Now interest rate decision There is little time left and market expectations generally mature a week before the Fed meeting. Charts prices this and the Fed price this as a communication task. just now Fed They may have done this with member Daly. Because Daly, whose stance is a copy of Powell’s, just said there should be a discount.

December Interest Rate Decision

We shared the interest rate stance with all members on Friday. There were 12 members but the outlook was 5-5. Jefferson and Powell’s Since the interest rate decision for December is not clear, we mentioned that we would see a controversial result with the breaking of equality. San Francisco Fed President Mary Daly gave the message to the markets in her recently published interview that this balance may be disturbed because everyone knows her as the member who does not deviate from Powell’s stance.

“On the labor market, I’m not so sure we can get through this. It’s fragile enough at the moment and the risk is that there will be non-linear change.”

Daly, who said earlier this year that they expected inflation to explode due to cost increases resulting from customs duties, emphasized that this did not happen, and that the risk had weakened significantly, implying that the main focus should remain on employment.

“If this situation (low employment and low layoffs) continues and some additional layoffs are added to it, or if companies say, ‘My production is not growing as much as I thought … I’m going to reduce employment,’ then we’re very vulnerable to that.”

Members who want a discount;

- bowman

- cook

- miran

- Waller

- Williams

Those who do not want interest rate cuts

- Barr

- collins

- goolsbee

- musalam

- Schmid (This is the member who does not want it the most)

Powell vague, and although Jefferson was vague, he had some statements that seemed closer to the discount. Paulson and Daly are the 2 members asking for a reduction out of 7 non-voting members. Next year, at the January meeting, we wrote about the rotation issue where some of them would have voting rights. Among those without voting rights, those opposing rate cuts are Hammack, Kashkari, Logan and Bostic. Barkin is unclear.

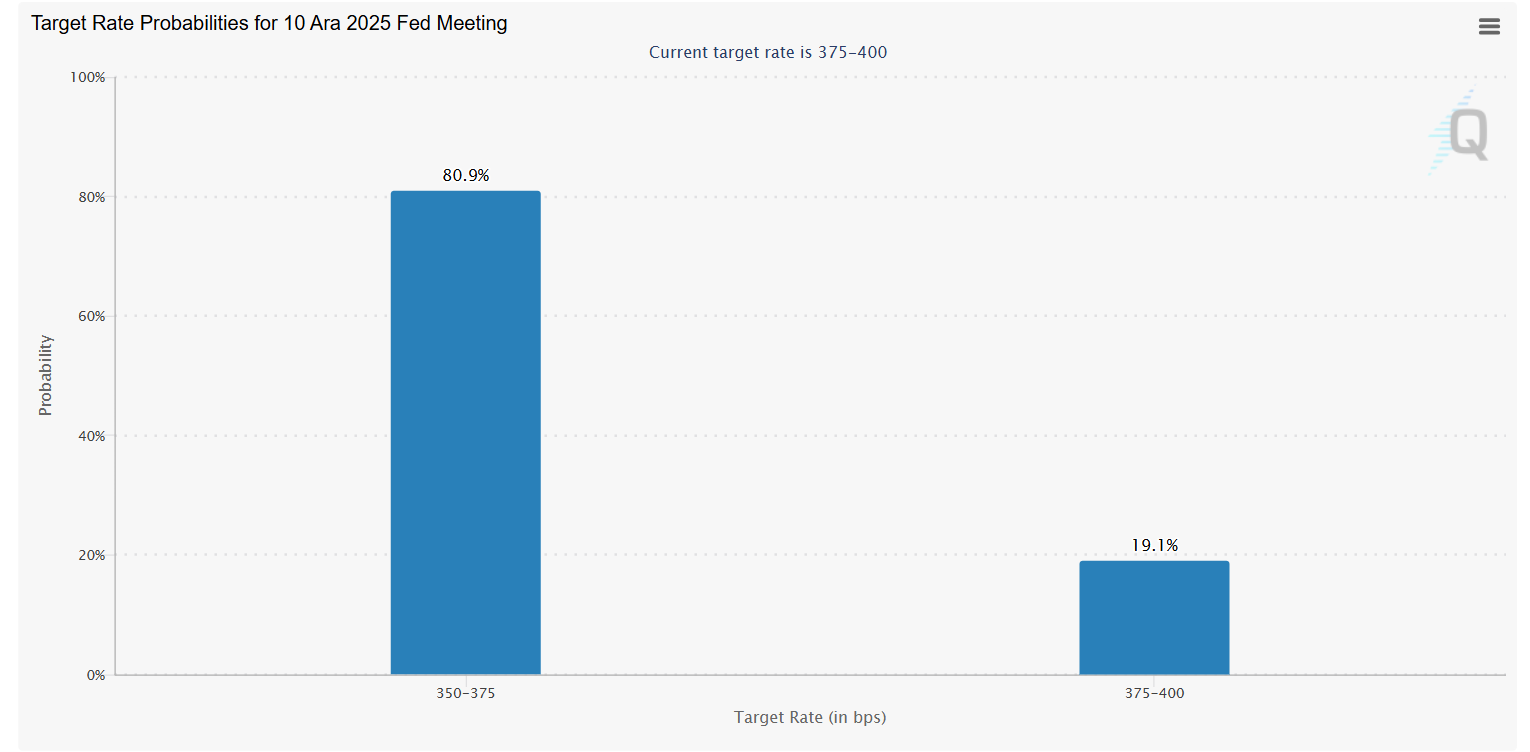

The interest rate cut expectation, which dropped to 30 percent last week, has exceeded 80 percent at the time of writing. As I mentioned above, the Fed does not like surprises. interest deduction It seems like it will happen and if the opposite happens, they have less than 10 days to prepare the market and it will cause a huge selling wave.