US markets will be closed until Monday, excluding the half-day on Friday. BTC price exceeded 90 thousand dollars before the closing, but fell below 90 thousand dollars again after the closing. Since it has only been a few minutes since the closure, it is difficult to say how the stock market’s closure will affect cryptocurrencies. BlackRock has taken a new step and JPM is taking the lead. But Kyle warns.

BlackRock and JPMorgan

New altcoin ETFs continue to enter our lives. But what really interests us is how much inflow BTC and ETH ETFs are seeing today. The stock market is going on a long holiday and for now, BTC has reversed its direction as the stock market closes. A significant part of the altcoins turned green and BTC continues the day with a 3 percent increase. Exceeding the 90 thousand threshold was important today.

BlackRockcontinues to accumulate BTC in its in-house funds. In a filing today, BlackRock Strategic Income Opportunities Portfolio said it owned 2,397,423 IBIT shares worth $155.8 million as of September 30.  $87,626.61&dateRange=custom&entityName=BlackRock%2520Funds%2520V&startdt=2025-11-26&enddt=2025-11-26″>announced. It is a positive data as it is 14% above the figure reported in June.

$87,626.61&dateRange=custom&entityName=BlackRock%2520Funds%2520V&startdt=2025-11-26&enddt=2025-11-26″>announced. It is a positive data as it is 14% above the figure reported in June.

MSTR There is a FUD revolving around it. We shared the details about the classification that MSCI will decide in January. JPMorgan is still being protested these days because it published a negative report regarding MSTR’s exclusion from the index. However JPMorgan Chaseinvestors can invest in BlackRock’s iShares Bitcoin Trust ETF (IBIT) is in the preparation of the new product that can be traded with 1.5x leverage. So he hasn’t given up on Bitcoin.

ARB and Kyle’s Warning

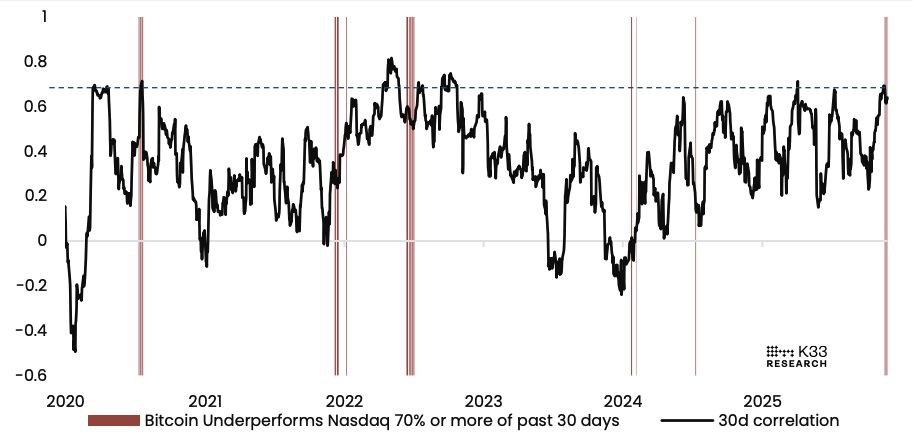

Bitcoin is down 36% from its all-time record high, and market sentiment is completely overblown, according to K33. This is where Kyle comes into play. BTC has underperformed the Nasdaq in 70% of sessions this month. This is a level of relative weakness that we’ve seen only a handful of times since 2020. If today’s rally is not a reversal, weakness could be more painful for BTC.

ARBBTC Drawing attention to the recovery in parity, Poppe said, “People expect altcoins to go to zero, but it will not happen like that,” and wrote that ARB Coin could gain up to 3x in BTC parity.

A big bottom has formed in BTC parities and if a return from these levels begins, rallies may be rapid. By the end of the article, BTC had returned to 90 thousand dollars.

News flow will be important in the coming hours. Since the stock market is also closed, new developments that determine the direction become even more important. about this CryptoAppsy The news section of the application can make your job easier.