Operation Choke Point turned into a black mark on the USA after Trump took office. In fact, necessary steps were taken to research and examine this issue. However, less than a year later, JPMorgan took a new step that caused Operation Choke Point 2.0 comments and closed the crypto CEO’s accounts.

JPMorgan and Cryptocurrencies

The company recently Strategy issued a negative rating for and this increased the motivation of short positions. Even though there are those who exaggerate and claim that JPMorgan opened MSTR short, this is not true. What is real is the world’s largest Bitcoin  $88,099.54 against the reserve company JPMorgan’s It was the analyst comment that recommended short selling.

$88,099.54 against the reserve company JPMorgan’s It was the analyst comment that recommended short selling.

this situation MSTR It is fueled by the motivation to face difficulties in payment and access to capital as a result of the mNAV decline. However, MSTR learned to be prepared for bear markets during the intense FUD days in 2022. The company announced that only a 3% annual BTC increase is enough for them and they are in extremely good shape.

Operation Choke Point

This was a banking operation that started in 2013 and then intensified around cryptocurrencies. The name Operation Choke Point, which represents the wave of arbitrary account closures by banks, went as far as closing the accounts of Trump’s supporters when he lost the elections. Then especially with the 2022 crypto crash We saw that the accounts of cryptocurrency exchanges and investors started to be closed.

JPM is already the largest cryptocurrency ETFs Even though it offered a solution, it started to close the accounts of people connected to cryptocurrency again. Bitcoin payment company Strike’s JPMorgan, which announced in an e-mail that it had cut off relations with its CEO, is currently at the center of criticism for Chokepoint 2.0.

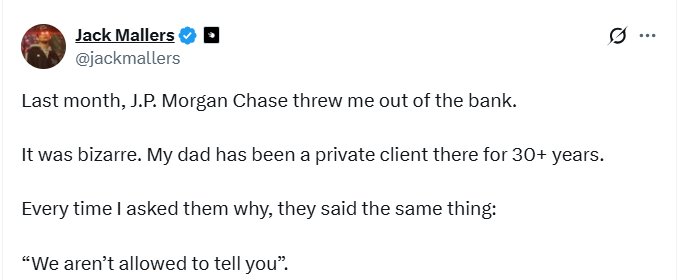

Mallers said:

“Last month, JP Morgan Chase kicked me out of the bank.

This was very strange. My father was a private customer of this bank for over 30 years.

Every time I asked why, they gave the same answer:

“We can’t tell you”

US Senator Cynthia Lummis said:

“Operation Chokepoint 2.0 unfortunately continues. This is damaging trust in traditional banking. It is time to end Chokepoint 2.0 to make America the digital asset capital of the world.”

The accounts of many cryptocurrency company founders and executives, including Custodia Bank’s Caitlin Long, are being closed without justification, and this will continue until a new Fed chair takes office.

Meanwhile in cryptocurrencies The agenda is busy and staying up to date is extremely important. Important developments of the day with both summary and detailed analysis CryptoAppsy You can follow it from the news section of the application.

Banks say or imply that they do so out of concern that they could face legal trouble due to crypto-related customers. However, there is nothing natural about users who make regulated transactions on central exchanges with full KYC verifications and withdraw money from the exchanges to their bank accounts. It is extremely disturbing that all cryptocurrency investors are treated like criminals in this manner.

Many studies show that proceeds of crime are transported and laundered through assets such as banks, cash and even gold, and crypto has a virtually non-existent share of this black money on a global scale.