FUD is something that cryptocurrencies have always lacked, and Hayes is back on the scene to eliminate this deficiency. Hayes, the co-founder of the BitMEX exchange, is a well-known name for cryptocurrency investors. Discussing the Tether reserve confirmation report today, the crypto tycoon drew attention to the apparent risk “from his own perspective.”

Problem with Tether Reserves

Hayes’ post, which attracted reaction a few hours ago, focuses on the change in Tether’s positions due to the Fed’s interest rate cuts. Saying that the company shifted its US bond holdings to Gold, anticipating decreasing revenues, Hayes wrote:

“Tether team is in the early stages of running a large interest rate trade. How I interpret this audit is that they think the Fed will lower interest rates, which will destroy interest income. In return, they buy gold and BTC, which in theory should rise as the value of the currency declines.

Gold + BTC A drop of around 30% in its position would wipe out its equity and in theory USDT would go bankrupt. I’m sure some major investors and exchanges will want to see their balance sheets in real time so they can assess Tether’s solvency risk. Get your popcorn ready, I predict the mainstream media will go crazy over this, especially all the editors from TDS who want to insult Lutnick and Cantor for supporting this stablecoin.”

However, Tether finances the aforementioned BTC or gold purchases from its earnings and excess reserves due to the newly issued USDT equivalent. “That was my assumption, too,” Hayes said, “but then why are cash assets less than outstanding liabilities, as they define them? What am I missing here?” he replied.

Cryptocurrency FUD

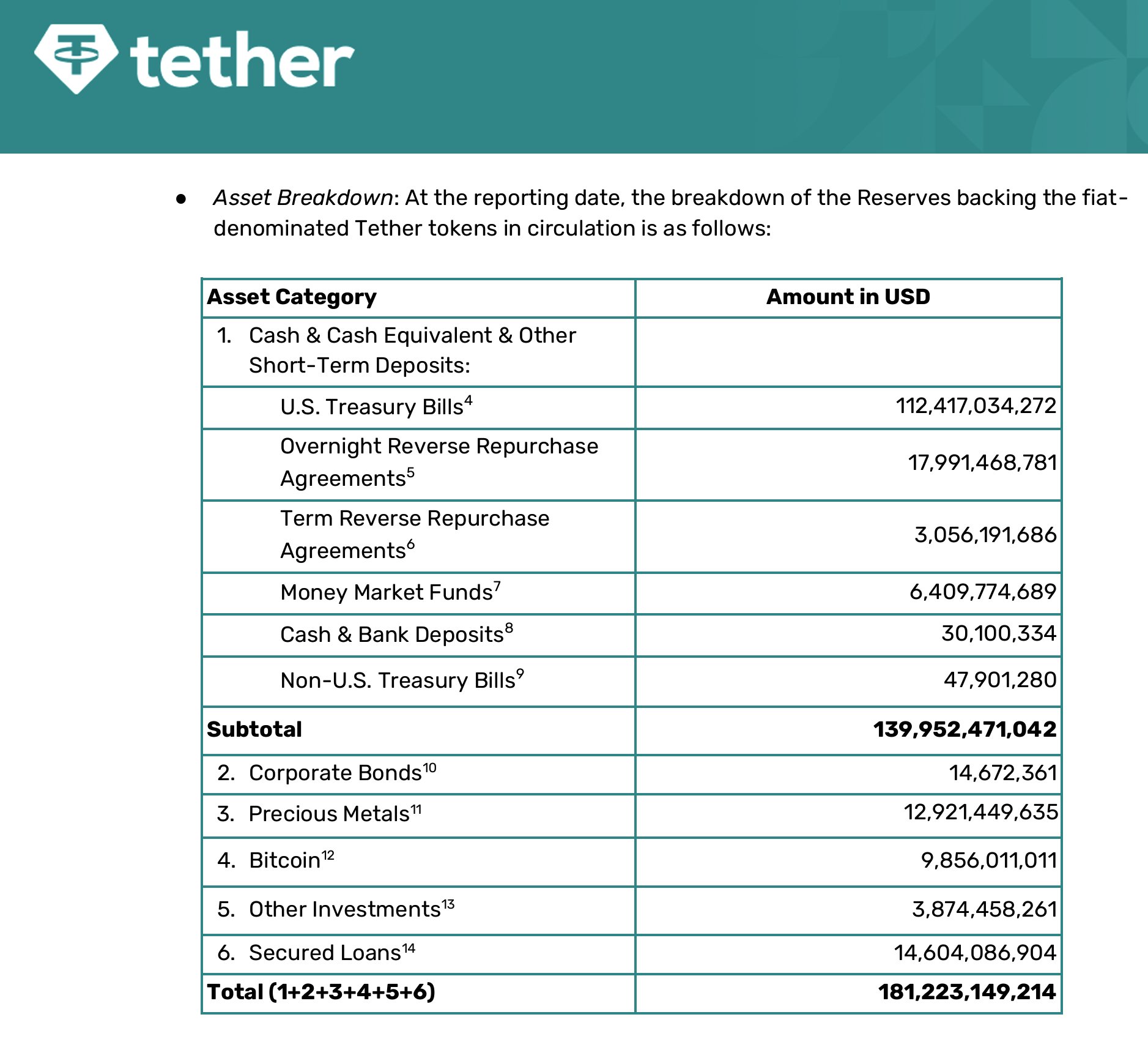

Tether’s situation is indeed confusing because its $181 billion reserve versus $180 billion (rounding down) USDT circulating supply does not appear to be insulated from risk. The company posts excess reserves and billions of dollars in earnings every quarter. But this gold and Bitcoin  $90,811.29 With the fluctuation in price, it may create a gap in reserves. Bonds and funds represent nearly $140 billion in assets. Precious metals and BTC are over $20 billion. Moreover, if we consider the decline in BTC price (since the report) the figure is lower.

$90,811.29 With the fluctuation in price, it may create a gap in reserves. Bonds and funds represent nearly $140 billion in assets. Precious metals and BTC are over $20 billion. Moreover, if we consider the decline in BTC price (since the report) the figure is lower.

Greg Osuri wrote the following on the subject;

“Tether has $174 billion in debt and $139 billion in cash to cover it; it’s a ticking time bomb right now. Just to be safe from USDT I would exit.”

Tether will probably share a new disclosure announcement in which its other investments and net profits are separated from its reserves. It is likely that they will do something to dispel this FUD in the coming hours. We may see the new BDO report coming tomorrow, they are likely to move quickly to manage this process. However, the company still has strong reserves to withstand a possible bankrun and can continue redemptions for a long time, as they showed in the FTX crash.