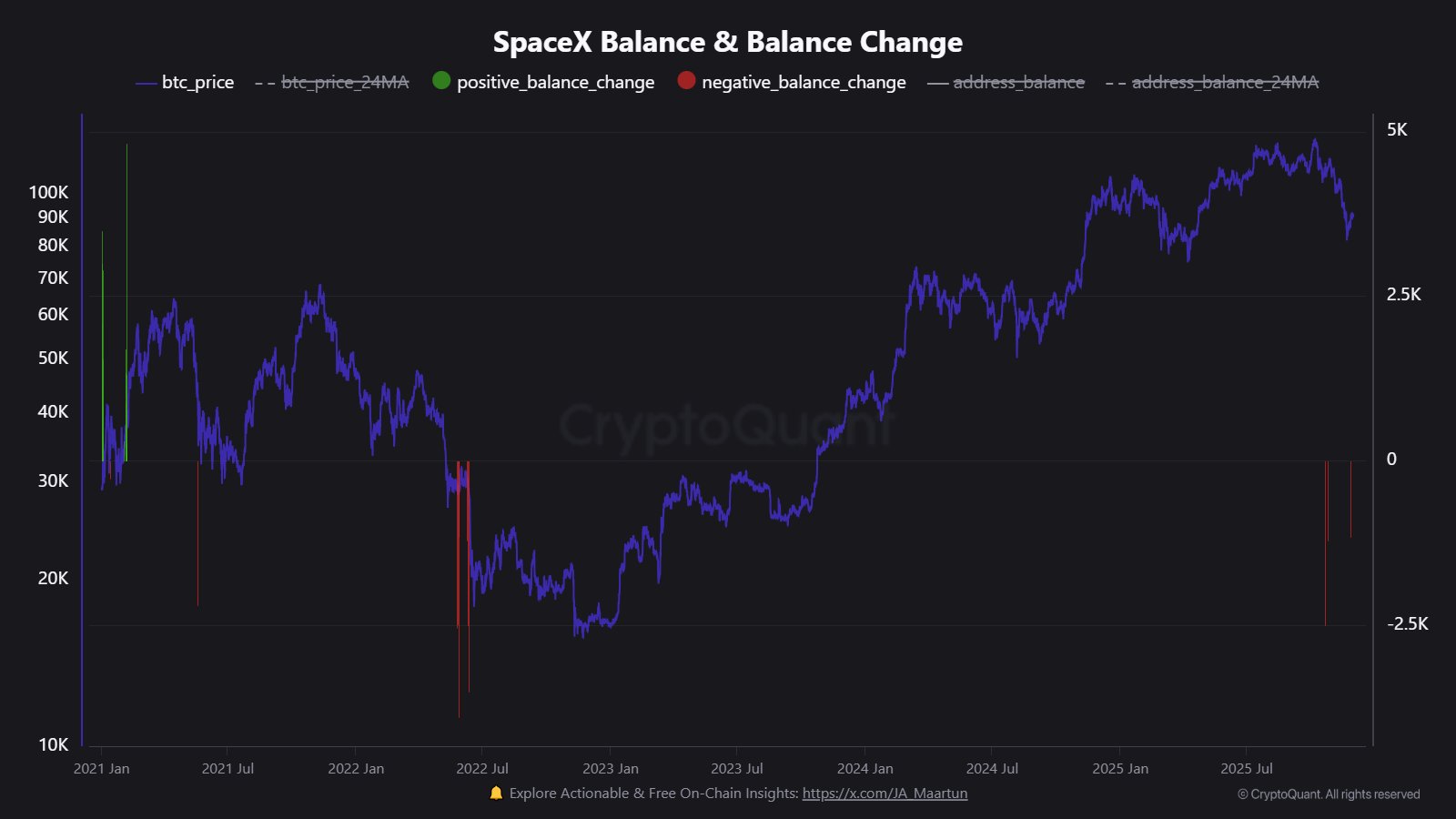

JA_Maartun, one of CryptoQuant analysts, says that an event that occurred at the beginning of the 2022 bear market is repeating. This is a bit prophetic but 2 weeks ago SpaceX Transferred 1,163 BTC and funds were moved to 2 addresses. The interesting similarity is that this also happened when previous bear markets started. If Elon Musk sees the future, I think he should deal with other things, so we can see this as a simple similarity.

Ali Martinez points out something more serious. SOL Coin What will be the consequences of the end of the rise that started in 2023? SOL Coin is about to break the uptrend support line from 2 years ago.

On paper, Martinez says there may be a drop below $50, but this is a very deep trend and occurred under abnormal conditions, so if it is lost, a return to $20-30 levels does not seem that logical. Especially since Solana is already the third largest crypto network and alternative asset for corporates.